Tokyo: The replacement of Japan's fin-ance minister four months into the government's term increases concern about the commitment to rein in budget deficits, Moody's Investors Service said.

"Japan's fiscal strategy unknowns deepen" with the appointment of Naoto Kan last week, Thomas Byrne, senior vice-president of Moody's in Singapore, wrote in a note yesterday.

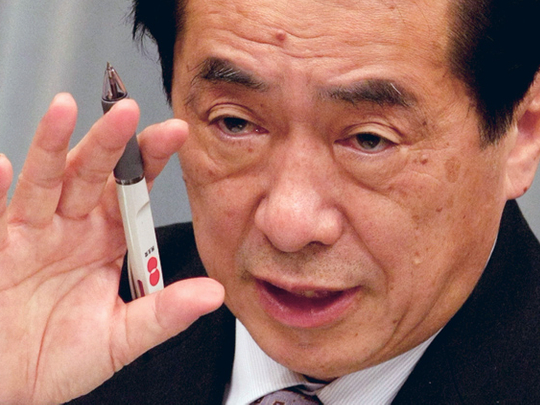

Byrne's stance contrasts with analysts at Goldman Sachs Group Inc. and Morgan Stanley, who said Kan has indicated a willingness to repair Japan's finances. The 63-year-old deputy prime minister last week replaced Hirohisa Fujii to become the country's sixth finance chief in 18 months, tasked with preventing a relapse into a recession while curtailing expansion of the world's largest public debt.

"The revolving door for leadership at the Ministry of Finance does not engender confidence that Japan will put together a credible fiscal strategy to reduce deficits and stabilise the massive government debt overhang in the medium term," Byrne said.

Kan said on January 7 that it will be a ‘challenge' to maintain fiscal discipline this year and he will try to secure funds to fulfil the ruling Democratic Party of Japan's pledges without exacerbating the debt burden.

The leadership change also ‘raises doubts' over the administration's commitment to a 44 trillion yen ($480 billion, Dh1.77 trillion) cap on new Japanese government bond sales for next fiscal year, Byrne said. Kan may "seek to further boost fiscal stimulus to an economy hamstrung by renewed and stubborn deflationary pressures", he said.

Debt rating

Moody's rates Japan's debt at Aa2, the third-highest investment grade, with a stable outlook. Byrne said the nation's sovereign outlook in the medium term depends on "stronger economic growth and a return to a gradual course of deficit reduction and debt containment".

"While we believe the domestic market will readily absorb even the record level of JGB [Japan government bonds] issuance this year, strains on JGB yields could emerge in outlying years," Byrne said.

Local residents held 94 per cent of Japanese government bonds as of June, Finance Ministry data show.

Yields on the benchmark 10-year note fell 1 basis point to 1.35 per cent in Tokyo yesterday. They reached a two-month high of 1.365 per cent on January 8, the day after Kan was appointed.

Morgan Stanley strategist Atsushi Ito said investors have ‘misunderstood' Kan's remarks since his appointment and his policy isn't based on increasing spending to spur the economy.

"He's not a fiscal expansionist," said Tokyo-based Ito. "He wants to achieve a policy mix of fiscal austerity, monetary accommodation and a weaker yen."

Kan will try to get parliament's approval for the government's record 92.3 trillion yen budget for the year starting April 1.