Dubai: On any given day, countless oil tankers depart Middle East ports laden with crude petroleum bound for far flung destinations around the globe.

But a new flotilla of tankers is appearing on the horizon, sailing into the Middle East with a different kind of brown gold below decks.

Enter the dawn of the sugar tanker, each loaded with tens of thousands of metric tonnes of raw sugar and plotting a course for Al Khaleej Sugar Co., the world's largest stand alone sugar refinery located in Dubai.

The fleet of bluewater steel leviathans that transport unprocessed sugar in their holds, not in containers, is part of a new joint venture between refinery owners Jamal Al Ghurair Group of Dubai and Brazilian sugar producer Copersucar.

The new deal has formed what's called the Copa Shipping Company, a secret weapon to help the partners combat global volatility of sugar prices spawned by more than two years of cyclones, floods, droughts and a corresponding tightening of sugar supply due to crop losses.

Cost-effective deployment of sugar tankers backed by a colossal source-to-refinery infrastructure that relies on economies of scale will help the companies gain a competitive edge.

Al Khaleej Sugar, for example, processes an average 1.5 million metric tonnes of raw sugar shipped annually from Brazil into refined white sugar — it also trades a further one million metric tonnes of raw sugar on markets from its mega sugar depot in Dubai, the world's largest warehouse of its kind.

Daily production at the refinery of 6,000 metric tonnes a day will surge to 7,000 metric tonnes per day in 2011 as part of expansion plans now under way at Al Khaleej Sugar.

Copa Shipping Company will be a pivotal extension in the logistics supply chain to boost $1.35 billion (Dh4.95 billion) in annual revenues for the refinery.

"From the outset, the company will be large due to the volumes of sugar and ethanol exported by Copersucar, the largest sugar commercialization operation in Brazil and the volumes transported by the JAG Group, which also controls the largest sugar refinery in the world," officials said in a statement.

Each company will hold a 50 per cent share in the new shipping company.

Maritime specialists

"The Copa Shipping Company will operate on all the continents as of the first quarter of this year and will maintain a structure, offices and operations in Brazil and in Dubai in the United Arab Emirates," officials said. "It will be managed by a team of maritime freight specialists."

The renewed strategy will build in massive operating efficiencies by reducing or eliminating unnecessary costs that have hampered traditional supply chain models of the sugar producing industry.

Officials said the new partnership "will increase its scale and its expertise in maritime freight, driving competitiveness and investment in this mode of transportation."

The new shipping company "will improve management of ship-loading time windows, optimising the entire logistics chain and improving asset utilisation, benefiting all its end customers."

Jonathan Kingsman, managing director and founder of Kingsman SA, a global sugar brokerage and analysis firm, said shipping and processing raw sugar in bulk was Al Khaleej Sugar's game-changing business philosophy when it forged the world's first destination refinery in Jebel Ali port in Dubai in 1995.

"Dubai has always been a major trading centre for the region and has become especially important for the sugar trade since the construction of the refinery. The Al Khaleej refinery is still the biggest stand alone sugar refinery in the world and when it was built, it revolutionised the way the sugar trade operated," Kingsman told Gulf News.

"Al Khaleej were the first to realise that it made more sense to move raw sugar in bulk to a refinery close to customers rather than to move white sugar in bags over large distances. Refining close to the customer reduced costs — shipping raw sugar in bulk is much cheaper than shipping white sugar in bags — and allows ‘just in time delivery' to the customer."

"Also, a large part of the cost of sugar refining is energy, and the Middle East is an energy exporter… the MENA region is a big growth area for sugar consumption with rising revenues and growing population."

Richard Oxley, managing director of Sugaronline.com, said: "Al Khaleej is a very serious player globally and appears to be going from strength to strength."

When the World Trade Organisation (WTO) in 2006 limited the European sugar regime to annual exports of four million tonnes a year from a previous seven million tonnes, companies such as Al Khaleej Sugar seized the opportunity and increased production, he said.

Port-to-port shipments

"This left a gap in the market for destination refineries in the Middle East as it meant that there was a guaranteed market for anything produced over the domestic consumption," Oxley said. "Al Khaleej saw this and expanded the refining capacity…"

In an exclusive interview with Gulf News from the company's Deira offices, Cyrus Raja, General Manager of Al Khaleej Sugar, said success relies heavily on port-to-port marine shipment from Brazil to Dubai to keep its operating overhead low. More than 40 sugar tankers a year transport raw product from Copersucar ports in Brazil to Dubai, he said, and the complete process from shipping to final product can range from 45 to 60 days.

