While the value of gold, which has always been seen as a safe investment, has plunged over the past few months, traders are predicting that diamonds have a glittering future as a solid investment option. Interest in the gem spiked following gloomy financial figures from the US and China, along with concerns over a national sell-off of Cypriot gold reserves that sent prices plummeting in April and dented confidence in the gold market.

“We started selling diamonds to investors a year and half ago and we are seeing increased interest because prices are rising and gold has become a more precarious investment,” says a spokesman from diamond brokers, the Waldman Diamond Company, based in New York.

“Diamond investment is driven by different factors than gold and is dependent much more on consumer demand, particularly in the Far East. Diamonds are a different kind of commodity from gold and are not affected by the performance of currencies or economies.

“All the studies done in mines around the world say that the supply is falling. No new mines have been found for quite some time and it takes time for new ones to be turned into operational mines. The projection for supply is that there will be a dramatic drop. The projection for demand is that it will rise.”

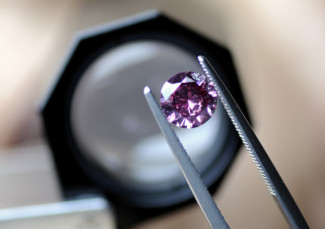

Their rarity and timeless appeal are just some of the reasons diamonds are set to become an investor’s new best friend. Their size and portability make them easy to transfer, but their beauty is one of the major reasons they’re so coveted – even as a long-term investment.

“Investors are people who like diamonds and who recognise their dual value – sentimental and economic,” says the Waldman Diamond Company spokesman. “People who invest in gold store it in vaults and don’t take it out and stroke it. Diamond investors are more like the types of people who invest in paintings – people want to appreciate their diamonds.”

But unlike art, which can be fragile and get damaged over time by the environment, diamonds are strong and durable.

Rising confidence Vashi Nanwani Dominguez, a Spanish entrepreneur and founder, owner and chief executive officer of Diamond Manufacturers in London, agrees. “Certain types of diamonds have held their value over the past few years better than other more volatile equity investments,” he says, underscoring the fact that diamonds are gaining in investor confidence.

Smith & Barrow, a leading US-based active asset management firm specialising in precious mineral commodities, supports this claim. “Diamonds are stable, high-yield investments, the values of which have the potential to withstand economic downturns, inflation and currency devaluations that directly impact the price of oil, gold or cash,” says a company spokesperson. “Diamonds become a hedge against inflation, and will actually increase and maintain value in times of deflation.”

Karim Merchant, chief executive officer and managing director of Pure Gold Jewellers, explains why diamonds have such a timeless appeal. “Diamonds represent a good long-term investment because of their rarity,” he says. “If statistics are to be believed, with the current rate of mining we will have no new diamonds 50 years from now. This makes diamonds very attractive to many buyers. Currently, there is no substitute for diamonds.”

Kristopher Schellhas, a former Chicago Board of Trade futures trader, also believes diamonds are a good investment option. Kristopher, who is the co-owner of US-based Investment Diamond Exchange, which tracks the diamond market and helps investors buy the precious rocks, says, “Emerging economies are fuelling unprecedented demand for diamonds and jewellery. The fundamentals for diamond price appreciation are amazing now because all the existing diamond mines that are substantial are at their peak capacity.”

When global diamond dealer De Beers created the phrase, ‘A diamond is forever’ in a 1948 marketing campaign, it wasn’t commenting on the physical strength of the gemstone, but the famous phrase is as scientifically factual as it is romantic.

Splinters from stars

Diamonds have been objects of desire for thousands of years. It is thought that they were first recognised for their beauty and used for decorative purposes in India between 3,000 and 6,000 years ago. Records show that deposits were found along the Krishna and Godavari Rivers and that the ancient Indians used them in worship. The ancient Greeks and Romans also recognised the value of the stones and believed they were splinters from stars.

The constant appeal of diamonds over the course of history is perhaps in part because the gems were created aeons ago. Diamonds grow deep under the earth’s surface in a layer of rock between 140 and 190km below the Earth’s mantle. Scientists have determined that diamonds are created in unimaginable conditions in temperatures of 1,325°C and under 50,000 kg/cm² of pressure.

Most of the diamonds used in jewellery today were mined in Africa, Canada, Russia, Brazil and Australia.

The rarity and beauty of diamonds have given them an almost mythical appeal, and the most famous ones are steeped in history and draw crowds when they are put on display.

In 2010, one such diamond – the Hope Diamond – was displayed at the Smithsonian Institution’s National Museum of Natural History in Washington, DC. It has been described as the most famous diamond in the world. Then there’s the Wittelsbach-Graff Diamond, which was displayed at Expo 58 in Brussels. Later, in 2008, Laurence Graff, a billionaire diamond dealer, bought it at an auction for over $25 million (Dh91 million) – $10 million more than its estimated price. It has had a rich history. Said to have originated in India, in 1664, Philip IV of Spain gave it to his daughter, the Infanta Margarita Teresa, to celebrate her engagement to Emperor Leopold of Austria. In 1772, it acquired its name by passing to the Wittelsbach family of the House of Bavaria. After the First World War, Bavaria became a republic and the Crown Jewels, including the diamond, were sold.

Dubai has a thriving diamond trade and Pure Gold’s Karim has some advice for people who are looking to invest in a diamond or are lucky enough to own one already. “A diamond’s brilliance and ability to reflect light depends on its clarity and cut,” he says. “The fewer inclusions, the less distorted the light will be. Different angles and cuts are designed to enhance the way diamonds reflect light.

“There is no special care necessary for diamonds, just ensure that you take basic care of them. Always clean diamonds with a soft cloth, avoid using substances such as ammonia. Soak your diamonds in a mixture of mild liquid detergent and warm water and use a soft brush to clean them. Take care not to touch the stones with your fingers. Dry them with a tissue. If you cannot clean them yourself, you can take them to a jeweller.”