New York

Procter & Gamble Co. may have prevailed in its proxy fight against activist investor Nelson Peltz, but the contentious showdown has left its investors as divided as ever.

The world’s largest consumer-products company said Tuesday that Peltz fell short of the votes needed to be elected to the board, based on preliminary results. But the investor isn’t going quietly: His firm, Trian Fund Management, said the decision was too close to call and that it’s waiting for certification by an independent inspector.

Peltz argued that P&G suffered from a bloated structure and a lack of new brands favoured by younger shoppers. While he hasn’t called for the replacement of Chief Executive Officer David Taylor or a break-up of the company, the 75-year-old did suggest reorganising the maker of Tide and Pampers into three largely autonomous units.

Many investors agreed with Peltz’s message. And regardless of how they voted, the process threw a spotlight on a broader dissatisfaction among shareholders, said Ali Dibadj, an analyst at Sanford C. Bernstein & Co.

“They expect more from the company,” Dibadj said. Taylor “has a bit of room to deliver on results, but he’s going to be in the spotlight and under the microscope in a very big way over the next several quarters.”

BlackRock Inc., which own about 6 per cent of the consumer-brands company, split its vote. Two million shares were cast for the board’s proposal while the remainder were voted in favour of Trian’s, according to a person familiar with the matter. The firm owned about 156.4 million shares as of Oct. 6 but may not have voted all its outstanding shares, the person said.

Peltz said he believed the vote margin was plus or minus 1 per cent, and the support he garnered from shareholders should be a sign to Taylor that he deserves a board seat.

“Even if they win, which I’m not sure they did, think about what Pyrrhic victory it is,” he said in an interview on CNBC. “Everybody but the current employees voted for us. Up and down the line.”

Outdated Critiques

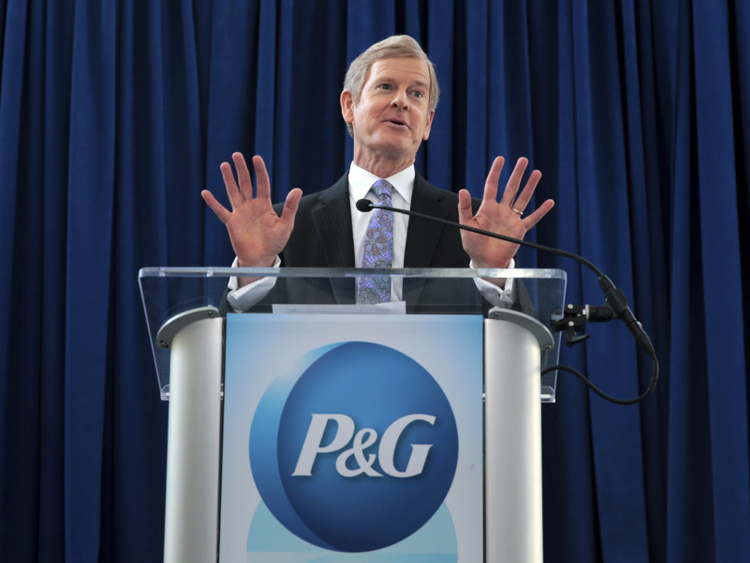

Over the years, P&G has struggled to churn out as many blockbuster products and overcome a culture of bureaucracy. But Peltz had an outdated view of the company, Taylor has repeatedly said. In a statement Tuesday, P&G said it’s a “much stronger, more profitable company” than a few years ago.

“P&G shareholders have spoken and we respect their decision,” Damon Jones, a company spokesman, said in an email. While acknowledging the vote was close, he declined to comment on whether the company might accommodate Peltz in some way, short of putting him on the board.

Peltz said on CNBC that P&G’s board didn’t give him a fair shake and never went over a 93-page white paper issued by Trian last month. He said he only met with Taylor and lead director James McNerney to discuss his plans and his only other interaction was with board member Ken Chenault during a brief meeting.

“I didn’t show them the white paper. We didn’t go through the white paper with them. They didn’t do their job,” Peltz said.

Past Stints

Peltz bought a $3.5 billion stake in P&G earlier this year before embarking on the three-month board fight. P&G is only the third proxy fight by Trian since Peltz cofounded the firm in 2005. The New York hedge fund won two seats on the H.J. Heinz board in 2006 and Peltz remained on the board until 2013. Two years ago, he failed in his attempt to appoint four directors to the board of chemical maker DuPont Co.

Peltz touted his experience on the boards of large consumer companies in addition to Heinz, including Mondelez International Inc. and Wendy’s Co. P&G said whatever he learnt is irrelevant since those companies sell food, an area the company exited. Five former Heinz directors wrote a letter backing Peltz’s campaign, and he gained the support of the three largest proxy-advisory firms as well.

Read more on who wins when activist investors pounce

Trian notched a victory on Monday with the appointment of co-founder Ed Garden to the board of General Electric Co.

Bill Ackman, another billionaire investor known for seeking management changes and company break-ups, said Peltz’s differing ideas on P&G’s strategy were “a perfect reason to put him on the board.”

“P&G looks terrible,” Ackman said in an interview Monday. “They may win because 42 per cent of the stock is held by retail, management has all their names, numbers and email addresses. Many of them are probably based in Cincinnati. But it would be a bad thing for P&G if Nelson isn’t on the board.”

Ackman disclosed a $1.8 billion stake in P&G in July 2012 and pushed to replace then-CEO Bob McDonald, who was pursuing a $10 billion cost-cutting program. P&G did get rid of McDonald the following year and brought back its former CEO A.G. Lafley. Ackman divested his stake in 2014.

Dibadj at Sanford Bernstein and Jack Russo, an analyst at Edward Jones & Co., said they were surprised at how strongly P&G resisted giving Peltz a seat at the table.

“It’s not like he’s going to put his agenda through with one board seat,” Russo said. “It’s foolish for the company to be as concerned about this as they were, but it’s also foolish to say P&G has been doing nothing. They’ve been doing a lot. It’s not easy to change a company this size.”