Germany's largest industrial companies are preparing themselves for a surprisingly strong business rebound this year after rising demand from emerging markets kick-started revenue growth in recent months.

Executives from a broad range of sectors have regained confidence and the willingness to spend money on investments and acquisitions, according to research based on a Cheuvreux conference that involved more than 100 companies.

"German managers show surprising optimism and bullishness. 2010 is set to be a year of strong recovery for many companies," said Bernd Laux, head of German equity research at Cheuvreux, the French financial services group.

The research follows positive business outlooks from several German chief executives in recent days.

Axel Heitmann, chief executive of Lanxess, the chemical company, last Monday said 2010 results would be much better than last year's, thanks to a faster-than-expected return to pre-crisis levels in China and other emerging markets.

SAP, the world's largest business software maker, said last week it expected to grow 5-8 per cent this year.

Export-driven German companies have been hit hard by the global downturn in the past year, a period when output in Europe's largest economy shrank by 5 per cent.

But a rebound in demand from Asia and Latin America has spurred revenue growth.

Daimler, the premium carmaker, more than doubled its car sales in China in December, while SAP reported an increase in fourth-quarter revenue growth in Asia (excluding Japan) of 46 per cent.

Leo Apotheker, SAP's chief executive, told the Financial Times: "The epicentre of economic growth is shifting towards the developing world."

Spending on capital

Some companies are reopening their wallets and starting to lift their capital expenditure budgets a trend that will give the hard-hit engineering sector some badly needed order inflow.

Laux said that managers were now "more willing to put excess cash back to work by lifting capex spending and acquiring market share or access to new technology".

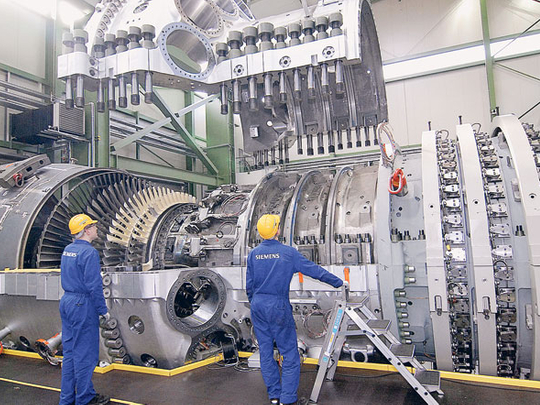

Joe Kaeser, chief financial officer at Siemens, Europe's largest engineering group, said last week that after exceptionally low capital expenditure during 2009, "you will see a catch-up of investments in the next few quarters".

Laux said that the biggest rebounds were taking place in the automotive, chemical and alternative energy equipment sectors.

Lanxess decided in January to bring forward a 400 million euro (Dh2.01 billion) investment in a new Singapore rubber plant. Heitmann said Lanxess would "increase our growth-focused capex spending this year".

Lanxess's example highlights how growth-driven investments are almost entirely focused on emerging markets.

Laux said that "in western Europe, it will for the time being predominantly be maintenance spending and investment into productivity".

— Financial Times