Washington: As Lennar Corp., one of the nation’s largest home builders, pushed ahead with an $8 billion (Dh29.38 billion) plan to revitalise a barren swathe of San Francisco, it found a trusted voice to vouch for its work: the Brookings Institution, the most prestigious think tank in the world.

“This can become a productive, mutually beneficial relationship,” Bruce Katz, a Brookings vice-president, wrote to Lennar in July 2010. The ultimate benefit for Brookings: $400,000 in donations from Lennar’s different divisions.

The think tank began to aggressively promote the project, San Francisco’s biggest redevelopment effort since its recovery from the 1906 earthquake, and later offered to help Lennar “engage with national media to develop stories that highlight Lennar’s innovative approach”.

And Brookings went further. It named Kofi Bonner, the Lennar executive in charge of the San Francisco development, as a senior fellow — an enviable credential he used to advance the company’s efforts.

Think tanks, which position themselves as “universities without students”, have power in government policy debates because they are seen as researchers independent of moneyed interests. But in the chase for funds, think tanks are pushing agendas important to corporate donors, at times blurring the line between researchers and lobbyists. And they are doing so while reaping the benefits of their tax-exempt status.

Thousands of pages of internal memos and confidential correspondence between Brookings and other donors — like JPMorgan Chase, the nation’s largest bank; KKR, the global investment firm; Microsoft, the software giant; and Hitachi, the Japanese conglomerate — show that financial support often came with assurances from Brookings that it would provide “donation benefits”, including setting up events featuring corporate executives with government officials, according to documents obtained by The New York Times and the New England Center for Investigative Reporting.

Similar arrangements exist at many think tanks. On issues as varied as military sales to foreign countries, international trade, highway management systems and real estate development, think tanks have frequently become vehicles for corporate influence and branding campaigns.

“This is about giant corporations who figured out that by spending, hey, a few tens of millions of dollars, if they can influence outcomes here in Washington, they can make billions of dollars,” said Sen. Elizabeth Warren, Democrat-Massachusetts, a frequent critic of undisclosed Wall Street donations to think tanks.

Similar goals

Think tank executives reject any suggestion that they are tools of corporate influence campaigns and say they are simply teaming up with donors that have similar goals, like helping cities with economic development.

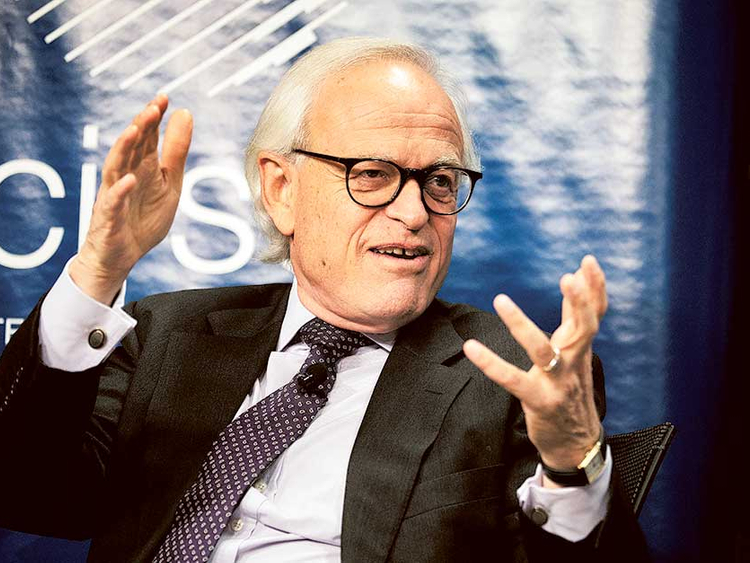

“We do not compromise our integrity,” said Martin S. Indyk, Brookings’s executive vice president. “We maintain our core values of quality, independence, as well as impact.”

But he acknowledged that the arrangement to appoint the Lennar executive as a senior fellow had created the “appearance of a conflict of interest”.

At think tanks such as Brookings, the majority of reports and events, with titles like ‘Five Evils: Multidimensional Poverty and Race in America’ or ‘India at the Global High Table’, have no obvious link to corporate donors.

Still, the benefits afforded to corporations looking to cloak themselves with the authority of think tanks are strikingly evident, according to a review of documents from more than a dozen institutions.

The likely conclusions of some think tank reports, documents show, are discussed with donors — or even potential ones — before the research is complete. Drafts of the studies have been shared with donors whose opinions have then helped shape final reports. Donors have outlined how the resulting scholarship will be used as part of broader lobbying efforts.

The think tanks also help donors promote their corporate brands, as Brookings does with JPMorgan Chase, whose $15.5 million contribution is the largest by a private corporation in the institution’s history.

Despite these benefits, corporations can write off the donations as charitable contributions. Some tax experts say these arrangements may amount to improper subsidies by taxpayers if think tanks are providing specific services.

“People think of think tanks as do-gooders, uncompromised and not bought like others in the political class,” said Bill Goodfellow, the executive director of the Center for International Policy, a Washington-based think tank. “But it’s absurd to suggest that donors don’t have influence. The danger is we in the think tank world are being corrupted in the same way as the political world. And all of us should be worried about it.”

Tax exemption

Executives at Brookings, the Centre for Strategic and International Studies and other think tanks say they have systems in place to ensure that their reports are based on scholars’ independent conclusions.

Donations from the corporations to Brookings are tax exempt based on the premise that the think tank’s work benefits the public good, not a company’s bottom line.

But two lawyers who specialise in non-profit law — Miranda Perry Fleischer, a professor at the University of San Diego School of Law, and Clifford Perlman, a partner at a New York-based firm — said Brookings’ agreements raised questions.

“Tax deductions are subsidies that are paid for by all taxpayers,” Fleischer said. “And the reason the subsidy is provided is that the charitable organisation is supposed to be doing something for the public good, not that specifically benefits the private individual or corporation in the form of providing them goods or services.”

Indyk said that opinion was “totally unfounded”, noting that Brookings had retained its own lawyers to review the documents and found no problems.

“Brookings’s conclusion that all of these activities it engaged in with these donors primarily benefited the public rather than the donors is consistent with the applicable federal tax standards,” Douglas Varley, one of the lawyers for Brookings, said in a statement.

Other think tanks have been even more closely aligned with corporate agendas.

FedEx teamed up with the Atlantic Council — a think tank that focuses on international relations, with annual revenue that has surged to $21 million from $2 million in the last decade — to build support for a free-trade agreement the company hoped would increase business.

Six months before the Atlantic Council report was issued, FedEx and the think tank worked on plans to use the report as a lobbying tool.

“The impact and reach of the report would be maximised by a rollout event” including a “public report launch with member[s] of Congress from one of the relevant committees,” said a two-page summary drafted by the Atlantic Council months before the study had been completed.

When the report came out in late 2014, its conclusions mirrored arguments FedEx had been aggressively pushing on Capitol Hill, including recommending a reduction in trans-Atlantic tariffs and allowing more duty-free shipments.

Frederick Kempe, the Atlantic Council president, said that FedEx had donated just $20,000 to help fund the effort and that the staff at the Atlantic Council had handled the research.

“There is no doubt the work of think tanks has more credibility than the work of lobbyists, but the only way we preserve it is through intellectual independence,” Kempe said.