Pakistan stock exchanges punching above weight

The country's stock exchanges, already on an upward trend in the past few months, is expecting a further boost through the privatisation of various government entities and blue-chip companies. Is this the time to invest?

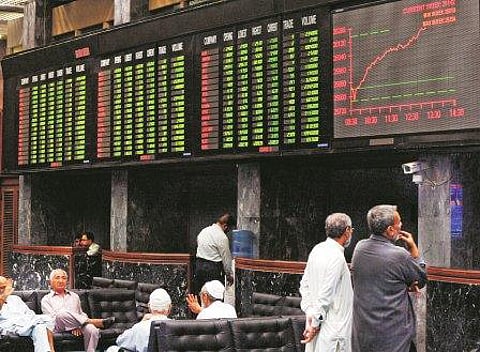

Although Pakistan’s stock market is not really big, it is good for surprises. The Karachi Stock Exchange, the largest and most liquid in the country with a current market capitalisation of some $54 billion (Dh198.3 billion) is among the smallest in Asia behind the bourses of Vietnam, Sri Lanka, Cambodia and Laos.

After it overcame a de-facto crash triggered by political woes in the country, its main KSE index that represents the movement of the 650-plus listed companies grew from less than 5,000 points in early 2009 to more than 27,200 points in January, which makes a gain of more than 500 per cent. Being the financial capital of the country, the KSE lists many Pakistani consortiums as well as overseas enterprises listings.

Economic measures

The other two stock exchanges in the country, in Lahore (LSE) and Islamabad (ISE), didn’t fare badly either. The LSE is the second-largest stock exchange in the country with more than 600 companies listed. It was the first exchange in Pakistan to introduce online trading, which is now used by more than 50 per cent of traders. The exchange is mainly focused on companies and industry sectors in the economic hub of the Punjab region.

The ISE, the youngest stock exchange in the country, set up in 1992, lists a broad range of about 260 different companies, whose exact number — as with the other exchanges — cannot always be determined as frequent delisting, mergers and defaulting of companies take place. At the outset, the Islamabad bourse suffered from low liquidity. For this reason it set up a unified trading system with the LSE in 2007.

Riding a wave of improving economic conditions in the country and the implementation of economic reforms, the Pakistani stock market has made quite a few people wealthy.“There are a lot of small investors who have doubled their investments over the past two years,” says Muhammad Imran, Chief Investment Officer of Karachi-based ABL Asset Management. “Especially those who invested through professionally managed equity mutual funds.”

Financial news provider Bloomberg placed the KSE among the ten best stock markets in 2013 with its benchmark index posting an annual return of 49.4 per cent in Pakistani rupee terms and 37 per cent in dollar terms, after an increase of 48.9 and 37 per cent in 2012, respectively.

This growth has lured international investors to the Pakistani stock market. Star investor Mark Mobius, for example, fund manager at Franklin Templeton Investments, has more than $1 billion (Dh3.67 billion) invested in Pakistani stocks, mostly in the energy sector, having bought them partly at the height of political tensions.

Underlying potential

“Pakistan tended to be ignored by international investors. But behind the news in the press, there is a normal life in Pakistan. And that’s what we focus on,” he says in an assessment of the stock market there. In total, he has invested 8.82 per cent of his $11.67-billion Templeton Asian Growth Fund’s assets in Pakistani shares, according to Reuters.

With the Pakistani economy on an upward trend, the decision seems to have been wise. Things are getting in line in the 193-million-people country, which now offers a growing large and lucrative market for consumer goods, construction and financial services firms, which constitute the bulk of the Karachi stock market. In spite of this, there is a huge gap in income between the industrialised centres and rural regions, buying power is strengthening and confidence of the financial community returned. Another boost is expected when, as announced by Prime Minister Nawaz Sharif, as much as 68 public sector entities selected for privatisation will eventually do that partly via the stock market.

“At some point, Pakistani stocks have been undervalued by at least 50 per cent,” says Zain Hassan, a financial analyst in Karachi. “And they are rapidly catching up now.”

Another reason for the high inflows to the exchanges has been an amnesty law issued in 2012, not unusual for frontier economies. Domestic investors were allowed to buy shares with no questions at all asked where the funds were coming from, with the aim to encourage them to bring their undocumented funds to daylight and invest them in the market. That way, black money flew back into the formal economy and within reach of the taxman. The amnesty is valid until June.

However, it can still be tricky to invest in Pakistani stocks. On the KSE, for example, less than one-third of the listed companies are trading shares regularly, and unsuspecting investors can easily get trapped by a lack of liquidity or extremely high volatility. Another problem is the country’s struggling currency. The falling rupee is cutting returns for foreign investors.