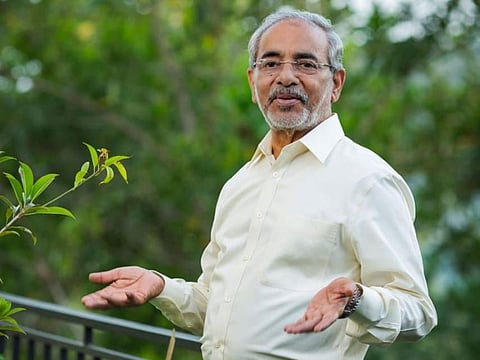

Teaching UAE's Indian expats how to save and more: Sharjah's K.V. Shamsudeen of Barjeel Geojit

Shamsudeen keeps spreading the word on savings, especially with UAE's blue-collar workers

Also In This Package

Dubai: Sharjah-based K.V. Shamsudheen cares a lot about wealth – specifically, in creating it for others. If that happens to be for those in the lowest rungs of the UAE’s workforce, then all the better.

Because for the better part of 50 years, Shamsudheen has been spreading the word about wealth creation from savings – and well before terms like ‘financial literacy’ and ‘helping the unbanked’ started floating around in the financial services apace. One could argue that his formula is as basic as it can get – but for two generations of the UAE’s blue-collar workforce from India, his ways have delivered results. For them.

Shamsudheen, a partner at investment firm Barjeel Geojit, is not done spreading the word – yet. Whether it’s on radio, online forums, and – before COVID-19 – investor sessions, he’s been telling them to save… and keep saving.

“When I ask expatriates whether they have achieved their financial objectives, 95 per cent will say ‘Yes!’,” he said, talking to Gulf News from his home in the south Indian state of Kerala. (Shamsudheen was supposed to return to the UAE after Eid, but the COVID-19 second wave and travel restrictions put paid to those plans.)

“But when I ask them do they have enough resources to maintain their current financial status when they return for good, only 3 per cent will say ‘Yes’. When people lost jobs because of the pandemic, I saw both ends of the spectrum – those left with no investments. And another who had followed what I had to say about keeping aside those monthly savings. They had enough resources for a regular income [even with the altered situation].”

Not just doing the talks

Shamsudeen, who came to the UAE in 1970, is a senior partner at one of the country’s biggest retail stock brokerage firms – Barjeel Geojit Financial Services – with assets under management of $525 million. And these represent the toil of as many as 41,000 investors and not just a few high networth individuals (HNIs).

“It is the first Indo-UAE joint venture in the UAE’s financial services space,” he said. “The present shareholders are Sheikh Sultan Sooud Al Qassemi, Sheikh Saud Bin Majid Al Qassemi, Kerala-based Geojit Financial Services, and myself.

“In the 1990’s, there was a lot of interest in capital market investments among NRIs. A lot of them started to speculate and a lot lost money. Those days a lot of fly-by-night operators were grabbing investments from NRIs.

“I had the ambition to have a “trustworthy” brokerage house in the UAE and was continuously trying to find a local partner to start one jointly with Geojit. Saud Salim Al Mazrouei introduced Sheikh Sultan Bin Sooud Al Qassemi, who already has a brokerage license in Sharjah in the name of Al Saud Stock and Bonds llc. Later, in 2001 its name changed to Barjeel Geojit Financial Services llc.”

A day job

His role at Barjeel Geojit was always going to be a day job for Shamsudeen. Much of his hours would be spent on cajoling, berating and commiserating with low-income workers in the UAE – and the Gulf – and get them to spare an extra dirham if possible for their futures. On radio talk shows, he will have callers saying they are missing out on premium payments, or that the markets are tanking and whether they should be selling or holding. Shamsudeen gives a patient hearing, never losing his cool and trying to ease that other person’s distress or doubt.

So, is his time management all about helping out the less fortunate? Do HNIs even figure in his scheme of things? “When we are giving service to all segments of the Indian community, we are not neglecting HNI investors. We have a good number as clients.

“I know people living in apartments with rents of Dh200,000 and saying he could not save because of high expenditure. The lowest salary I had seen was Dh 700, and thy were saying we could not save because of high expenditure.

“I have been promoting Systematic Investment Planning (SIP) since 1970 - those days the terminology was not even there. I used to say “micro saving and regular investment”.”

Absorb… and gain

Shamsudeen dismisses any mention that stock market or mutual investments should not be something that low-income expats should ideally be looking at. When bank rates are at historical lows, they need exposure to something that can net better returns. Setting aside set monthly instalments under SIP schemes, he says, would be the ideal option.

“The majority of our small investors are SIP investors and are not at all facing market fluctuations,” he said. “When the market declines, the investor will get more units and market fluctuations are an opportunity for them.”

In the 1980's, I was known as the "IPO man" - the reason was people knew I will have the application forms of all the good companies because I was choosy. I used to suggest to them where I had invested. Trust created over these five decades is my asset today - a third generation is coming to invest through my organization.K.V. Shamsudeen of Barjeel Geojit

A few more lessons

COVID-19, on the flip side, has delivered its share of lessons. “People started to control expenses, and more of them started to invest monthly,” said Shamsudeen.

In his view of things, that’s the best outcome an expat can aim for. And something that Shamsudeen has been expounding for well over 40 years - and he's not done yet.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox