Since September 2007, when the British Government and the Bank of England bungled the Northern Rock affair, one government after another has sent in the boy scouts in an attempt to douse what has become an international economic wildfire.

Their efforts haven’t worked. Indeed, they have often made matters worse — much worse — and the fire remains uncontained.

Heads of state continue to rush from one meeting to the next. Worryingly, they (and the army of pundits that follow them) continue to focus most of their rhetoric on whether fiscal austerity or more fiscal stimulus is the right strategy to contain the crisis and turn things around.

Instead, they should be focusing on the money supply. As history shows us, money and monetary policy trumps fiscal policy.

When the monetary and fiscal policies move in opposite directions, the economy will follow the direction taken by monetary (not fiscal) policy. For doubters, just consider Japan and the United States in the 1990s.

The Japanese government engaged in a massive fiscal stimulus programme, while the Bank of Japan embraced a super-tight monetary policy. In consequence, Japan suffered under deflationary pressures and experienced a lost decade of economic growth.

In the US, the 1990s were marked by a strong boom. The Fed was accommodative and President Clinton was the most austere president in the post-Second World War era. President Clinton chopped 3.9 percentage points off federal government expenditures as a per cent of GDP. No other modern US President has even come close to Clinton’s record.

Since the crisis commenced in the early fall of 2007, most countries have applied huge doses of fiscal stimulus, and — with the exceptions of China, Japan, and Germany — taken contractionary “monetary” stances. How could this be? After all, central banks around the world have turned on the money pumps. Isn’t that simulative? Well, yes, it is.

But, central banks only produce what Lord Keynes referred to in 1930 as “state money”. And state money (also known as base or high-powered money) is a rather small portion of the total “money” in an economy.

Even after the Fed more than tripled the supply of state money in the wake of the Lehman Brothers collapse in 2008, state money in the US still accounts for only 15 per cent of the total money in the economy.

This is the case because the commercial banking system creates most of the money in the economy by creating bank deposits. Accordingly, at present, 85 per cent of the total money supply in the US has been created by the banking system. In a wrongheaded attempt to make banks safe in the middle of a slump, politicians and regulators have mounted an international campaign to force banks to recapitalise and to increase their capital-asset ratios.

The regulators are very proud of their progress. For example, the European Banking Authority issued a preliminary report on July 11, 2012, in which it congratulated itself for forcing banks in Europe to raise $115.6 billion in capital since December 2011 and for boosting their capital-asset ratios.

But, these bank capitalisation mandates, when applied in the middle of a slump, are misguided and dangerous. They have forced banks to deleverage on a massive scale. In consequence, the privately produced portion of the money supply has contracted in most countries.

And since this private part of the money supply is so much larger than that accounted for by state money, the net result has been a tight monetary reality in most countries — with the exception of China, Japan, and Germany. This explains why we are witnessing so many credit crunches at the same time central banks are pouring out liquidity.

