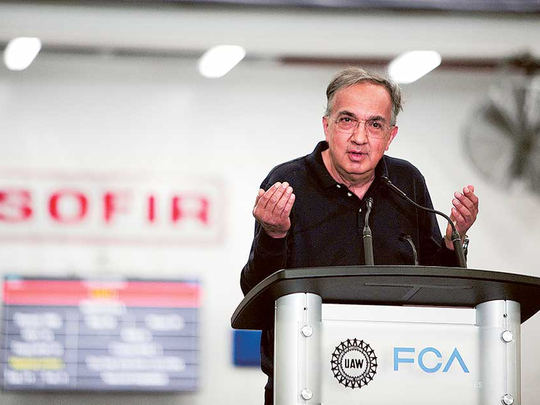

Milan, Rome: Fiat Chrysler Automobiles NV chief executive officer Sergio Marchionne said he sees chipmaker Samsung Electronics Co as a possible strategic partner, amid interest from several potential buyers for the Italian-US car producer’s Magneti Marelli components unit.

“We have a very good relationship with Samsung, both as a supplier and as a potential strategic partner,” Marchionne said late Saturday in an interview with Bloomberg Television in Rome. “I happen to have a good relationship” with Samsung Electronics Vice-Chairman Lee Jae Yong because both serve on the board of Exor SpA, the biggest shareholder in Fiat Chrysler.

Samsung is in advanced talks to buy some or all of Marelli, people familiar with the matter said earlier this month. The South Korean manufacturer is particularly interested in Marelli’s lighting, in-car entertainment and telematics business, the people said, asking not to be identified because the discussions are private. Marchionne, who declined in the interview to comment on whether Samsung is a suitor, will have the chance to meet Lee on Monday, when the Exor board is scheduled to review the investment company’s second-quarter earnings.

Fiat Chrysler shares slipped 1 cent to to €6.155 (Dh25.29) at 9.10am in Milan. Samsung rose 1.7 per cent.

Samsung’s negotiations with the Italian-US carmaker on a Marelli deal have slowed recently over differences about the valuation of the businesses, Maeil Business Newspaper reported August 25. Lee is set to discuss a Marelli deal with Marchionne when the Samsung executive visits Europe for the Exor board session, it reported.

Marchionne said that while Fiat Chrysler has had several suitors for the auto-parts unit, “I made no comments on the Samsung deal at all” following media reports. At the same time, “we are not interested in just selling Magneti Marelli, which has a strategic value to us,” and “whatever happens with that business going forward, it won’t happen overnight.”

The unit “is going to provide a significant platform for technology development.”

After calling off efforts to pursue a merger with General Motors Co, Marchionne has made eliminating debt his highest priority before he leaves his CEO post in 2019. Achieving the goal would put Fiat Chrysler, the first major carmaker to strike a deal with Google on driverless vehicles, in a better position to find a partner. Marchionne contends that the auto industry needs to consolidate to finance investment in new technology.

Challenging targets

An eventual sale of Magneti Marelli would help Marchionne achieve what analysts see as the most challenging part of his five-year strategy, which includes more than doubling net income and building a cash reserve of at least €4 billion ($4.5 billion; Dh16.43 billion), in addition to getting rid of debt.

Fiat Chrysler raised its 2016 earnings forecast in July, and Marchionne said at the time that the new targets were “conservative.”

The CEO said in the interview Saturday that the carmaker will wait until the end of the third quarter to review its predictions.

“I need to get a better read of two things,” including prospects for the US market and any recovery in the Brazilian market, “which continues to be depressive,” he said.