New York: Moody's Investors Service and Fitch Ratings affirmed their AAA credit ratings for the US while warning that downgrades were possible if lawmakers fail to enact debt reduction measures and the economy weakens.

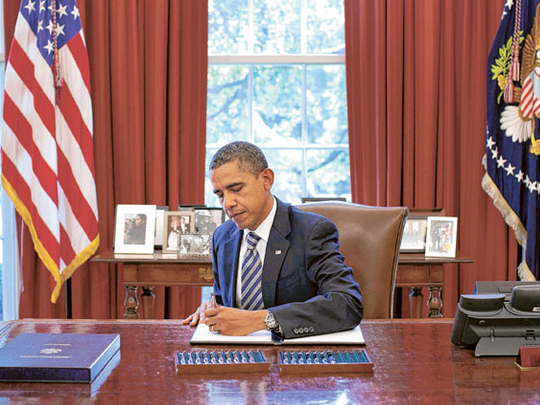

The outlook for the US grade is now negative, Moody's said in a statement on Tuesday after President Barack Obama signed into law a plan to lift the nation's borrowing limit and cut spending following months of wrangling between Democratic leaders and Republican lawmakers.

The compromise "is a positive step toward reducing the future path of the deficit and the debt levels," Steven Hess, senior credit officer at Moody's in New York, said in a telephone interview on Tuesday. "We do think more needs to be done to ensure a reduction in the debt to GDP ratio, for example, going forward."

Broader economy

JPMorgan Chase estimated that a downgrade would raise US borrowing costs by $100 billion (Dh367 billion) a year, while Obama said it could hurt the broader economy by increasing consumer borrowing costs tied to Treasury rates. The ratio of general government debt, including state and local governments, to gross domestic product is projected to climb to 100 per cent in 2012, the most of any AAA-ranked country, Fitch said in April.

"A downgrade is a sign that Congress is failing to address a real fiscal issue," Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia, said in an interview before the announcements.

A decision on the rating may be made within two years, or "considerably sooner," according to Moody's Hess.

Fitch's David Riley said that while the rating may be cut in the medium term, its risks in the near-term "are not high." The company expects to complete the ratings review by this month.

"Although the agreement is a good first step in adjusting the fiscal challenges that the US faces, it is just a first step," Riley, Fitch's London-based head of sovereign ratings, said in a telephone interview on Tuesday.

Standard & Poor's put the US government on notice on April 18 that it risks losing its AAA rating unless lawmakers agree on a plan by 2013 to reduce budget deficits and the national debt. S&P indicated last week that anything less than $4 trillion (Dh14.6 trillion) in cuts would jeopardise the grade.

S&P, which has ranked the US AAA since 1941, rates 18 sovereign issuers as AAA, including Canada, Germany and Singapore, according to Bloomberg data.