Dubai: With global financial markets consistently in sell-off mode amid the escalating COVID-19 crisis, it is important for investors to consider the issue and its implications it has on their investment portfolio.

Although at a time like this the most common advice is to ‘stay the course’ and not to make any changes to your portfolio, you could make your portfolio less risk sensitive by adding more long-term diversified assets.

Only more volatility ahead

Going forward, even with increasingly significant public and private efforts aimed at social distancing, the number of confirmed cases is likely to rise sharply – and more volatility will continue to affect your portfolio. In addition, social distancing should have some impact in slowing the spread of the disease.

Analysts say that the negative impacts of social distancing should begin to hit the economy hard by the second quarter of this year, but what does this mean for your portfolio?

In the second quarter of this year, analysts say that the negative impacts of social distancing should begin to hit the economy hard, with very sharp declines likely in cruises, airlines, hotels, sporting events, movies, theatres and restaurants among other industries.

So as an investor, while you should brace for more topsy-turvy fluctuations to such related stocks – here is what market experts had to say on changes to your investment portfolio in the short and long term.

What analysts have to say?

Analysts say it is important that investors take a long-term view, rather than a short term one – given that there is more selling pressure seen in markets in the coming months.

“The COVID-19 crisis confirms, once again, the value of a diversified portfolio as gains in have, to some extent, offset stock market losses. The current crisis also reminds us of the value of high-quality assets. A crucial first step for any company to thrive in a rebound is to be able to survive a downturn.

“The crisis should prove the value of active managers, as skilled investors adjust portfolios both to weather the storm but also to take advantage of the altered economic and social landscape that is likely to follow.

“Finally, the crisis will underscore the importance of valuations across financial assets. The last few years - relatively calm years from an economic perspective - have allowed some valuations to become unhinged from others with investors generally paying a premium for hopes and dreams and demanding a discount for prudence.

"This crisis reminds us that no single aspect of an investment is as important as the ability to get in at a reasonable price at the start. No matter how volatile financial markets are in the weeks ahead, opportunities will emerge for investors who can think and act with discipline in an increasingly emotional environment.”

Don’t go fully stock repellent

While analysts don’t think the coronavirus will send us back to Stone Age, they do think the coronavirus is most likely a recession-inducing virus. But despite all the uncertainty and human suffering, the financial consequences are likely to resemble those of a moderate recession.

At the onset, if you are an investor who already possesses an all-terrain portfolio of quality businesses with strong balance sheets, top management, and recurring revenues, with the addition of bonds and other safe-haven assets such as gold, stand down on any hasty decisions to make major adjustments.

Also, if many of the company stocks in your portfolio pay meaningful dividends, and most of them are noncyclical (they will not be impacted by recession), analysts say they’ll survive and strive no matter what the virus throws at them.

If you are an investor who already possesses an all-terrain portfolio, stand down on any hasty decisions to make major adjustments.

No to just bonds or ‘timing the market’

When there's an economic slowdown or even a recession, the prevailing wisdom is that investors should move away from equity funds and move toward fixed-income assets such as bonds.

While bonds and similarly conservative investments have shown their value as safe havens during tough times, investing purely in it isn't the right strategy for investors seeking long-term growth.

Investors also must understand that the safer an investment seems, the less income they can expect from the holding.

The odds of making the right move are stacked against you. Even if you achieve success once, the odds of repeating that win over and over again throughout a lifetime of investing simply aren't in your favor.

Don’t let emotions cloud judgement

Stocks often have their biggest, most explosive gains at the ends of major bull markets (that been rallying for a long period of time).

In short, before the big ‘melt down’ arrives, we have the big ‘melt up’. It's the final push higher before the bear market kicks in. The most recent major example of this happened at the end of the 1990s bull market.

During a market melt up, the time horizon extends from five years to 10 to forever, while during meltdowns it shrinks to months and then weeks.

During market melt-ups and meltdowns, emotions can start to impact your time horizon – that’s very human. But we need to remind ourselves that the more rational we are, the better decisions we’ll make.

The goal of every investor should be to keep emotions (fear and greed) in check and to remain as rational as possible, even when the world around us is anything but.

Answer lies in diversification

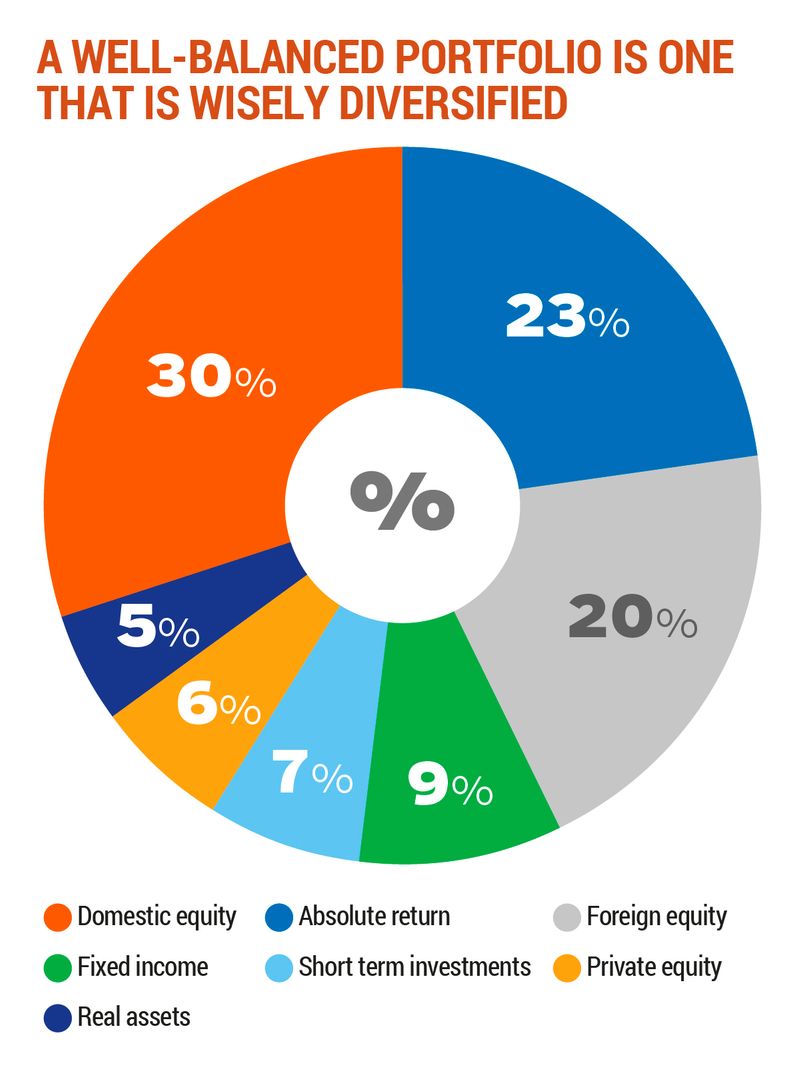

A far better strategy is to build a diversified mutual fund portfolio.

A properly constructed portfolio, including a mix of both stock and bond funds, provides an opportunity to participate in stock market growth and cushions your portfolio when the stock market is in decline.

Such a portfolio can be constructed by purchasing individual stocks or bonds in proportions that match your desired amount of investment.

Alternatively, you can do the entire job with a single fund by purchasing a mutual fund with "growth and income" or "balanced" in its name.

Whether the market recovers quickly or years from now, the most important thing to remember is, it will recover. And so will your investments.