Earlier this year, Dubai drew up the Islamic Economic Strategy to promote further economic diversification and become the centre for global Islamic economy in the next three years.

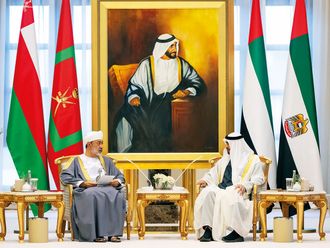

In line with the vision of His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, the UAE has started to make targeted investments in the Islamic finance education sector so that it can not only train its people to meet the increasing demand for skilled professionals in the sector, but also project itself as an education hub for Islamic economics.

“As education providers, it is critical for us to create and prepare the human capital that can adequately support the developments in the sector and transform the emirate into the main centre of knowledge, education and research in all aspects of the Islamic economy,” Dr Ayoub Kazim, Managing Director of Tecom Investments’ Education Cluster, tells GN Focus. He adds, “The Islamic Economic Strategy is based on seven pillars and one of the key strategic directions to achieve the goal is through education and training. Emiratisation in the Islamic finance sector is high up on our agenda and we are closely working with our partners to discuss how we can empower Emiratis with the right skills and knowledge so that they can also help the country fulfil its mission.”

Fourth-largest in the world

“According to the Islamic Finance Development Indicator (IFDI), a numerical measure representing the overall health and growth of the Islamic finance industry worldwide, the UAE has the fourth-largest Islamic finance industry in the world, with $118 billion (around Dh433 billion) in total Islamic finance assets,” says Dr Sayd Farook, Head of Islamic Capital Markets, Thomson Reuters. The indicator was created by Thomson Reuters, the world’s leading provider of intelligent information for businesses and professionals and Islamic Corporation for the Development of the Private Sector (ICD), the private sector development arm of the Islamic Development Bank (IDB). The report shows that the UAE sits on the third position, behind the UK and Malaysia, in Islamic finance education, with 31 course providers and nine universities offering degree programmes. “This confirms that the demand for Islamic finance education is robust and will continue to grow,” says Dr Farook.

Successful financial model

As the UAE moves towards establishing itself as the world’s most important Islamic finance centre, the constraints of a limited talent pool can affect the way forward. Agrees Dr Naeem Radi, Member of the Board of Trustees, Al Khawarizmi International College, a leading provider of Islamic finance education in the UAE, as he points out, “Currently, the biggest challenge for Islamic banks in the region is the severe shortage of professionals who are qualified in Islamic banking. Almost all managers and officers working in Islamic banks come from conventional banks and they do not hold degrees in Islamic banking. All we need to do is to educate and train the existing workforce in the Islamic banking sector and make them aware of the spirit of Islamic Economics and why Islamic banks are more successful than conventional banks.”

Dr Radi adds, “Students are also not aware of the huge job opportunities that exist in Islamic financial institutions. Most school students still think that Islamic Banking and Finance is a kind of old religious study, while it is a successful financial model.”

An analysis by Tahseen Consulting, a specialised advisor on strategic and organisational issues in the Arab world, highlights that $87-124 billion could potentially enter the UAE Islamic banking system by 2015, creating approximately 7,800 new jobs at Islamic banks, if the current asset concentration ratios remain similar. Additionally, 500 jobs will be created in other Islamic financial services segments. The Islamic financial services sector will double in size from approximately 10,000 employees in 2011 to 20,000 in 2015.

Quality education

As the UAE works towards achieving its leadership’s vision, the demand for quality education in Islamic economics across all sectors — from finance, marketing and HR to legal and FMCG — is set to gain traction. To help meet the demand, the Cass Executive MBA programme in Dubai has included a specialised Islamic Finance stream.

Ehsan Razavizadeh, Regional Director, Middle East and North Africa and Head of the Cass Dubai Centre, says, “It is aimed at fund managers, investment consultants and advisors, as well as those who work in the banking and other financial services sector and are interested in Islamic finance.

“The course equips students with the main tenets of Sharia-compliant financial dealings demonstrating Islamic Finance in a holistic fashion and in the context of the modern and global financial system, of which it is an increasingly important part. We also offer electives in Islamic Banking and Finance, Islamic Economics and Islamic Law of Business Transactions,” Razavizadeh adds.

Courses on offer

Al Khawarizmi International College, with campuses in Abu Dhabi and Al Ain, offers degrees and short professional programmes in Islamic banking. “We expect that the demand for higher education in the field of Islamic economics in general and Islamic banking and finance in particular will increase during the next five years due to the shortage of adequately prepared and qualified staff, who can manage and operate the growing number of Islamic financial institutions in the GCC,” says Dr Radi. “We plan to offer other programmes in Islamic Economics such as Islamic insurance and Islamic hospitality.”

Also responding to the demand for Islamic finance courses is University of Wollongong Dubai (UOWD). The faculty of business at UOWD is developing a master’s degree programme in Applied Finance with specialisation in Islamic Banking and Finance. >

Dr Hela Miniaoui, Associate Professor at UOWD, whose teaching and research interests include Islamic finance, says, “UOWD also integrates studies on Islamic Finance at the undergraduate level through the foundation level course, Islamic Culture, which provides all students with an introduction to the main aspects of Islam as a way of life. It regularly brings in practitioners of Islamic banking as guest speakers. As Islamic finance becomes of global interest, the UOWD has hosted students from overseas, including a delegation from California State University, to learn about the principles of Islamic finance.”

Long way ahead

Experts, however, point out that for the UAE to enjoy continued and sustained growth in the Islamic finance sector, it needs to focus on improving the quality of content. Dr Farook says, “Most universities focus on the theoretical learning, whereas the financial workplace requires savvy business-ready leaders and professionals that can understand how to navigate unique business and strategy challenges.”

Although, educational institutions have started to offer Islamic finance programmes, the country has a lot to do before it can claim to compete with countries such as the UK and Malaysia, the top global destinations for Islamic finance studies.

“The UAE and the wider GCC rely on the west to provide training and leadership to its future leaders. There is a knowledge vacuum when it comes to training for leaders working in Islamic finance and other sectors of the Islamic economy,” says Dr Farook.

For the UAE to become a hub for the Islamic industry, Dr Farook suggests that the country needs to develop Harvard-style business schools for the Islamic markets. They should have a structured curriculum covering minimum one to two years of combined business and Islamic economics and markets perspectives, two to three years of sector specialisation and one year of research that enhances the big picture understanding of a student’s specialised area.”