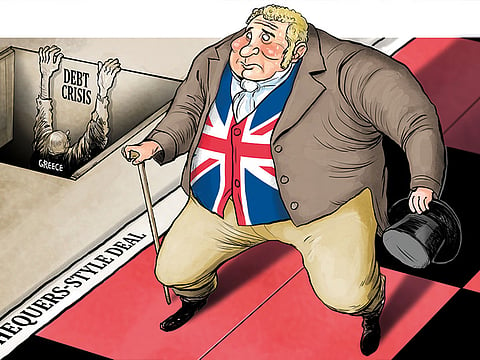

Greece is still suffering from the EU’s self-interest. UK will suffer, too

The damage done during the Greek debt crisis is a lesson on how Britain will fare under a Chequers-style deal

So it is “Cabin crew, doors to manual” and, as you settle back and prepare to hand over €20 for an easyMeal, you may be reflecting on that delightful week you just had in the Med — the bustling marinas, the crowded restaurants — and you may conceivably have been persuaded by all those United Kingdom cheerleaders for the European Union (EU) that the euro crisis is indeed at an end.

You may now go along with the fashionable pro-EU narrative, that the nice Mario Draghi of the European Central Bank has cracked it, that the euro is in robust health, that Club Med countries are on the way to durable recoveries. And you may even ask yourself whether they are therefore right — those same London-based cheerleaders for the EU — when they say that this tentative euro recovery proves that the UK’s best bet is to stay in legal lockstep with Brussels, to the point of doing exactly what the EU tells us to do — even when we have no influence on those decisions.

Is that what you have concluded, after a week in the sun? If so, you have been drinking too much retsina. The euro crisis is far from over. The single currency remains an unmitigated disaster. One day it remains highly likely that it will implode. And in the meantime, the experience of Greece alone is a lesson in the absolute insanity of any country allowing itself to be bullied by EU negotiators.

Drive around any big Greek city, away from the tourist spots, and in every boarded-up building and smashed window you see the devastation of Greek industry — which, in three years from 2010, went from boasting 80,000 factories to 57,000. In the frenzied anti-establishment graffiti you see the rage of a lost generation of young people who still feel they have no hope of a job. Overall unemployment is still running at 20 per cent; the economy is still a quarter smaller than in 2008; and there are an astonishing 35 per cent of people living in absolute poverty.

That is an extraordinary figure for a EU country. Yet, it is so high precisely because Greece is a EU country and meekly obeyed the prescriptions of Brussels. It wasn’t just that they could not (or dared not) reclaim their monetary independence. The Greeks were forced — mainly by Chancellor Angela Merkel of Germany — to accept an austerity regime of draconian budget cuts that became a self-perpetuating downwards cycle of economic decay.

It is absolutely crucial to understand that when the EU imposed this programme they were not thinking first of Greece or the Greek people. No, they were thinking of the EU; of the balance sheets of EU banks; of the risk to the euro of a Greek default. So the Greeks found themselves in the appalling position of negotiating with people who did not really have their interests at heart, and who believed furthermore that it was politically useful to make an example of Greece, and that Greek suffering might be a memento mori to anyone tempted to differ with the orthodoxy of Brussels (sounds familiar?).

Ten years after the crisis began, it is just nonsense to believe that the EU project — to save the euro at all costs — has worked. Yes, Greece has become a kind of economic colony with many Greek assets (state telecoms, 14 regional airports) now owned by Germany. But the economy is still plagued by debt. And as you look around the Mediterranean, you can see elements of the same story: How the euro has not only failed in its objective, but produced the exact opposite of what was intended.

The economic advantages of monetary union were always sketchy — something to do with boosting cross-border trade by reducing transaction costs. But as former German chancellor Helmut Kohl and others made clear, the real purpose was political — to knit the people of EU together in a union of hearts and minds.

Neither outcome has happened. There has been no measurable intra-EU trade boost as a result of the euro; and instead of producing economic and political convergence, the euro has been a force for divergence, as the northern economies — mainly Germany — have done better, and the less productive economies have done worse, as so many economists predicted before the euro was launched.

Far from dissolving any political tensions between the nations and people of the EU, the euro has actually created tensions where none existed before. The last time I was in Athens, I actually heard an anti-German demonstration outside the Foreign Ministry: That’s right, people marching against the paymaster of the EU. It would have been unthinkable 20 years ago, and it is the direct result of the euro.

It is true that the Eurozone is benefiting from a general global economic upturn — hence the eager talk of the Remainers in the UK — but it is clear that the weaker economies, notably Italy, are in a much worse position than in 2008 to withstand the next economic shock, banking crisis or whatever. There will be such a shock, of course, and this time, for the euro, it could well be fatal.

In the meantime, the Greek suffering goes on, and the lesson is clear. As the former Greek finance minister, Yanis Varoufakis, has explained, the tragedy of the Greeks was that they never had the nerve to tell their EU masters to get lost. They were never able to take back control, to run their economy in the interest of their electors.

That has a direct read-across for Britain. Under the Chequers proposals, Britain is about to make a historic mistake and turn the country into a rules-taker from Brussels, with no say on those rules — not just for industrial goods and food, but across a wide range of economic activities. Look at the humiliation of Greece — a EU member — and ask yourself how the EU will legislate with the UK out of the room, and when Britain can no longer do anything to protect itself from the imposition of those rules. Will the EU act in UK’s interests and the interests of UK jobs and growth, or the interests of the EU?

The answer is clear. It is written in graffiti all over Greece. Why, then, is Britain proposing to turn the UK, in important respects, into the perpetual punk of Brussels? Chuck Chequers.

— The Telegraph Group Limited, London 2018

Boris Johnson is former foreign secretary of Britain.