Al Khaleej Sugar refinery is located adjacent its own dedicated 220-metre long berth with a 14-metre draft capable of accommodating sugar tankers that can carry up to 82,000 metric tonnes each — one single shipment can contain more raw sugar than smaller refineries process in an entire year.

"For us, we pick the most competitive shipping," Raja said, referring to Handymax ships capable of carrying 50,000 metric tonnes and larger Panamax vessels of 70,000 metric tonnes. "Many refineries don't have this option, they can't charter more than 40,000 metric tonnes."

Utilising larger vessels can increase the bottom line on one shipment by $250,000, he said, and when bigger ships are used repeatedly in a corporation's operating year, the cost advantages quickly add up.

Efficiency measures continue on shore when ships arrive at Al Khaleej Sugar port, he said.

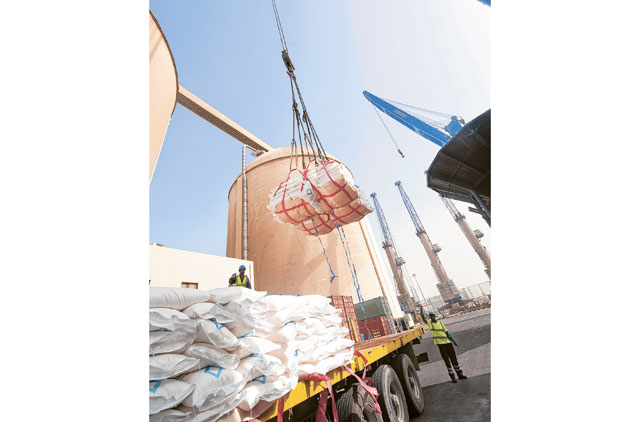

Four shore-based cranes are armed with giant claws to liberate raw sugar from the ship's holds, then deposit each scoop into four hoppers from which conveyor belts weigh and transport the material to the sugar warehouse before it is refined.

"A 50,000 metric ton vessel normally takes about seven days to discharge [within the industry]. At Jebel Ali, we have a discharge rate of 32,000 metric tonnes," Raja said.

The faster a sugar tanker is unloaded, the sooner it can embark and be redeployed in further shipments leading to less expensive downtime, he said.

Raja said that he places great attention on the time and the amounts of raw sugar purchased to avoid downturns in the price per ton on the London exchange. To capitalise on the unusual ability to store 1.2 million metric tonnes of sugar in any given moment in its 84-metre tall dome-shaped storage facility, Raja said the company can buy at lower prices, hang on to it and sell later on when the price moves upward resulting in millions of dollars in profits.

"We have a store that is five times the size of traditional refiners. We use it as a trading pool," he said.

When Al Khaleej Sugar first opened its refinery in 1995, Raja said they were keen to find new efficiencies and by 1999 worked in partnership with Copersucar to come up with a new line of raw sugar that stood up better to the refining process.

In its infancy, the refinery produced about 2,600 metric tonnes of refined white sugar a day, less than half of today's output by a roster of 800 employees.

The end result came in the form of what's called VVHP (Very Very High Polarisation), a form of raw sugar "that lowers the refinery cost and increases the yield."

The refinery has come a long way from its early days when the global sugar industry didn't know what to make of a new company building a refinery in a desert country with no domestic sugar cane production.

"In the beginning, the sugar world was very sceptical of the project," Raja said, adding that at the time, the UAE imported all of its white sugar for consumption. "The reason why it turned out to a success story is that Dubai is strategically located to cater to the Middle East and Far East."

Today, about 10 per cent, or 150,000 tonnes of the refinery's white sugar is sold domestically within the UAE to trading houses, industry and beverage companies and the remaining 90 per cent is exported to 40 countries in the Middle East, Far East and Europe.

For export purposes, Al Khaleej Sugar at times takes advantage of Dubai's position as a trading gateway by booking shipping containers that would otherwise be returned to the Far East empty, he said.

The company also benefits from its home in Jebel Ali port where containers are shipped out across the world on a weekly sailing basis. Each container can hold roughly 24 metric tonnes of refined white sugar.

An estimated 60 per cent of the refinery's white sugar production is shipped from Dubai on container ship, according to the company.

To streamline the regional land transports of Al Khaleej Sugar's refined product to GCC countries, the company formed a wholly-owned subsidiary, Brothers Transport Co.