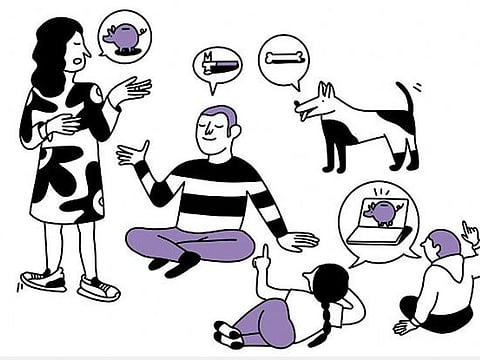

A balancing act of finances: Raising children and running a household

There are pitfalls to avoid while navigating household expenses

It’s often difficult for families with children in the UAE to keep a handle on their finances, given how the cost of housing, school, food, transport and entertainment all make a dent in the monthly budget.

Mothers, who often oversee household finances, suggest that the best tip is to know your family income, track spending, make a budget and stick to it. If you are unable to make ends meet and are living on debt, you need to commit to cutting down expenses.

Incorporating financial discipline into your day-to-day life is key to meeting your children’s education expenses – both present and future – as well as running the household. It’s also important to educate the children to not try to keep up with their friends.

As a parent of school-going kids in the UAE, you need to plan ahead and account for much more than just tuition fees. Think uniforms, commute, books, stationery and excursions.

According to Edarabia, which monitors costs of education, parents in Dubai shell out between Dh12,733 and Dh64,093 annually on tuition fees alone. This does not include other expenses such as admission, transportation, school uniforms and books.

Select an affordable school

“To begin with, it is important to select a school you can afford. You can save a fixed percentage of your monthly income per child - say 5 per cent. So, if you have three kids, that’s 15 percent of your income being set aside to cover their education costs,” observes Ambareen Musa, founder and CEO of Souqalmal.com, a financial comparison website.

Sneha Rebecca, a digital creator and social media influencer, is a mother of three boys in Dubai. She and her husband moved their children from expensive schools to more affordable ones to manage finances better. “Personally, we have seen our financial fortunes go both extremes in our 17-year history in Dubai, but being content, conservative and trying to not keep up with the Joneses has been our secret to thriving,” Rebecca warns.

House rents, a big expense

Faced with acute financial setbacks during the global financial meltdown, Rebecca’s family faced the realities head on and took small steps every day. This helped them tide over the crisis. Today, the family owns a house in Dubai and are relieved to be free of paying rent and mortgage.

“But to do that, we had to stay longer in what I considered less than ideal circumstances, especially since my friends lived in fancy apartments in the heart of town. In hindsight, I’m glad we took that step because since having children, our expenses have gone up but rent is one less thing to worry about and we now live in a beautiful home,” the Indian expat tells Gulf News.

Optimal income for a family of 5

Gulf News contacted several mothers in the UAE to ascertain an optimal income for a five-member family. A monthly income of approximately Dh20,000 to Dh22,000 is ideal for a family with three children to lead a comfortable life in the UAE. Of this, the family can allot Dh7,000 on monthly rent, Dh2,000 on utility bills, Dh2,000 to Dh3,000 per child for schooling, Dh3,000 for groceries, up to Dh2,500 for car loan and fuel costs and Dh1,000 for miscellaneous expenses.

The breakdown

Sharing a few tips on how to cut down on expenses, Rebecca suggests families to shop smart. For instance, instead of heading to a supermarket daily, budget for a weekly spend and stick to it; check for expiry dates and consume stuff before they expire; avoid doubling up on products at home by checking to see what’s in stock; eat home cooked food through the week; and shop for kids’ clothes, shoes and school essentials during sales.

When it comes to entertaining kids, mothers can consider alternative options like play dates at home, Netflix, potluck dinners, park and beach outings. Kids can also be encouraged to be smart in their utility usage – instruct them to switch off lights and gadgets when not in use, switch off the AC when you leave the house and be mindful of water consumption when brushing teeth, shower, etc. These steps can help bring down your Dewa bills.

How to budget smartly

Don't head to a supermarket daily, budget for a weekly spend and stick to it Check for expiry dates and consume stuff before they expire Eat home cooked food through the week Shop for kids’ clothes, shoes and school essentials during sales Consider cheaper options like play dates at home, Netflix, potluck dinners, park and beach outings for kids Encourage kids to be smart in their utility usage

Need for a contingency fund

Zahra Abdalla, an author and TV chef, is also a mother of three boys in Dubai who allots a portion of her salary into savings and uses that savings to generate income. “In general, I am a planner and extend that planning into my finances - I set targets for monthly savings, and I allot budgets for different expenses in our day-to-day life, and always make sure to have a contingency fund. The main and most important rule of thumb is that if I can’t afford it, I don’t buy it,” she adds.

It is recommended that families document their daily spending habits in a journal to review how they spend every week and every month. This helps to understand where you spend unnecessarily.

Earn, save, spend

Svetlana Deshais, a senior wealth adviser at deVere Acuma and a mum of three, follows a three-step principle for her earnings: earn, save, spend. However, most people in the UAE earn and spend, leaving nothing to save. She suggests that the costs of accommodation and utilities should not exceed more than 30 per cent of a family’s monthly income.

Sharing her tips on how to cut down on expenses, Deshais recommends limiting weekly activities to 2-3 per child, using apps such as Entertainer and Groupon while dining out, and avoiding lavish birthday parties for small children. The wealth advisor invests cash into products that generate passive income every three months, which covers the family’s annual holidays.

Wants vs. needs

Mothers must also learn to strike a balance between their family’s wants and needs. They must optimally allocate financial resources to ensure the family’s well-being. “If foregoing a family holiday means having enough to pay your child’s annual school tuition, you’ll have to be the one making that call,” reckons Musa.

If foregoing a family holiday means having enough to pay your child’s annual school tuition, you’ll have to be the one making that callAmbareen Musa, founder and CEO of Souqalmal.com

Another pitfall parents must avoid is to postpone planning for their children’s financial future until it is too late. That’s when they resort to taking out education loans to afford expensive school and college fees.

Families must also take out appropriate insurance for the bread winner to plan for the worst and avoid nasty financial surprises.

Saving for higher education

It is recommended that parents use a diversified approach to set aside money for their children’s higher education. To many parents, structured savings plans may seem like the most systematic way to go about investing for children’s education. There are many international platforms that can provide families with regular saving habits, making sure they can afford to educate children.

“Deposit accounts, high-yield savings accounts, National Bonds and gold investment accounts are low-risk alternatives for parents looking to save within the UAE. For other investors with a higher risk appetite, stocks and rental property may be viable options too,” recommends Musa.

Abdalla uses a mix of strategies to save for her kids’ education: Some investments offer monthly returns which are then re-invested into their education, other approaches are basic savings account that accrue interest overtime.

A diversified approach

Meanwhile, Rebecca stresses the need to have a contingency pot because there’s always something that will throw your budget off track.

“The only way to do this is to live within your means and save. National Bonds have amazing plans and I recommend them to invest your savings,” she notes.

Deshais suggests that families must not only save money in bank accounts as this will mean that they lose every year because of inflation. “Your money must work for you. This can be achieved through fixed interest or many other sensible strategies, making sure you beat inflation,” she adds.

Tips from mothers

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox