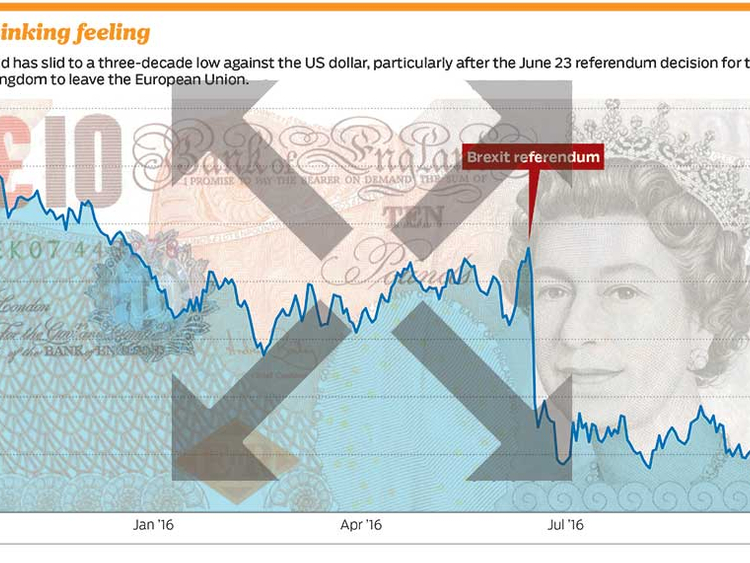

The pound has fallen to a 31-year low amid signs that the UK government is leading the country into a hard exit from the European Union. At the same time, the FTSE 100 — Britain’s most prestigious stock market index — is close to reaching an all time high. Why is Britain’s currency suffering while shares in its biggest companies are soaring?

Why has the pound fallen?

British Prime Minister Theresa May sent a strong signal on Sunday that curbs on immigration were more important than remaining inside the EU’s single market. Investors take a dim view of the UK pulling out of the EU’s tariff-free zone. They also don’t like the notion of restrictions on immigration that deny employers vital staff. Both policies will reduce GDP growth, they believe.

Investors began to sell the pound soon after the speech and the momentum increased following a warning from the chancellor of the exchequer on Monday that the next two years will be a difficult time for the economy. On Tuesday, May repeated her warning that a hard Brexit was likely, which provoked another round of selling.

Why, at the same time, is the stock market rising?

There are two key reasons. The first is that many FTSE 100 firms earn their revenues in dollars. Among them are the largest on the London exchange: oil majors BP and Shell; the mining companies BHP Billiton and Anglo American; and banks such as HSBC. As the value of dollars rises versus the pound, the profits of these companies increase. They become more valuable and the stock market goes up as a consequence.

Second, share prices have been increasing all year in response to prevarication by the US central bank, which has struggled to raise interest rates despite signalling a willingness to do so. The Bank of England, the European Central Bank and the Bank of Japan are already offering zero or negative interest rates. If the Federal Reserve cannot increase rates from the current 0.5 per cent, then investors must put their money into shares in order to earn a return.

Does it matter that the pound is falling?

The pound was worth $1.55 last October. Now it is hovering around $1.27. A year ago the pound bought €1.34. Like the dollar, the Euro is also stronger and a pound will buy a little less than €1.12. According to some economists the 20 per cent drop against the dollar and even bigger slide against the Euro is a good thing, boosting exports and deterring the consumption of increasingly expensive imports. This gives manufacturing sales a lift and helps the balance of payments, which is in a significant deficit currently. It is also hoped that holidaymakers will want to stay at home, spending their money in British resorts and not continental destinations.

The alternative view is that the pound’s value is a measure of the country’s worth relative to other nations and the recent falls means the UK is probably not the fifth largest economy in the world anymore, but the sixth or seventh.

Can the pound fall too far?

A trap door might open under sterling should the Tory messaging around a hard Brexit be taken as a sure sign that Britain will be shut out of the single market altogether. The pound almost reached parity with the dollar in the mid 1980s, but only for a brief period. It would be considered by most economists to be a huge vote of no confidence in the economy if there was a repetition.

Is the stock market too high?

The MSCI index of global stock markets is around the same level as before the 2008 financial crash. This is a huge worry, especially when much of the money in stocks and shares in the UK, the US, Japan and Frankfurt is invested by default. In other words, it is invested by fund managers who cannot get a decent return on other assets, especially corporate and government bonds. Therefore, the rising value of global stock markets is not related to profits, which are flat or declining, but just the welter of cash pouring into the exchanges. If there is an economic shock of some kind, it could trigger a panic, and then markets would have a long way to fall.