Before Washington Mutual collapsed in the largest bank failure in US history, its executives knowingly created "a mortgage time bomb" by steering borrowers to subprime mortgages and turning the loans into securities the company knew were likely to go bad, one of the most extensive investigations into the causes of the financial crisis has found.

Washington Mutual executives were aware in 2006, at the height of the mortgage boom, of problems at its Southern California-based subprime unit, which the company used to fuel its rapid growth in home lending, according to excerpts of internal emails and reports released on Monday by the Senate's Permanent Subcommittee on Investigations after an 18-month probe. The documents offer a stark and unvarnished view of the warning signs that were ignored as the bank tumbled toward failure.

The company's chief risk officers called the subprime subsidiary, Long Beach Mortgage Corp., "a real problem for WaMu". Stephen Rotella, Washington Mutual's former chief operating officer, described it as "terrible".

"Short story is this is not good," David Schneider, Washington Mutual's former president of home loans, wrote in a December 2006 email. "We are all rapidly losing credibility as a management team."

The emails and bipartisan committee findings come as the Senate panel launches a series of hearings looking at Washington Mutual's 2008 failure as a case study of the financial crisis. Former Washington Mutual executives are scheduled to testify on Tuesday, with testimony on Friday from regulators and later this month from credit rating firms and investment banks that also contributed to the bank's problems.

A report to be released on Friday from the inspectors general of two Treasury Department agencies that regulated Washington Mutual — the Office of Thrift Supervision and the Federal Deposit Insurance Corp. — is expected to fault the regulators for their oversight of the bank.

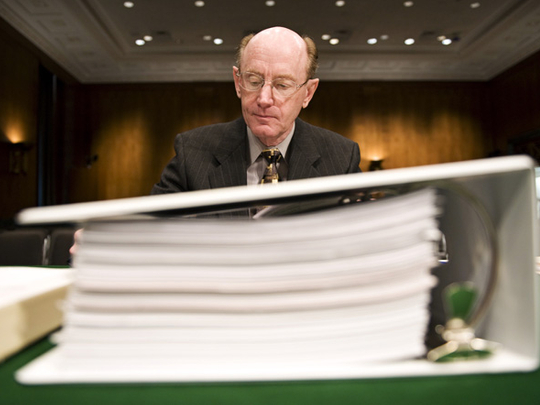

The hearings could help President Barack Obama and congressional Democrats make the case for a proposed sweeping overhaul of financial regulations, which the Senate is set to consider this spring, said Sen Carl Levin, D-Mich, the committee's chairman.

"Washington Mutual built a conveyor belt that dumped toxic mortgage assets into the financial system like a polluter dumping poison into a river," Levin said. "Using a toxic mix of high-risk lending, lax controls, and destructive compensation policies, Washington Mutual flooded the market with shoddy loans and securities that went bad. ... As the debate on financial reform begins, it is critical to acknowledge that the financial crisis was not a natural disaster, it was a man-made economic assault."

Justice Department officials are investigating the failure of Washington Mutual, which was seized by federal regulators at the worst of the financial crisis in September 2008 and sold to JPMorgan Chase for $1.9 billion.

California boom

Nearly a third of Washington Mutual's 2,200 branches were in California and it was a major player, along with its chief rival Countrywide Financial Corp., in helping fuel the state's housing boom — and reaping major profits from it.

Committee staff members said they would decide after the hearings whether to refer their findings to the Justice Department for possible criminal prosecution. The committee also will share its findings with the Financial Crisis Inquiry Commission, a bipartisan panel created by Congress to probe the crisis.

The committee's investigation, which included more than 100 interviews and depositions, found that Washington Mutual jumped headlong into subprime and other risky lending in 2003 to increase profits. The company and its Long Beach unit "used shoddy lending practices ... to make tens of thousands of high-risk home loans that too often contained excessive risk, fraudulent information or errors," according to a committee memo.

Internal company documents highlighted the profit pressures.

"In 2007, we must find new ways to grow our revenue. Home Loans Risk Management has an important role to play in that effort," read a late 2006 message from the unit's chief risk officer to the risk management team.

Adding to the problems, Washington Mutual and Long Beach Mortgage frequently steered borrowers who qualified for prime loans into riskier subprime loans, the committee found. Washington Mutual then spread the risk to investors by packaging the subprime loans into $77 billion worth of securities it sold to investors, the committee found.

"At times, WaMu selected and securitised loans that it had identified as likely to go delinquent" or securitised loans in which the company had discovered fraudulent activity, such as misstated income, without disclosing the information to investors, the committee found. The company's pay practices exacerbated the problem by rewarding loan officers and processors based on how many mortgages they could churn out.

Volume over quality

A June 2008 review by the bank's main regulator, the Office of Thrift Supervision, found a "culture focused more heavily on production volume rather than quality." Top employees could become members of the company's President's Club, which offered lavish, all-expense-paid trips to Hawaii or the Caribbean, the committee found. The master of ceremonies for events on one trip was Magic Johnson, and another event featured a rap skit entitled "I like big bucks," committee staff said.

"Now is the time to really kick it into high gear and drive for attending this awesome event!" read an internal Washington Mutual document to its home loan sales force in 2006. "I'm especially pleased with your ability to change with the market and responsibly sell more higher-margin product — Option ARM, Home Equity, Non-prime, and Alt A."

Levin said the findings showed the need for a new consumer financial protection agency, which Obama has proposed as part of his regulatory overhaul, to stop lenders from preying on borrowers.

"The bottom line is that WaMu had poor policies, poor controls, inadequate oversight of its loans [and] turned out toxic mortgages that sunk the bank, devastated homeowners and polluted the financial system like a poison," Levin said. "This was a Main Street bank that got taken in by these Wall Street profits."