Dubai: Mobile operators in the Middle East are actively pushing for growth of the non-voice value-added services (VAS) market as tumbling voice tariffs contribute to declining average revenue per user (ARPU) rates, said a top official from Indian firm Comviva.

"With many markets almost reaching saturation point or having surpassed saturation in terms of mobile subscriptions penetration, telecom service providers are in need to bolster the ARPUs and mobile VAS has the potential to alleviate declining ARPUs," Sabri Amireh, vice-president for Comviva Mena, said on the sidelines of the 14th annual GSM>3G Middle East Telco World Summit.

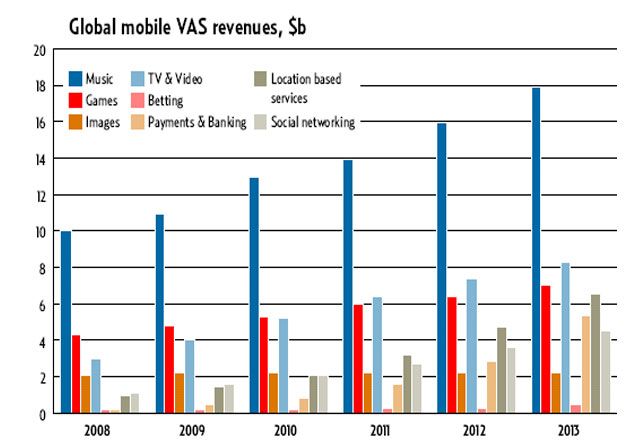

VAS services relate to extras outside voice calls. This includes SMS, MMS, music, ring tones, caller ring back tones (CRBT) commerce, banking, transfers and payments, video, gaming and mobile internet.

Customer loyalty

Amireh said as competition intensifies, companies see VAS as being an important differentiator for mobile operators. Music subscription, CRBT and mobile gaming have the ability to provide operators in the region with an opportunity to increase customer loyalty at a time of increased competition.

"The decline in broadband prices in mature markets and increase in bandwidth means operators need to look beyond the core triple-play offer of telephony, TV and broadband in order to boost profit and reduce churn in saturated markets. Certain VAS such as music subscription offer huge potential," he said.

According to Informa Telecoms and Media, the broadband market in the Middle East and North Africa (Mena) will grow from 7.1 million subscriptions to 27 million in 2014.

"The uptake of 3G and 3.5G will raise the bar for mobile broadband operators in terms of providing quality experience. In countries like Iran, Iraq and Afghanistan, mobile broadband services have not been launched yet so access to broadband is very limited. So the growth in these markets is huge," he said.

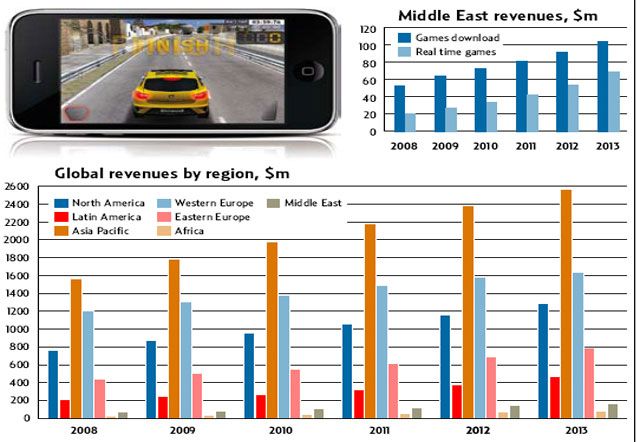

Mobile and online music sales are now rivalling the sales of physical music globally and the global music market is forecast to grow to $27 billion (Dh99.09 billion) by next year. According to an Informa report, global gaming revenues will touch $7 billion in 2013 from $4.8 billion this year. Out of this the Middle East will contribute two per cent this year.

He said the value of VAS in Mena stood at $350 million last year. Due to recession the value is expected to remain the same this year, but in 2011 the growth is expected to be around 35 to 40 per cent.

"The mobile VAS market in Middle East is anticipated to exhibit strong growth owing to untapped potential for VAS in these regions. The market is also expected to witness the emergence of stronger mobile VAS content providers/aggregators with the ability to grasp better revenue shares from the mobile operators," he said.

He said the main drivers for mobile gaming growth will be migration towards 3G and HSDPA networks; increasing availability of user friendly mobile phones with larger screens and advanced multimedia capabilities; provision of mobile games using subscription and bundling techniques that enable greater adoption of games and innovative pricing models.

"The next big thing that will happen in the next couple of years will be mobile advertising. According to Gartner (a global research company), global spend in mobile advertising will grow by an estimated 74 per cent in 2009 to $13 billion in 2013," he said. Comviva, formerly Bharti Telesoft, expects revenues to rise 6.25 per cent to $17 million this year compared to $16 million in 2008. The company expects revenues to rise to $20 million in 2010.