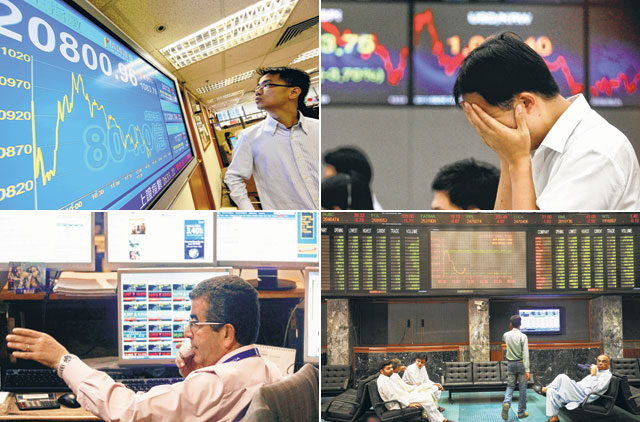

Tokyo/Washington: China and Japan called for global cooperation yesterday after a financial market rout signalled fear that Europe's debt crisis could spin out of control and the US economy may slide into another recession.

The comments from Washington's two biggest foreign creditors pointed to growing concern of contagion as Asian stock markets tumbled following Wall Street's steep dive a day earlier. European markets hit a 14-month low in early trading.

In Japan, Finance Minister Yoshihiko Noda said global policymakers needed to confront currency distortions, the debt crises and concerns about the US economy.

"I agree that these subjects should be discussed," he told reporters a day after Japan intervened to sell yen. "Each problem is important, but how to prioritise these issues is something to discuss from here on in."

Disadvantage

Japan sold yen on Thursday to try to cap the currency's rise, which puts its exporters at a competitive disadvantage.

There was market talk that it had intervened again on Friday, although the currency bounced back quickly, which suggests Tokyo was not in the market.

The yen has become a popular safe-haven bet as concerns about the US and Europe grow. China Foreign Minister Yang Jiechi said US debt risks were escalating and countries should step up cooperation on global economic risks. Yang, who is visiting Poland, called on the United States to adopt "responsible" monetary policies and protect the dollar investments of other nations. The US Federal Reserve holds its next policy-setting meeting on Tuesday, and economists say there is little more it can do to try to spur growth. A flurry of weak economic data and Europe's debt woes have fed fears of a fresh recession, triggering Thursday's sell-off on Wall Street, which was the worst since the global financial crisis.

Some $2.1 trillion (Dh7.7 trillion) in market value was wiped off the MSCI All Country World Index this week as of Thursday's close, Thomson Reuters Datastream showed, and that total looked set to rise on Friday as Asian and European stocks fell.

IHS Global Insight said there was now a 40 per cent chance the United States could slip into recession.

The market rout extended into Asia on Friday, where markets skidded about 5 percent. Chinese lender China Everbright Bank Co Ltd delayed a planned Hong Kong share offering of up to $6 billion, sources told Reuters.