DUBAI: Ripple, the San Francisco-based blockchain company, said it has signed an agreement with Saudi Arabian Monetary Authority (SAMA) to enable banks in the kingdom to use its cross border payments technology.

The pilot programme will be first of its kind to be launched by a regional central bank even as its overseas counterparts have been cautious about trading in cryptocurrencies but constructive on the underlying blockchain technology.

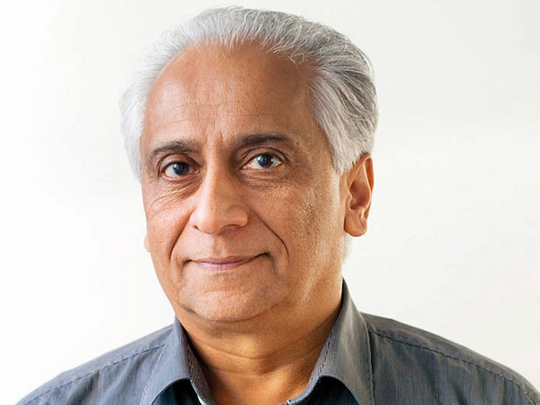

“Central banks around the world are leaning into blockchain technology in recognition of how it can transform cross-border payments, resulting in lower barriers to trade and commerce for both corporates and consumers,” Dilip Rao, global head of infrastructure innovation at Ripple, said in a statement on Thursday.

“SAMA is leading the charge as the first central bank to provide resources to domestic banks that want to enable instant payments using Ripple’s innovative blockchain solution,” Rao added.

Both Ripple and the Saudi central bank have created a programme to provide support to Saudi banks to use xCurrent, Ripple’s enterprise software solution that enables banks to instantly settle cross-border payments with end-to-end tracking, Ripple said in a statement posted on its website. It added that SAMA will support Saudi banks with programme management and training.

“Ripple could also provide real-time messaging, clearing and settlement of financial transactions for global banking and payment partners. This partnership could enhance efficiency, enhance data security and minimise cost involved in data storage,” said Y Sudhir Kumar Shetty, president at UAE Exchange, which also has partnered with Ripple for a similar arrangement.

Joint project

In December last year, the UAE Central Bank said it was undertaking a joint project with its Saudi counterpart to use blockchain technology in order to issue a digital currency accepted in cross-border transactions between the two countries.

“This is probably the first time ever that witnesses the cooperation of monetary authorities from different countries on this topic, and we hope that this achievement will foster similar collaboration in our region,” UAE Central Bank governor Mubarak Rashed Al Mansouri said in December last year.

Al Mansouri also said that the recent developments in fintech present both unique challenges and opportunities for the industry and the key is for both market participants and regulators to better understand the risks involved and the best ways to monitor and mitigate them.

“Crowdfunding platforms and blockchain technologies are a case in point. Crowdfunding platforms, for example have gained widespread attention and growth over the previous few years. At the central bank of the UAE, we started developing regulations in this regard in 2016 in order to safeguard the financial system and protect consumers, this project is at a final stage,” Al Mansouri had said.

_resources1_16a30b358e0_small.jpg)