Dubai: Over half of the Middle East's Islamic finance institutions (IFIs) flagged a need for raising capital and are likely to restructure current Islamic debt over the next 12 months, according to Deloitte's Islamic Finance leaders survey in the Middle East, the results of which were released yesterday.

Corporate issuers are also driving strong demand for sukuk bonds, according to Dr Hatim Al Tahir, Director of Deloitte's Islamic Finance Knowledge Centre in Bahrain.

"There is some significant amount of Sharia-compliant restructuring among companies," he said pointing to Nakheel, Investment Dar in Kuwait, Gulf Finance House in Bahrain.

"The sukuk was doing very well in the last five or six years, the return is attractive, and most importantly it's a kind of diversification in raising capital rather than purely conventional debt," he added.

A strong regulatory framework and efficient governance are a pre-requisite to the growth of the Middle East Islamic fin-ance industry, the report showed.

Regulatory reforms

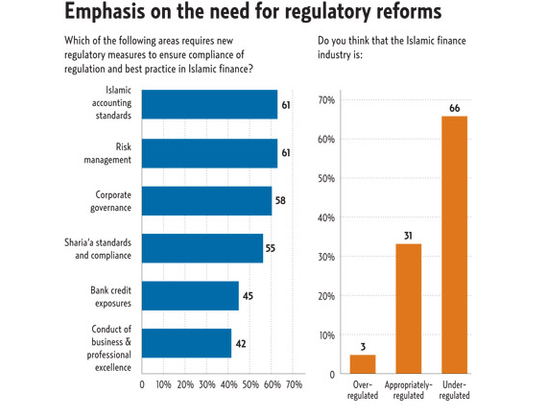

Industry leaders anticipate regulatory reforms in the post global financial crisis climate with 66 per cent believing the industry is under-regulated and 84 per cent believe regulations will increase in the GCC. Only 30 per cent believe there is high supervision in the GCC, the report said.

"It's part of an international call out for more regulation in banking because of violations in Sharia compliance and deviation from the Sharia essence in banks," said Al Tahir.

"To achieve this, IFIs should seek the assistance of independent professional services to help them highlight gaps and provide a roadmap of risk-based systems," the report said.

Islamic accounting standards and risk management were identified as the key areas for new or revised regulation if the industry is to succeed, the report said, as 64 per cent of the leaders surveyed agree that IFIs are lagging behind on implementing risk management systems.

Corporate governance will also be an area of intense interest both to regulators and to IFIs and investors, according to the report. This highlights the need for adopting best practices and transparency in financial reporting.

"The financial crisis exposed inadequate global standards in sukuk issues," said Daud Vicary Abdullah, Deloitte's Global Leader of the Islamic Finance Industry group, during a media roundtable. "There is a need for global standards without foregoing sharia in accounting, reporting regulatory, tax, risk management and products."

Indeed, 97 per cent of IF leaders said that Basel guidelines are relevant to the industry.

"It is high time as well as the right time for IFIs to embrace and implement whatever it takes to excel and remain vibrant," the report said.

Another anticipated vital development in Islamic finance is the Sharia governance landscape.

Over half of IF leaders (57 per cent) preferred a "single Sharia supervisory council in any one jurisdiction" to harmonise the differences in fatwas across the industry.

A major concern for 61 per cent for leaders is that IF professionals need more training and skills development, the report revealed.

"Investment in talent is essential for progress and higher levels of growth," said Al Tahir.

Islamic finance institutions are also challenged by the lack of a wide range of Sharia-based investment instruments; as a result, their investment allocations are not well-balanced between sectors, asset classes and markets, the report noted.

Nearly half of these institutions have investments locked in the GCC, with 41 to 100 per cent exposure in the region, which increases the risk of their investment portfolios.

Pointing to the risks of regional concentration and lesser diversification,

Al Tahir said GCC companies must look into expanding in Asia (namely: Indonesia, Malaysia, Singapore, and Vietnam), West Africa, and South Africa in real estate and manufacturing sectors.

"There has got to be some kind of new creation of products that are sharia compliant as well," said Abdullah.

Limited alternative

"It is evident that there is a limited alternative Sharia compliant investment product. Most recently, Islamic financial institutions in the Gulf have shown an increasing interest in markets such as Central Asia, India, China, Australia and Canada," the report said.

Though Islamic finance has grown rapidly, it represents only one per cent of the world's financial assets, said Abdullah.

"It is not yet punching its weight," he said, despite a growing Muslim population and the shift of economic power eastwards.