Dubai: An Indian entrepreneur living in the United Arab Emirates is calling on the Indian government to establish a domestic development fund for Non-Resident Indians (NRI) to invest in.

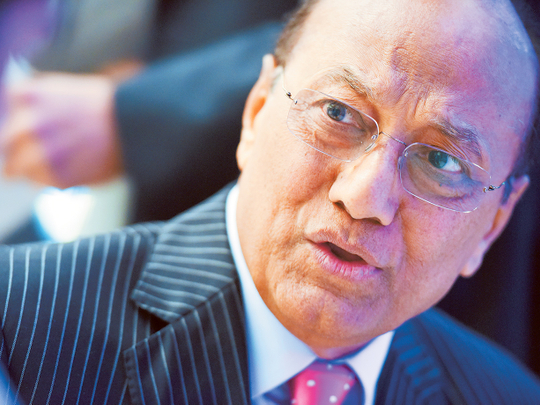

The fund should be used to finance mega infrastructure projects including roads, ports, airports and railways and also be accessible to People of Indian Origin (PIO), Paras Shahdadpuri, chairman of the Nikai Group of Companies, told Gulf News at an Indian business conference in Dubai on Tuesday.

There are nearly 30 million NRIs and PIOs around the world, according to January 2015 estimates by India’s Ministry of External Affairs. This means a single investment of $1,000 from each Indian living abroad would represent $30 billion in liquidity for the Indian government.

Indians living overseas would “absolutely” be interested in investing in such a fund, Shahdadpuri said, which would also free up liqudity pressure on the Indian government that is targeting 8 per cent annual growth in the coming years.

The Indian government expects its economy to grow by 7 per cent to 7.5 per cent this fiscal.

“The country is on the move,” said Shahdadpuri, a former president and a current board member of the Indian Business & Professional Council.

Shahdadpuri said the fund should offer “attractive” interest rates or “preferential priority” to develop projects like hotels alongside infrastructure built with the funds financing.

“It’s absolutely possible,” he said.

Shahdadpuri also said India should speed up the process to sell major assets such as airports to the private sector and proposed changes to India’s Public Private Partnership (PPP) law. Under a new PPP law the India government should be building assets to be sold and operated by the private sector, not the other way round like it is today, he said.

“Governments are never successful at operating.”

Since the 2014 election of Prime Minister Narendra Modi, India has announced a number of reforms to liberalise the country’s economy including opening sectors up to foreign investment.