Dubai: Population dynamics will be a crucial factor in the Gulf Cooperation Council’s future economic growth according to two recent studies by Indosuez Wealth Management and Standard & Poor’s.

Countries in the region have the potential to reap rich demographic dividends as many of them currently enjoy strong proportion of working age population in the age bracket of 20 to 64 years. But with ageing of this group, countries in the region will have to deal with the shrinking of the workforce.

Countries where demographic growth is strong also have to deal with the problem of the dependency ratio. This aspect applies to the GCC countries where dependency ratio is deteriorating due to the high young population and the relative pressure on the productive population.

“The issue to be tackled by 2050 will be the explosion in the population aged 65 and over. In Kuwait, the ratio between people aged 65 and over and the 15-64 age group was 2.6 in 2015, but will be close to 20 in 35 years’ time,” said Dr. Paul Wetterwald, Chief Economist, Indosuez Wealth Management.

Standard & Poor’s has forecast the Saudi Arabian population will expand rapidly from 32 million to 46 million between 2015 and 2050. Over the same period, the proportion of elderly people will rise to 15 per cent of total inhabitants from 3 per cent today.

“Age-related government expenditure on pensions and health care would rise to 14 per cent of GDP by 2050 from 6 per cent today. This could lead to a rapid increase in Saudi Arabia’s net debt ratio to 340 per cent of GDP by 2050 if governments were to take no further policy action,” said S&P Global Ratings analyst Trevor Cullinan.

The analysts suggest that in Saudi Arabia, the old-age dependency ratio will rise to 23 per cent in 2050 from 4 per cent in 2015. An ageing population is expected to place substantial pressure on economic growth and public finances. Demand for publicly provided health care and long-term care services and state pensions could increase pressure on public finances.

S&P analysts expect that the bulk of Saudi Arabia’s age-related spending will go toward pension outlays, projected to rise to about 9 per cent in 2050 from about 3 per cent in 2015.

While immigration is an effective tool to offset the impact of ageing, it seems unrealistic to consider that immigration will occur on a scale such as to stabilise the dependency ratio, according to the Indosuez Wealth Management.

“GCC countries have already used the immigration tool in a major way. For instance, Saudi Arabia has a population of around 28 million, of which more than 30% are immigrants. With 47 per cent residents below the age of 25 years, the Kingdom’s demographics are characterised by a young and fast-growing population,” said Dr. Paul Wetterwald.

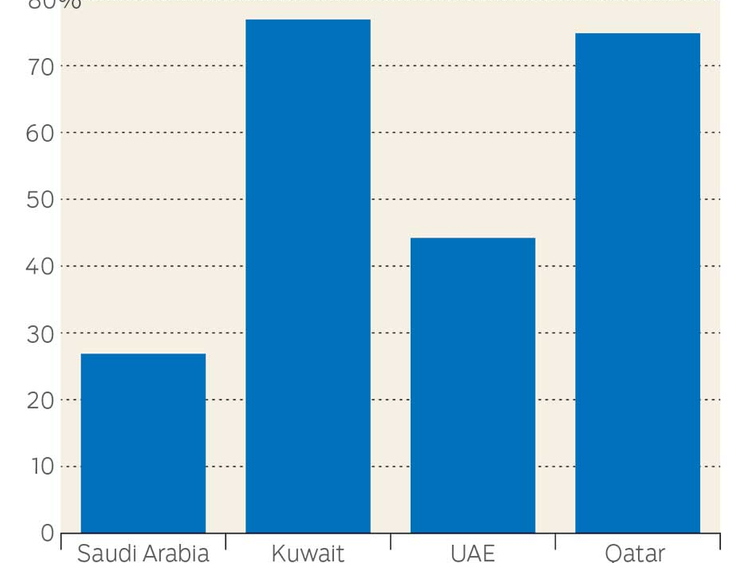

On one hand, the Saudi population growth was generated by immigration and on the other hand by a fertility rate of 2.1 children per woman. Although the foreign population size is high compared to the OECD countries’ average, other GCC countries are far more dependent on foreign labour than is Saudi Arabia. While Kuwait and Qatar featured a remarkable 80 per cent of immigrant population in 2010, the proportion of foreigners in the GCC countries reached 42.7 per cent in 2010, compared to 9.7 per cent in 1975.