It’s getting increasingly hard for strategists to stay bullish on Indian bonds after the longest rally since 2003.

Even as a banking system awash with cash continues to spur local demand for sovereign notes, Citigroup Inc sees gains fizzling out in the second half of 2017 as the central bank’s monetary easing cycle draws to a close. Standard Chartered Plc expects a pick-up in inflation to spur bond losses in the July-December period, while Societe Generale cites rising US yields as a key external threat for emerging Asia’s best-performing local-currency debt.

“This year could see the reversal of part of the softening in bond yields, as policy normalisation in advanced economies, and higher domestic bond supply reduces the room and effectiveness of further monetary easing,” said Ram Kamal Samanta, vice president for treasury at SBI DFHI Ltd.

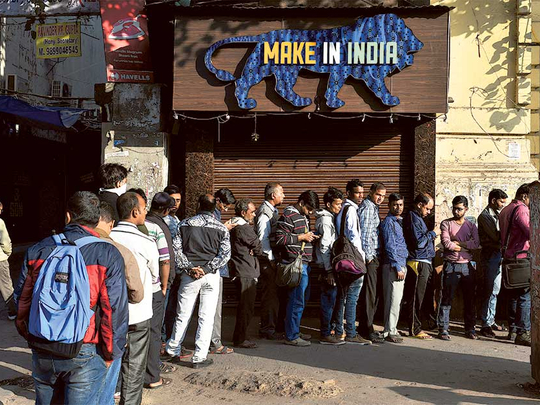

Investors earned 15 per cent on rupee sovereign notes in 2016, the most in Asia, as local banks purchased a record amount of debt after Prime Minister Narendra Modi’s shock currency recall flooded lenders with cash. While the benchmark 10-year yield dropped 125 basis points last year, it could slip just 9 basis points in 2017, according to the median estimate of a Bloomberg survey.

Appetite for the notes is seen ebbing as the administration removes the strict cash-withdrawal limits for citizens and these funds move back into the real economy. At the same time, strategists cite crude prices — which have a bearing on oil-importing India’s inflation outlook — and a potentially expansive budget as risks for bonds this year.

India’s 10-year bond yield is expected to end 2017 at 6.43 per cent, according to the median estimate in a Bloomberg December survey, compared with the 6.515 per cent it ended 2016. Bond yields had dropped for three consecutive years, the longest period of decline since 2003. The yield was down one basis point to 6.44 per cent Tuesday.

Here’s a look at the key arguments:

* End to monetary easing cycle

Consumer inflation was at 3.41 per cent in December. With members of the rate-setting panel wanting to focus on the 4 per cent mid-term target, compared with the 5 per cent for March, scope for further easing is limited. The benchmark repurchase rate will be cut by just 25 basis points this year, according to the median estimate in a Bloomberg survey. It dropped 175 basis points in the past two years.

“We expect the government bond yield curve to steepen in 2H 2017, signalling the end of the current monetary easing cycle and reflecting unfavourable demand-supply dynamics,” Nagaraj Kulkarni, Singapore-based senior Asia rates strategist at Standard Chartered, wrote in a January 6 note, while lowering the 12-month outlook for the debt to neutral from positive.

Citi said the 10-year bond yield could easily climb toward 6.5 per cent-6.6 per cent by year-end, while Societe Generale sees it at 6.6 per cent.

* Inflationary pressures may rise again

Higher global commodity prices, gains in government-administered minimum support prices, and an advance in rural wages mean inflation may average 4.9 per cent in fiscal 2018 from a projected 4.6 per cent in fiscal 2017, according to a Citigroup note dated January 9.

The Reserve Bank of India’s household inflation expectation survey for November forecasts CPI to rise by 90-270 basis points in the next three to twelve months, according to data released on December 7.

* Cash deposits at banks

The banking system is flushed with liquidity to the tune of Rs6 trillion ($88 billion; Dh322.88 billion), but more than half of it could be drained as new notes are issued and limits on withdrawals from banks are relaxed, according to the Citi note.

“The extent of the influx of deposits that stays back in the system post the demonetisation exercise is the key uncertainty,” Tushar Pradhan, the Mumbai-based chief investment officer at HSBC Global Asset Management, India, said last week.

* Yield differential

The yield differential between 10-year US Treasuries and similar-maturity Indian government bonds narrowed to 377 basis points in December, a seven-year low, and is at 407 basis points now. Foreign funds pulled out Rs382.4 billion from the country’s government and corporate bond markets last quarter.

“Yield is likely to move higher in 2017 on narrowing India-US yield difference and reduced foreign appetite for the Indian local currency bond,” said Amit Agrawal, Bengaluru-based rates strategist at Societe Generale.

* Bond supply

The government will probably relax its fiscal deficit target for the year ending March 2018 to 3.4 per cent of gross domestic product, from the 3 per cent planned, as it seeks to boost consumption, reward honest tax-payers, support redistribution and continue with its capex increase, Citigroup economists wrote in their note. Net borrowing by federal and state governments together can rise by 10 percent to Rs8 trillion, they wrote.