Dubai: A proposal to amend the rule regarding the 51-49 per cent ownership of companies will help support the UAE's recovery by attracting more foreign investors, according to a Dubai Chamber of Commerce and Industry report.

"The UAE Government is putting in place plans to continue making the country more attractive for foreign investors at a time of global economic instability," the Dubai Chamber said in the report released on Sunday.

"In particular, the government is planning to issue revised company, industry and investment laws that will significantly change the country's business landscape. The aim of the revised laws [which are in the final stages of being approved] is to make it easier for foreign investors to do business in the country and provide maximum protection for their investments."

The 2010 Economic Freedom Index conducted by the Heritage Foundation suggests that the ease of doing business in the UAE has improved, reflecting positive market sentiment and an overall increase in risk appetite, it said.

The UAE scored 67.3 out of 100 in the index, making its economy the 46th freest (out of 179 countries) .

This is an improvement of 2.6 index points than in 2009, which is primarily down to an increase in business freedom, investment freedom as well property rights.

In order to establish a business that sells products or services freely throughout the UAE (in non-Free Trade Zone areas), at least 51 per cent of the business must be owned by a UAE national. Forming this type of joint partnership is the best and easiest way to establish a business in the UAE. All businesses require a licence and licensing procedures vary from emirate to emirate.

"Looking ahead, by recognising the importance of business reforms, especially geared towards the private sector, the UAE Government has clearly improved the country's business competitiveness. This has laid the groundwork for future job creation, increased firm revenue and in turn overall business growth in the coming years," the report said.

Government spending

Total government expenditures, including consumption and transfer payments, are relatively low. In the most recent data (2008), the Ministry of Economy suggested that government spending in the UAE accounted for 8.5 per cent of GDP.

The government remains significantly involved in the economy through regulation and government-owned businesses. Salary increases projected for 2010 are expected to raise expenditures further.

The government influences prices through regulation, subsidies as well as numerous government-owned entities, including crude oil, gas, electricity and telecommunications. Inflation was high, averaging 11.2per cent between 2006 and 2008, but given the decline in the hydrocarbon sector as well as food costs, consumer prices are expected to have remained benign in the short-term.

The UAE's modern fin-ancial sector has become more efficient and competitive in recent years on the back of solid and rational financial regulation. Domestic banks offer a full range of services and Islamic banking is increasingly becoming prominent. In addition, capital markets are relatively well developed, and the two stock markets Dubai Financial Market and the Abu Dhabi Stock Exchange have become more attractive to foreign investment over the years.

Exports rising

The Dubai Chamber of Commerce said the emirate's exports and re-exports have been increasing on the back of an extensive foreign trade network while the UAE's rank in the 2010 Economic Freedom Index improved.

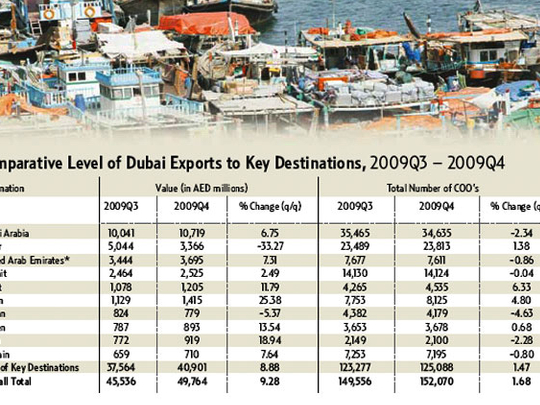

Dubai's exports grew by 9.3 per cent to Dh40.9 billion in the fourth quarter of 2009 from Dh37.6 billion in the previous quarter. Meanwhile, the total number of Certificates of Origin (COO) issued by the Dubai Chamber during the fourth quarter stood at 152,070, an increase of 1.7 per cent from the third quarter.

In the Gulf, Saudi Arabia was the largest recipient of Dubai's exports in terms of value and volume, in the third and fourth quarters of 2009.