Abu Dhabi: Expanding business through overseas acquisitions is the strategy driving the growth of Emirates Telecommunications Corporation (etisalat) amid a contracting UAE market share.

"The UAE market added only 83,000 active mobile subscribers during the second quarter this year, 73 per cent less than last quarter's additions and 55 per cent lower than our estimate of 185,000," EFG-Hermes said in a report recently.

The domestic telecommunication services provider announced two new acquisitions in two days, an indication the company has adopted an aggressive growth strategy that will enable it to become a major world player in the years ahead.

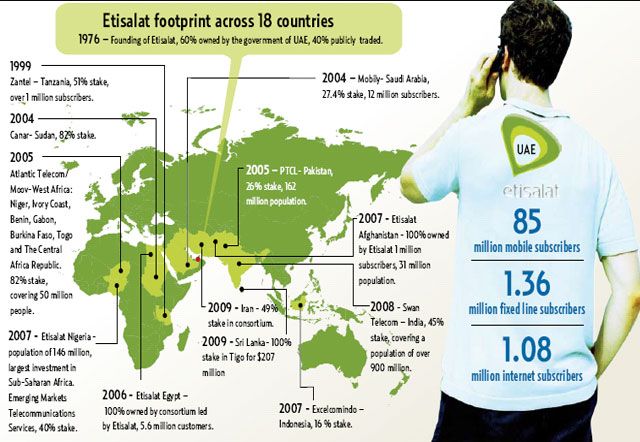

Etisalat currently is the third largest telecom player in the Arab Gulf region with operations in as many as 18 countries, including Egypt and India.

On Sunday, etisalat said it had acquired a 16.6 per cent stake for an unspecified sum in SoftAtHome, a software provider of home operating platforms that helps service providers deliver convergent applications for the Digital Home.

On Saturday, the company said it had acquired 100 per cent of Tigo Sri Lanka, the Sri Lankan unit of Nasdaq-listed Millicom International Cellular S.A., for $207 million (Dh760.3 million).

Logical addition

"Entering the Sri Lankan telecom market is a logical addition to our interests in the Asian continent," said etisalat chairman Mohammad Hassan Omran after the company acquired Tigo Sri Lanka.

"The acquisition promises attractive returns as the Sri Lankan government is increasing its effort to promote foreign investment in all sectors.

"The acquisition is of a mature operator with a strong reputation for its good network and quality of service. It also offers great opportunities for synergy with our other operations in the region, particularly in the UAE, Saudi Arabia and India," he added.

Tigo Sri Lanka which began its operations in 1989, is now, with a market share of 21 per cent, the second-largest mobile phone operator in Sri Lanka. As of last month, the company had 2.25 million subscribers.

Etisalat had submitted a binding offer to Millicom on September 4 this year to buy 100 per cent of shares in Millicom-Sri Lanka.

Standard Chartered Bank acted as the financial adviser to etisalat for the acquisition of Tigo Sri Lanka.

Etisalat shares fell marginally on Sunday to Dh12.45 on the Abu Dhabi Securities Exchange in line with the broad market trend.

The telecoms operator already has existing investments in Asia including Pakistan, Afghanistan, Indonesia and India — markets which are among the fastest growing in the telecommunications sector.

Abu Dhabi-based etisalat is 60 per cent owned by the UAE government. Last year, it bought a 45 per cent share in new Indian operator Swan Telecom for about $900 million.

Meanwhile, the region's telecom companies are expected to fare well, despite the economic downturn.

"We forecast an aggregate third quarter of 2009 revenue of $9.3 billion for our coverage universe (Egypt, UAE and Saudi Arabian telecom operators), up two per cent from $9.1 billion in the second quarter of 2009," EFG-Hermes said yesterday in another telecom report.

"Multi-country operators contribute almost 74 per cent to this figure. Wireless operators should see quarter-on-quarter revenue growth of 4.7 per cent, while integrated operators should post a lower 0.7 per cent quarterly revenue growth."