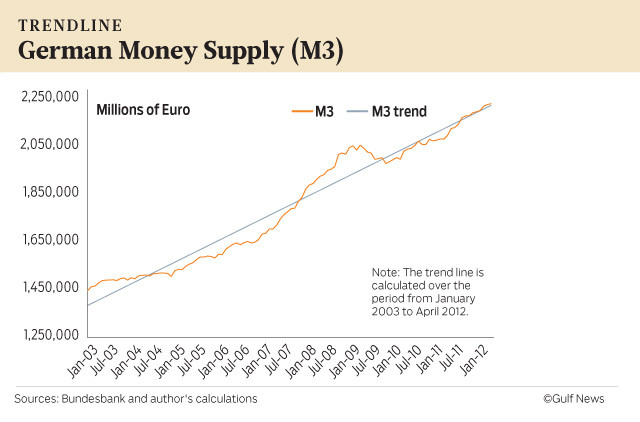

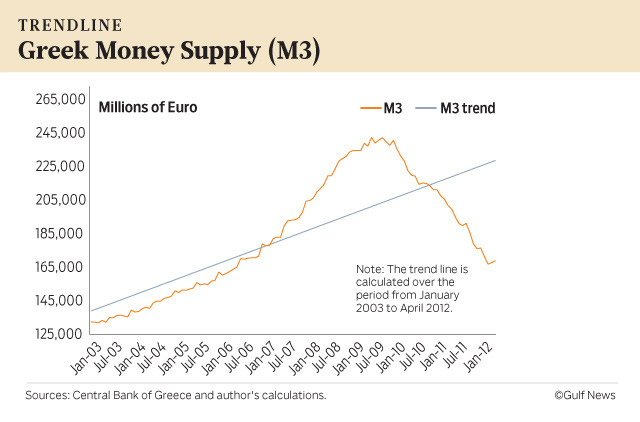

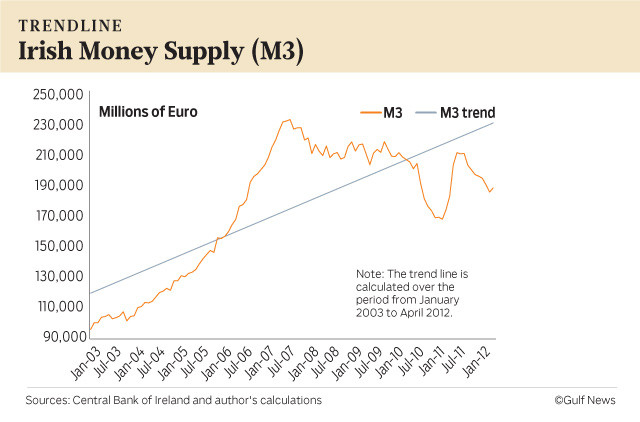

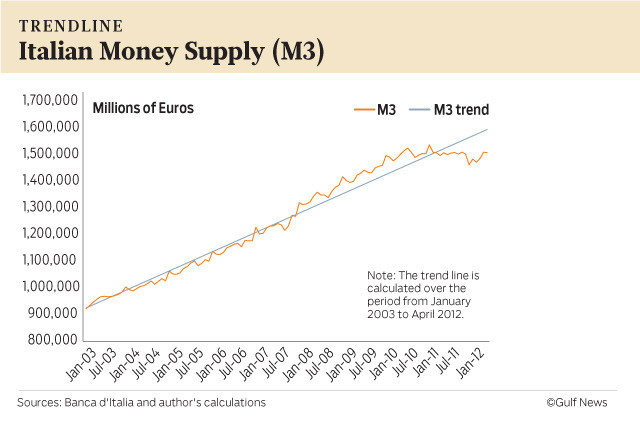

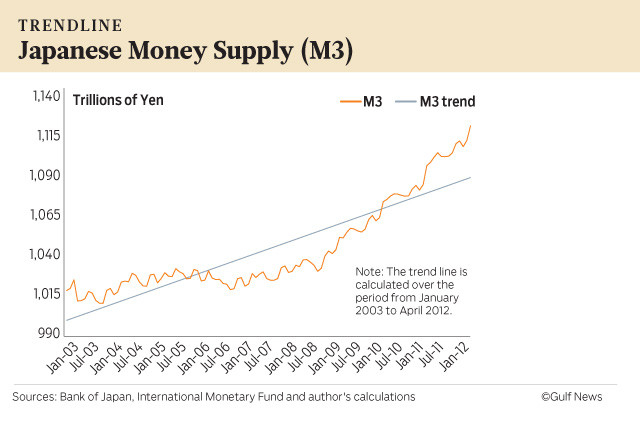

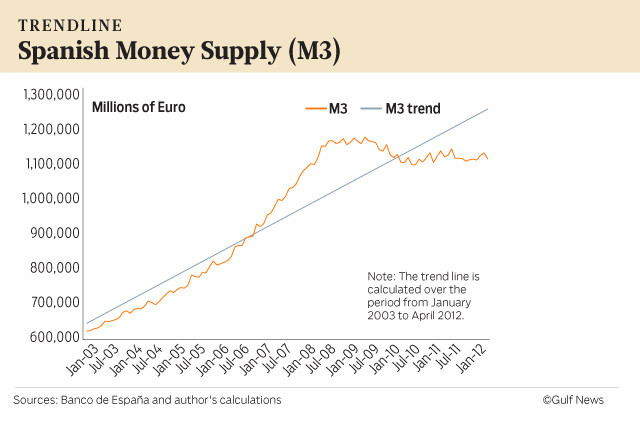

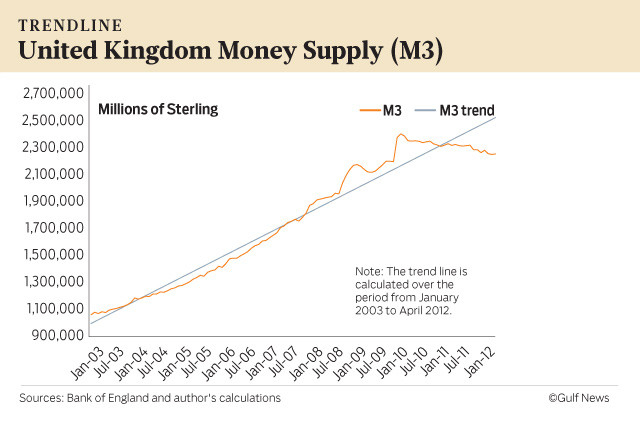

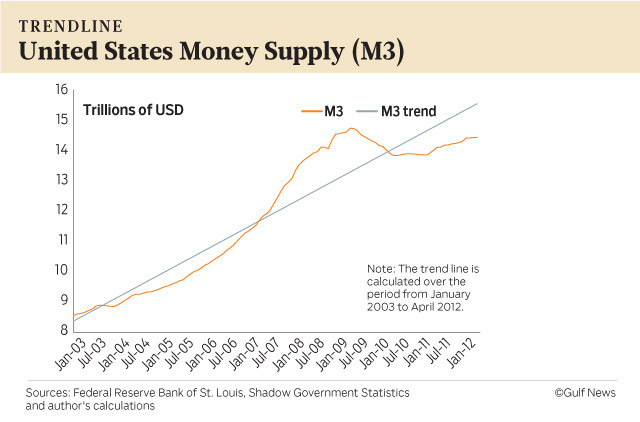

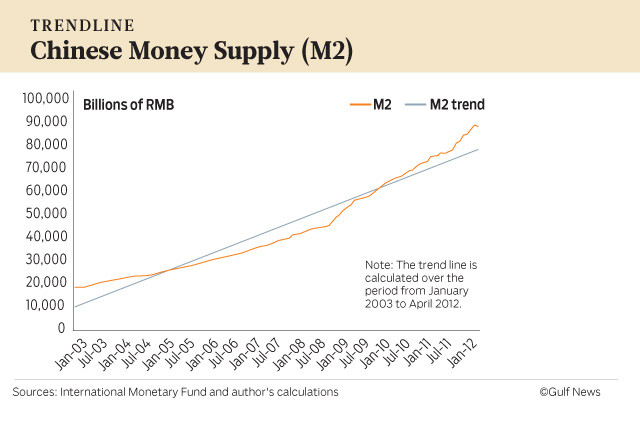

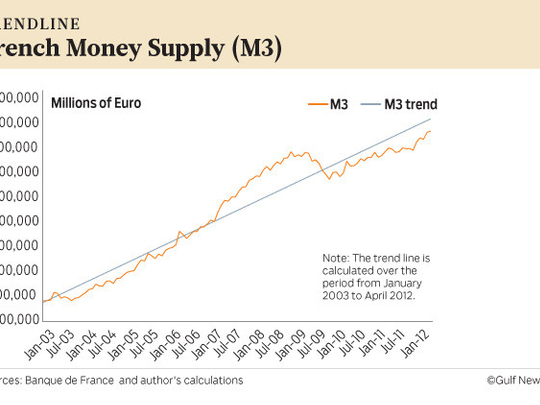

The following series of charts tells the story and represents a case in which a picture is literally worth a thousand words. For each country, lines representing a trend-rate of money growth and the actual money supply are plotted. For most countries, the pattern is clear: today, there is a gap between the trend-rate level of the money supply and the actual money supply.

The gap magnitudes are contained in the table that follows the country charts. In all cases where the gap is negative, there is a general deficiency in the total money supply and the economy is either in a growth recession (like the US), or in a full-blown recession (like Greece). In the three cases where the gap is positive, growth is relatively strong.

The table below indicates that, to close the negative gaps, a significant addition to the money supply would have to occur. While there is nothing golden about the trend level of the money supply, it is suggestive. But, how can the money supply be augmented?

To boost the money supply in the current environment, debt market operations must be employed. At the centre of these operations are government transactions with non-banks that change the bank deposits held by those non-banks.

While there are many debt-operation possibilities, we will limit our discussion to one that would directly boost the money supply, without increasing the government’s net debt. The process begins with the government borrowing from commercial banks. Short-dated government paper is transferred to banks. In exchange, the deposit balance of the government is credited.

This new government deposit is not counted as a part of the money supply. The government then uses its bank deposits (which are not considered money) to purchase long-dated government bonds from the non-bank private sector. These transactions add to the non-bank private sector’s bank deposits and directly to the money supply, because bank deposits in the name of private persons and entities are money. So, the quantity of money is directly increased by this debt market operation and an equivalent amount of long-dated government debt is reduced — literally eliminated. (Since there is little point in the government holding claims on itself, the government cancels the claims.)

Of course, the amount of short-dated government debt increases when the government initially borrows from the commercial banks. Accordingly, the debt market operation leaves the government’s total net debt unchanged, but it does change the composition of the government’s debt, leaving it with a shorter average duration.

Debt market operations — like the one described — would directly increase the money supply, contain the crisis, and allow for much-needed market-friendly reforms.

Steve H. Hanke is a Professor of Applied Economics at The Johns Hopkins University in Baltimore and a Senior Fellow at the Cato Institute in Washington, D.C.