Abu Dhabi: Abu Dhabi’s Gross Domestic Product (GDP) jumped to Dh196.1 billion in the fourth quarter of 2015, marking a 7.7 per cent increase over the same quarter in 2014, the government said in the press release on Sunday.

The growth was enhanced by the emirate’s non-oil sector, whose GDP rose 8.8 per cent at fixed prices and accounted for 50.7 per cent of the total GDP (up from 50.2 per cent in the fourth quarter of 2014). Oil GDP also rose at a rate of 7.1 per cent.

According to the Abu Dhabi Economic Performance Report issued by the emirate’s Department of Economic Development (DED), segments such as financial markets, the tourism sector, and non-oil foreign trade recorded improved performance during the quarter.

In the tourism sector, indicators show that the number of hotel guests in the first quarter of 2016 rose 11 per cent over the comparative period in 2015 to over 1.11 million guests. However, occupancy rates fell 4 per cent to 79 per cent during the quarter.

Hotel revenues were also down to Dh1.7 billion in the first quarter of this year — a 6 per cent decline over the Dh1.82 billion recorded in the same quarter of 2015.

In trade, Abu Dhabi’s non-oil foreign trade jumped in the January–February 2016 period to reach Dh30.8 billion (up 7.7 per cent from the same period in 2015). This was supported by a higher rate of non-oil exports that reached Dh9.8 billion, though the value of imports dropped 9.1 per cent.

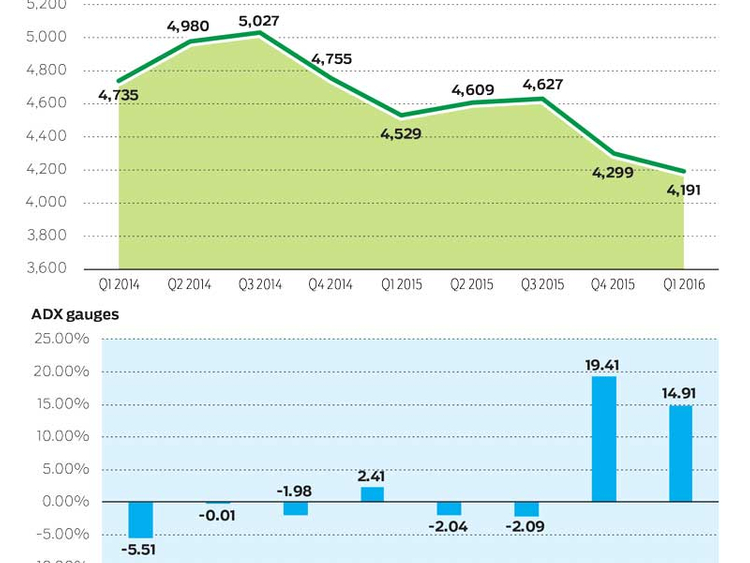

As for developments in financial markets, the Economic Performance Report showed that the Abu Dhabi Securities Exchange general index rose 1.9 per cent in the first quarter of 2016 over the fourth quarter of 2015. The energy gauge rose 2.41 per cent, as the property gauge surged 19.4 per cent and the telecommunication gauge jumped 14.9 per cent.

Foreign investors

The banking sector index fell, however, by 5.5 per cent, as did the investment and financial services sector index (down 2 per cent). The market also saw increased buying activity from foreign investors who accounted for 57.1 per cent of the total number of purchases in the first quarter of 2016 — up from 53.3 per cent in the fourth quarter of 2015.

According to the report, the stability of oil prices above $30 (Dh110.19) a barrel contributed to a rise in the equity market’s indices.

Ali Majid Al Mansouri, the chairman of the Abu Dhabi DED, said that the strong performance of the non-oil sectors shows the positive impact of the country’s diversification efforts and its efforts to transform the fluctuations in oil prices into an opportunity.