Dubai: The UAE has diversified its investment portfolio in recent years by plunging billions of dirhams into a variety of UK assets.

The investments stretch over a great swathe of sectors, from premier league football clubs to prime pieces of London real estate and from historic ships to budget hotels.

Trade between the two countries has always been very strong. Bilateral trade for the first six months of 2008 reached a massive £2.52 billion (Dh15.68 billion).

Of this, UK exports to the UAE from January to July 2008 stood at £1.87 billion. UK imports from the UAE stood at £646 million.

Although the UAE is awash with petrodollars, Dubai in particular generates the least income from oil and has made concerted efforts to find other sources of wealth outside its borders.

"The UK represents the most liberal investment environment in Europe and Dubai and the UAE represent the most liberal investment environment in the Middle East, so the synergies are there.

"The historic relationship between the UAE and the UK is very strong and probably [has] never been stronger," said Mark Beer, chairman of the British Business Group in Dubai.

Interest in purchasing stakes in prolific English football clubs has also rocketed, triggered most recently by the famous purchase of Manchester City by the Abu Dhabi United Group in 2008.

Former Hydra Properties chief executive, Sulaiman Al Fahim is now chairman of Premier team Portsmouth FC.

It was reported that Shaikh Ahmad Bin Saqr Al Qasimi, chairman of the Ras Al Khaimah Department of Customs and Seaports, has bought a 60 per cent stake in an unnamed English Premier League football club, which he later denied.

Real estate has always been the apple of Dubai's eye and as such, property investment in the UK is in the billions.

International Hotel Investments (IHI) bought hotel and former government office building, The Metropole, and the adjoining 10 Whitehall Place for £130 million in 2005. The buildings will be revamped as a five-star hotel. One of IHI's principal shareholders is Istithmar, the investment arm of Dubai World.

Istithmar itself bought One, Trafalgar Place, also known as Grand Buildings, in a deal thought to be worth around £155 million in 2005.

Dubai International Capital (DIC), controlled by His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, bought the budget hotel chain Travelodge in a £675 million deal in 2006. Travelodge operates 291 hotels in the UK, Ireland and Spain.

DIC said it would invest in the chain to make it the UK's leading budget hotel operator by the 2012 Olympics.

The Adelphi, one of London's best-known art deco buildings, was purchased by Istithmar in 2006 for £300 million.

Borse Dubai also bought a 28 per cent stake in the prestigious London Stock Exchange as part of a series of deals between Nasdaq and Borse Dubai.

The UAE also spent huge chunks of money in aquatic real estate in the form of the historic QE2 and P&O. Istithmar bought the QE2 for $100 million (Dh367 million) in 2007 to start a new life as a luxury hotel on Palm Jumeirah.

However, the ship's future has changed course as she is now heading off to South Africa to host visitors to the 2010 Football World Cup. DP World already owns P&O.

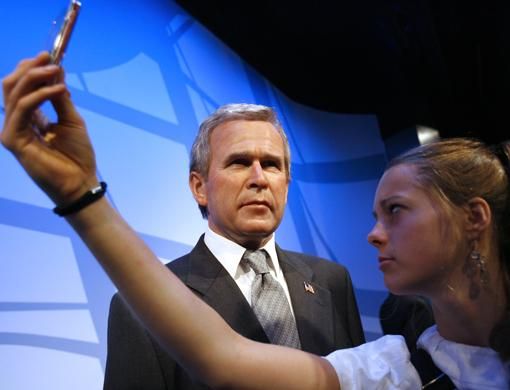

DIC bought Madame Tussauds in 2005 for £800 million. It sold it to Merlin Entertainments for £1 billion in 2007 but DIC kept a 20 per cent stake.

Merlin Entertainments also owns Legoland, the London Dungeon and the aquarium chain Sealife Centre.

Theme park Alton Towers was included in the deal.

Dubai International Capital bought a one-third stake in the London Eye from BA for £95 million in 2006.

Engineering group, Doncasters, which manufactures parts for Airbus, was taken over by Dubai International capital for £700 million in 2005.

The UAE also has its fingers in the aviation pie, with a new landmark for London in July 2008 - a giant model of an Airbus A380 at the gateway to Heathrow Airport.

These investments alone amount to around £2.91 billion.

"By investing in markets like the UK, it leads to diversification of the portfolio here. And, historically, there is less volatility because the UK market has tended not to be volatile from an investment point of view," Beer said.

Around 45 per cent of the UK's exports to the GCC went straight to the UAE. Of this, 72 per cent went to Dubai.

The UAE is in the top ten highest growth markets for the UK government and the largest Middle East market to the UK. The UAE supplies one third of total GCC exports to the UK. Dubai has the lion's share of this, at 66 per cent.

This does not include soft exports, such as services and tourism.

Do you think the UK is still a good place to invest in? In light of the current global crisis, which country do you think is a good place to invest money in? Why?

Your comments

I think investing in UK is not safe coz its statistics is very low in current scenario. Its better to invest in an emerging markets like in BRIC nations.

Nabeel Rahman.T

Dubai,United arab eUAEmirates

Posted: August 05, 2009, 06:29

yes the uk is a good place to invest and traditionaly so for arabs who share a history with the brits , but in my view the middle east is still the best place to invest . my choice is saudi arabia as my # 1 choice .

Ahmad

New York,US

Posted: August 05, 2009, 00:27