End of 'dead zones': $20/month for 5G direct-to-cell Starlink phone service soon?

SpaceX just shook smartphone world, as direct-to-cell gets a 5G boost in $17b deal

SpaceX has announced a deal Monday to acquire wireless spectrum licenses from EchoStar.

SpaceX has pulled off another cosmic curveball — snagging $17 billion worth of spectrum from EchoStar.

This marks a huge step in the company’s push to expand its Starlink Direct-to-Cell (DTC) services, say telecom industry experts.

On Monday (September 8, 2025) the landmark deal was finalised.

It consists of $8.5 billion in cash, $8.5 billion in SpaceX stock, and coverage of approximately $2 billion of EchoStar’s interest payments through late 2027.

It’s dubbed 'game changer'

Here’s why:

#1. Exclusive rights to S-band: The $17-billion deal grants grants SpaceX exclusive rights to critical satellite based 5G, based on S-band spectrum previously under scrutiny by the FCC due to underuse by EchoStar.

#2. Spectrum boost: The acquisition also resolves those regulatory issues and significantly bolsters SpaceX’s spectrum holdings for mobile satellite connectivity.

#3. Independence: On a strategic level, the deal reduces SpaceX’s dependence on leased spectrum from traditional mobile carriers such as T-Mobile, AT&T, and Verizon.

#4. Tech enabler for satellite-to-cell: This signals a shift toward building an independent satellite-to-cell network infrastructure.

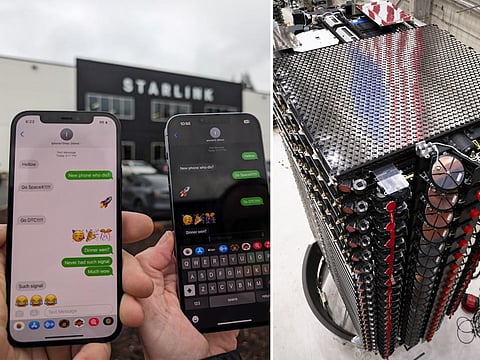

End of 'dead zones'?

For President and COO Gwynne Shotwell, the deal isn’t just about satellites in space, it’s about ending mobile dead zones on Earth.

Think Starlink, but souped up: next-gen direct-to-cell (DTC) satellites with 100x the capacity of today’s models, plus full-blown 5G baked in.

The telco world is rattled.

On September 8, US carrier stocks slipped about 4% in premarket trading as investors realised SpaceX is no longer just that rocket company — it’s coming for mobile.

$20/month for 5G phone service via Starlink?

$5 Analysts are buzzing that SpaceX could offer global 5G for as little as $10–$20 a month. That’s pocket change compared to what carriers squeeze out of customers in emerging markets.

Translation: telcos are sweating.

Backing all this ambition is the Starship rocket, SpaceX’s not-so-secret weapon. Its latest test flight successfully tossed mock Starlink satellites into orbit, proving it’s nearly ready for primetime.

Once operational, Starship can fling huge batches of the new laser-linked satellites skyward, knitting together a planet-wide mesh of high-speed coverage.

If he goes that route, telecom giants might want to fasten their seatbelts.

The FCC helped pave the way here. Regulators had long fretted about EchoStar’s underused spectrum.

With SpaceX lobbying hard — and even pressure from Trump-era officials — the stage was set for the handoff.

Now, regulatory hurdles are cleared, and the runway for rollout is wide open.

No more “one bar” frustration in rural towns, remote islands, jungles, or deserts — this is true anywhere-on-Earth connectivity.

The vertical integration angle is the kicker.

By owning its own spectrum, SpaceX can skip the middlemen — no need to beg carriers for bandwidth.

Satellites talk to smartphones direct

Instead, the satellites talk directly to phones.

That’s not just disruptive, that’s a full-blown jailbreak from the old telecom model.

And of course, the Musk factor hangs over everything.

Rumours swirl about Tesla cars linking straight to Starlink, or Musk launching his own mobile devices (long rumoured, but didn't happen so far).

Imagine buying a Tesla that comes with built-in satellite service — car, charger, and cell plan bundled together.

Takeaways

SpaceX’s $17-billion acquisition of EchoStar spectrum gives it exclusive control over key frequency bands, freeing it from reliance on leased spectrum from carriers like T-Mobile and Verizon that have slowed satellite-to-cell progress.

The deal also follows FCC scrutiny of EchoStar’s underused spectrum and strengthens SpaceX’s position as global demand for seamless connectivity accelerates.

Cheap, global 5G straight from space? For billions who still live off the network grid, it could be nothing short of game-changer.

Bottom line: this isn’t just another Musk headline grab. With the S-band secured, SpaceX is positioned to rewrite the rules of mobile connectivity.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox