Dubai

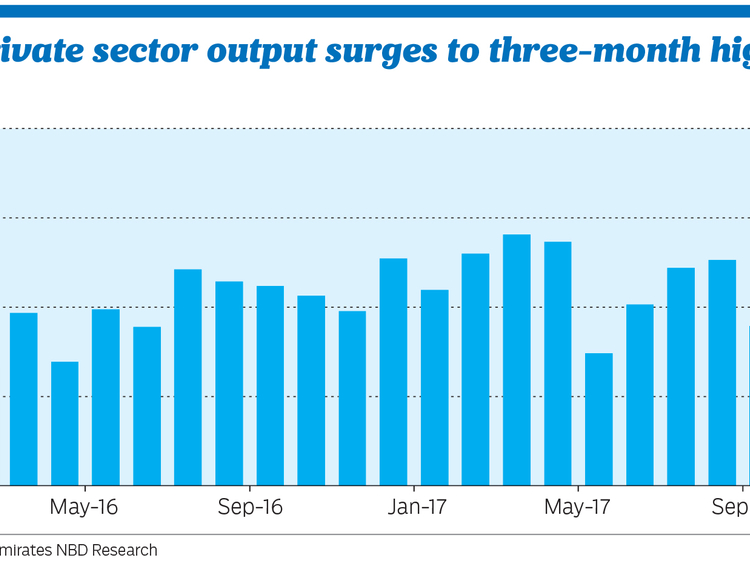

The Emirates NBD Purchasing Managers’ Index (PMI) for the UAE rose to 57 in November from 55.9 in October, signalling a faster rate of growth in the non-oil private sector last month. The PMI reading was the highest since August, and the second highest reading this year.

“The PMI reading for November confirms our view that the UAE’s non-oil sector will likely see strong growth in the fourth quarter of this year, as both households and business will likely boost purchases before VAT comes into effect at the start of next year. However, the continued softness in employment and lack of wage growth suggests that any boost to household consumption this quarter will likely prove temporary,” said Khatija Haque, Head of Mena Research at Emirates NBD.

Output and new orders rose at a faster rate last month, despite an outright decline in new export orders. “This suggests that the driver of growth is domestic demand. Steep growth in both output and new business contributed to the latest improvement in business conditions,” said Haque.

Firms responded to higher output requirements by increasing buying activity at the fastest pace in the survey’s history, whilst many respondents reported that they anticipate operating conditions to further improve in the next 12 months.

Input cost inflation accelerated in November, on the back of higher purchase costs. However, firms were unable to pass on these higher costs, with average selling prices declining modestly once again in November. Purchasing activity and accumulation of pre-production inventories has been sharply higher year-to-date compared with last year. While some of this might be attributed to pre-VAT stockpiling, survey respondents indicated they had boosted inventories ahead of an expected upturn in sales.

The overall level of business optimism remained high in November, although the index slipped slightly from October to 59.2. Firms cited projects related to Expo 2020 as one reason for their optimism about the coming year.

Output continued to increase during November’s survey period, thereby extending the current sequence of growth that began in February 2010. Furthermore, the rate of expansion was the strongest registered in 33 months.

November data showed despite sharp growth in domestic new orders, foreign demand contracted in the latest survey. The rate of decline was moderate overall. Firms in the non-oil private sector frequently commented on intense competition for new work in key export markets. Furthermore, job creation remained muted overall in the context of historical data, partly reflecting easing business confidence. Optimism moderated in the latest survey and remained well below the long-run average, despite positivity towards the impact of Expo 2020 on domestic demand.

On the price front, selling prices continued to fall for the third month running in November. The rate of discounting was moderate overall and slower than that registered in the previous survey. According to anecdotal evidence, firms reduced output charges to stimulate client demand.

Average cost burdens rose at a solid rate during the latest survey period. November’s data thereby lengthened the current sequence of rising operating expenses to six months.