Expect to dig deeper into your pocket in the new year for that morning cup of java.

Higher coffee prices are brewing for 2011 thanks to a combination of bad weather, shrinking global production and ballooning consumer demand.

Prices of more than $2 (Dh7.34) per pound for green coffee on world commodity markets could rise sharply next year, analysts predict, forcing major food retailers and coffee outlets to pass along costs to consumers who are turning more to higher quality Arabica coffee beans over more common robusta varieties. Last week, arabica coffee beans reached a 13-year high of $2.27 per pound.

With prices forecast to climb anywhere from 30 per cent to 50 per cent, those in the industry, from growers to coffee houses, are bracing for what may be another tough year.

José D. Sette, Executive Director of the International Coffee Organisation (ICO) based in London, said crop shortfalls — most notably in Colombia due to heavy rains — are taking their toll in the marketplace.

The ICO in London is an intergovernmental body vying to help 77 export and import countries to encourage a sustainable world economy.

"Coffee prices have risen primarily as a result of a shortage of high quality arabica beans, caused especially by two successive disappointing crops in Colombia and a lack of availability of coffees of comparable quality from other origins," Sette told Gulf News from the UK.

Long-term risk

"Prices have risen considerably since the second quarter of 2010. To a certain extent, higher prices are welcome and necessary to attract investment in new plantings [especially of arabica coffee], which are needed to meet increased world demand in the future. On the other hand, if prices rise too far, there is a potential for an excessive volume of new plantings, which may lead to a situation of oversupply in the future. In the short term, the coffee industry is coping by raising prices to consumers and by increasing the proportion of lower-priced coffees in their blends," Sette said.

Despite a bleak prediction for some quarters of the coffee sector, Sette said the global industry is set to break revenue records driven by unrelenting demand by consumers.

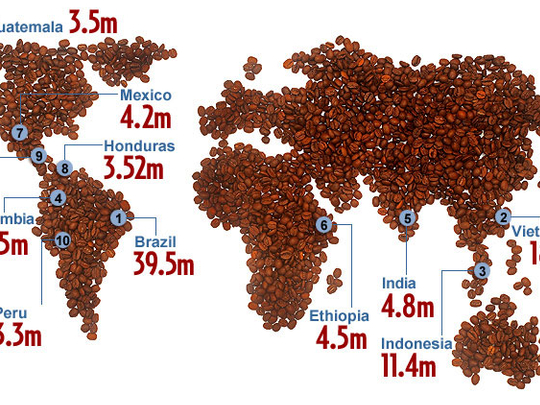

"The value of world coffee exports on an FOB [freight on board] basis is expected to reach a record of $16.5 billion in 2010. Meanwhile, estimates of the total value of the world coffee market vary widely, from around $35 billion to more than $70 billion," he said. "Coffee production fluctuates from year to year as a result of climate and crop cycles. The initial ICO estimate of production for coffee year 2010-11 is 133 million bags of 60 kilogrammes [each]."

Those numbers are expected to grow in the years to come as demand remains steady.

"In recent years, growth in production has not kept up with increasing demand. Demand for coffee has been growing steadily at a rate of between two per cent and 2.5 per cent per annum over the last 10 years and is expected to continue to grow at a similar rate in upcoming years," Sette said.

Middle East market

In the Middle East, the majority of consumers are still tea drinkers but demand is growing year on year in the region for higher quality blends of roasted coffee.

"Although having played an important role in the development and transmission of the culture of coffee drinking to the world, many Middle Eastern countries are predominantly tea-drinking markets. In these circumstances, instant coffee, because of its relative ease of preparation, is an important way to introduce consumers to the habit of coffee drinking. Over time, as is happening in the UK, there is a tendency to migrate to roast and ground coffee."

Sette said, "we should see the expansion of coffee consumption in the Middle East as a healthy challenge for the world coffee sector. In fact, emerging markets, such as the Middle East but also including many other parts of Asia and also Eastern Europe are, in conjunction with the internal markets of coffee producing countries, the locations with greatest potential for increase of coffee consumption in the future."

Per year, "coffee consumption in the UAE is estimated at around 285,000 bags of 60 kilogrammes," he said, although much of the coffee consumed in the country is ground from the robusta bean and is shipped from places such as Brazil and Malaysia, not from nearby Yemen.

"The volume of coffee produced in Yemen is relatively small and insufficient to be marketed worldwide as a single origin coffee by the big chains," Sette said. "However, a great potential exists in niche markets for specialty coffee, but this will require sustained and consistent marketing efforts."

Have you been affected by the recent price hikes of food items like onions and coffee? Will you continue using these items? Or will you seek alternatives until prices go down?