The story of India’s financial sector is easily split into two chapters: the protectionist pre-liberalisation era of 1947-1991, also known as the license raj, and the post liberalisation era that began with Manmohan Singh’s dream budget in 1991. There are institutions and individuals who made their mark on each epoch, while some watershed acts continue to affect policymaking and economic progress. Here is a look at the most significant:

Central bank

Established in 1935, the Reserve Bank of India also served as the central bank of Burma (now Myanmar) until 1947, and of Pakistan until 1948. Set up to regulate the issue of bank notes and secure monetary stability on the subcontinent, it was originally a shareholder’s bank until 1949, when it was nationalised by the government. The RBI has helped build financial infrastructure through national entities such as Unit Trust, Deposit Insurance and Credit Guarantee Corporation, Industrial Development Bank, National Bank of Agriculture and Rural Development, and Discount and Finance House.

Exchange rules

In 1974, the Foreign Exchange Regulation Act, or FERA, became the primary law responsible for India’s foreign exchange regime. Following the nation’s rapid industrialisation, the act aimed to strengthen exports and regulate the inflow of foreign capital so as to avoid a balance of payments crisis.

The liberalisation era took off in 1991 and by the late nineties, FERA was considered too restrictive for the country with the result that it was replaced by the more liberal Foreign Exchange Management Act, or FEMA, in the year 2000.

Nationalisation

Although the Imperial Bank of India was the first to be nationalised, when it was transformed into the State Bank of India following the acquisition of a controlling interest by the RBI in 1955, it is the nationalisation of private banks in 1969 that reformed the financial system. Following the Banking Companies Act, the ownership of 14 commercial banks that controlled 70 per cent of the country’s deposits transferred to the state, thus widening the funnel of credit available to the nation’s population. In 1980, six more banks were nationalised.

Regulatory schemes

Today, India’s economy rests on a comprehensive network of guidelines. “Among the most important regulatory frameworks that have shaped the Indian economy are capital markets (Securities and Exchange Board of India, 1992), telecoms (Telecom Regulatory Authority of India, 1997) and insurance (Insurance Regulatory and Development Authority, 1999),” says Brij R. Singh, CEO of Baer Capital Partners, a Dubai-based financial advisory that promotes India-focused private equity funds. “As with the nationalisation of its banks, India also nationalised its life insurance business in 1956 and general insurance business in 1972,” he adds.

New policy

Then Prime Minister Rajiv Gandhi’s new economic policy reduced the powers of the licence raj significantly, allowing businesses and individuals to purchase capital and consumer goods and import without bureaucratic restrictions.

“In 1985, Jerry Rao started consumer banking for Citibank India with a focus on the middle class, ushering in credit and debit cards, and auto and personal loans,” says Dr Sharad Nair, Founder of Apex Advisors DMCC, a boutique financial advisory. “This was followed by the launch of NRI banking services in countries with diaspora concentrations like the UAE, US and Singapore.”

Liberalisation

During Prime Minister Narasimha Rao’s tenure, his finance minister Manmohan Singh responded to a balance of payments crisis by burying the licence raj, reducing tariffs and interest rates, ending several public monopolies and allowing foreign direct investment in many sectors in what is widely seen as the most important annual budget in independent India. The landmark move set the nation on the road to economic liberalisation and paved the way for growth rates of 6 to 8 per cent in the following decades.

Digital documents

Few transactions in India are possible today without two numbers. The new series of Permanent Account Number (PAN) for personal identification and financial records was made mandatory across India in 1998. The Unique Identification Authority of India, a statutory authority established in July 2016, collects biometric and demographic data of resident Indians through Aadhaar. Both are now linked.

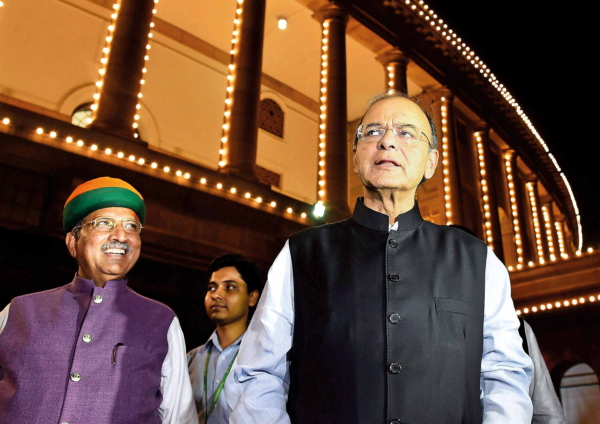

Demonetisation

In a televised address on November 8 last year, Prime Minister Narendra Modi announced the demonetisation of currency notes of Rs500 and Rs1,000, which accounted for 86 per cent of the currency in circulation. While the sudden liquidity crunch initially made people face tremendous hardships, Modi described this as a ‘purification drive’. “Aimed at removing illicit money and forged banknotes from the economy, and a crackdown on money laundering, this is a huge step towards a cashless economy, and integrates millions of Indians into the formal financial sector,” says Gaurang Desai, CEO, Dubai Gold and Commodities Exchange.

GST launched

On July 1, a new national goods and services tax (GST) came into effect, replacing a battery of state taxes in an attempt to transform India into one unified common market. This is being introduced in India after a 13-year-long journey since it was first discussed in the report of the Kelkar Task Force on indirect taxes and was billed as the biggest financial reform since independence.

“GST is a gigantic move that promises to clean up complicated taxation laws, and reduce petty corruption and cost of goods, while giving the central and state governments an efficient means of tax collection,” says Desai.