Buying a home is a big milestone for almost every one and every family. It is a big financial commitment, and a major way to being part of a chosen community.

Many people, however, make uncalculated moves when they buy their home, which can be triggered by their inexperience or the mere fact that they’re too excited and in a rush to get the process done. In fact, to make buying a home the right investment, you must take many considerations that ensure your decision is feasible financially and personally.

Here are some factors to keep in mind:

Total monthly payment

Assuming your lender’s officer doesn’t help you out with cost calculations, it is important that you think about the total monthly payment that your new house will require. That is not the same as your mortgage payment, which is only one item. The total monthly payment includes your insurance premium, estimated maintenance cost and homeowners-association fees, if any.

Many people make the mistake of comparing the mortgage payment to their rent, which isn’t a fair comparison. The first step to setting your monthly budget for a home is to add up all the costs and come up with the total monthly payment that you’re comfortable with.

Location

Your budget may be taking you to neighbourhood that you’ve never lived in. When you buy a house in particular location, you will be influenced with this community and neighbourhood in several ways. First, these are your neighbours and immediate contacts. If you’re not comfortable with this social setting, you probably will want to make a change shortly afterward, which will hurt your financials.

You home location also impacts your current commute to work, as well as future job opportunities. For example, a house that is far from a major city may become a hurdle in the future when you’re trying to get a new job or send children to schools. These may seem like far-in-the-future prospects when you’re buying a house, but remember a house is only a good investment if you hold onto for several years.

Impatience

There is a range of houses between the one that you start off thinking you should buy and the one that you can actually buy and like on the long run. There are also many factors that may influence your decision if you take your time to look around. Seeing what’s available and making decisions about which compromises you’re willing to live with as well as your priorities should be an essential part of the process.

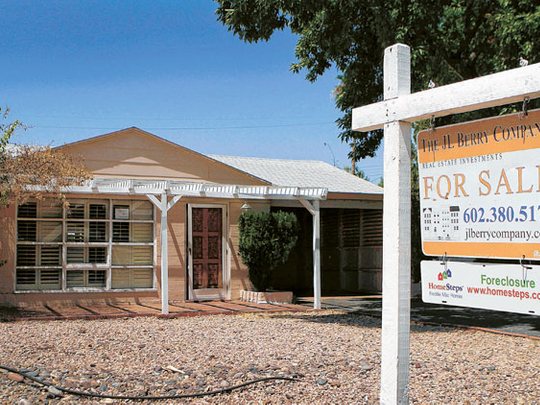

Working with a reliable real estate agent is critical, but still it is your ability to slow the process down and not rush to the first house that fits your basic requirements that matters. In some markets where the inventory of available houses for sale is tight, this can be particularly challenging because every opportunity presents itself as a catch. Remember, however, regardless to the circumstances, you’re the one who will own that house. So make sure that you’re making the right decision.

Resale value

You may no plans in the near future to sell the house, but things happen. It is therefore important to think about what if you’ve to. If your plans change because of a job loss, a family emergency or the like, you probably will need to sell your house quickly. A house that has too many compromises — in terms of location or amenities — can be tougher to sell. That is why it is important to balance what you can personally accept as compromise and what others — or future buyers — would accept.

Major concerns can be any pending maintenance that will require cash investment and the number of rooms and bathrooms versus the space. For example, a three-bedroom house with one bathroom may be considered unappealing for most potential buyers. A house on a busy, noisy street may be difficult to sell in a buyers’ market where many alternatives are available.

Rania Oteify, a former Gulf News Business Features Editor, is a Seattle-based editor.