Who’s behind the future of money?

Bitcoin is the virtual currency taking the world by storm, but who is its mysterious creator?

The simple answer is Satoshi is the inventor of Bitcoin, the controversial internet currency that many experts believe will change the world. But Satoshi is anonymous. He wrote the code for the program that controls the complex Bitcoin system and then disappeared, leaving a few scant clues as to his or her true identity.

Since he was linked to the mystery, Michael has received an avalanche of emails. In April he issued a statement to try to end the speculation, in which he admitted he was flattered to be a suspect but denied the accusation.

“I am certainly the wrong person,’’ he wrote. “There are far too many possibilities to consider for Satoshi, not to mention the many thorough investigations that have been undertaken. However, it seems that even limited searches yield candidates who fit the profile far better than I think I do.

The first boost for the Bitcoin came when the Cyprus financial calamity highlighted an aspect of banking that many investors found shocking. Money stashed in banks accounts, which people assumed was secure, was actually vulnerable to the vagaries of a volatile political situation.

Accounts were frozen and savings were raided to pay for the troubled nation’s $13 billion (Dh48 billion) financial bailout. Some investors stand to lose 80 per cent of the deposits they hold on the Mediterranean island.

The issue left many questioning whether centralised, corporate banks were sensible places to hold money in, and sent disgruntled investors looking for new homes for their cash.

The result was an upswing of interest in Bitcoin, which can be traded online and is not controlled by any government or central bank.

Online gold

So what is a Bitcoin? Launched in 2009, the virtual currency is like the online version of gold – it is a store of value. But instead of being made of physical elements, such as gold, paper or metal as money is, Bitcoins are made of computer code.

Like gold, they are mined over time by a computer process. Bitcoin speculators can join together and link their computers to mine for more Bitcoins in the virtual world. In order to do this the computers have to solve increasingly complex mathematical puzzles.

Bitcoins can be exchanged through person-to-person online Bitcoin exchanges, which trade currency for Bitcoins and pay that money into a PayPal account from where you can withdraw it as cash.

As interest in Bitcoin rose, so did its value, leading to a digital gold rush, which saw the price of a Bitcoin see-saw precariously.

Data from Google showed that Russians were behind much of the increase in interest, which was not surprising given that many of the worst-hit investors in Cyprus were Russian.

The program that controls Bitcoin will only ever release a finite amount of them over a certain amount of time. The supply is controlled by an algorithm, which is in turn controlled only by the mathematical formula it follows.

It issues around 25 new Bitcoins every 10 minutes, but this rate will decrease over time, making new Bitcoins rarer and driving up the value of the currency.

Splitting opinion

The jury is still very much out on whether Bitcoin is a feasible real-world currency. Supporters say it will end banking greed, while opponents claim it is too open to hacking attacks to be a secure form of tender.

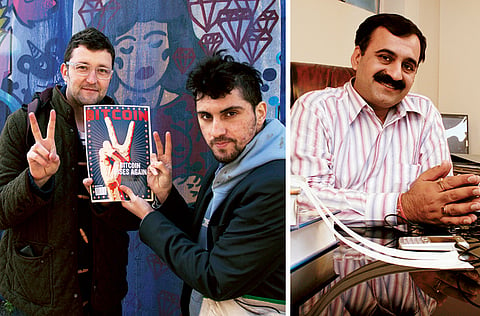

London-based founder of Bitcoin exchange Intersango Amir Taaki has nothing but praise. “They are used for preserving your freedom of financial speech,” he insists. “It is the first time we have a currency not controlled by any central bank or central party. We are at the forefront of huge technological change.

“In London alone there are over 60 traders,” he continues. “Anyone can go on the internet and start with Bitcoin now, accept payments from anywhere in the world and do business with anyone. It’s just going to grow – it’s growing each day.”

But Pavan Duggal, a cyberlaw specialist in New Delhi, is sceptical. “It has a huge number of legal, policy and regulatory issues,” he says. “Is Bitcoin legal? Can it be enforced in any jurisdiction because no law in the world has been enacted which directly impacts Bitcoin?

“More significantly, in which jurisdiction will a dispute arise should there be a dispute pertaining to payments made by Bitcoin? It brings huge challenges.”

Max Keiser, co-founder of the Hollywood Stock Exchange, which allowed people to trade in virtual currencies such as Moviestocks, Starbonds and Hollywood Dollars, is a big believer in Bitcoin, and with good reason – he is a Bitcoin millionaire. The online whiz who was instrumental in launching internet trading in the mid Nineties is also in the frame as a Satoshi suspect – a claim he denies.

Earlier this year Max told a radio show, “I did not invent Bitcoin. I think the reason people say that is because I did invent the virtual currencies and virtual trading back in 1996.

And of the mysterious Satoshi he said, “He potentially is so much of a game-changer, it’s such a quantum leap away from the federal reserve system that it is killing economies around the world. We are going to have a revelation that finally we are going to escape the nightmare that is the central bank system.”

So what do we know about Satoshi Nakamoto? There is no record of his existence before Bitcoin was created. He first surfaced in November 2008 when he published a paper on the mailing list of an obscure cryptography website in which he described the currency and claimed to have been working on it since 2007. Nobody using the list had heard of him and he gave little away as to his identity.

The nine-page paper described how Bitcoin would work and how coins would be mined online. It was released at a time of financial turmoil when trust in banks was at an all-time low and governments in the US and UK had begun quantitative easing – essentially printing money to stimulate the economy.

The price of gold was rising as investors looked for more stable places to store their wealth. As an alternative currency, Bitcoin required no faith in the politicians or financiers who had wrecked the economy.

Its predetermined release of units kept supply growing at a predictable rate. In the conclusion to Satoshi’s paper, he refers to the software developers as “we”, giving rise to suspicions that Bitcoin was created by a group of people, who were hiding their identities behind the Satoshi pseudonym.

The birth of a currency

He continued to make modifications to the Bitcoin software and post technical information on the Bitcoin Forum until his contact with the growing online community gradually began to fade. Almost all modifications to the source code of the software were done by Satoshi – he accepted contributions relatively rarely.

Someone noted that in Japanese Satoshi means “wise.” Another speculated that the name was made by taking letters from four global tech companies: SAmsung, TOSHIba, NAKAmichi, and MOTOrola. But it was doubtful that Satoshi was even Japanese. The English used in his first paper was precise and the spelling and grammar suggested he was British.

Other theories claimed that perhaps Satoshi was a subversive group of workers at a company or agency, such as Google or the National Security Agency.

A few days after his uncharacteristic outburst, Satoshi disappeared as unexpectedly as he’d appeared, posting a message to say that he was “moving on to other things”. Just before he left, he set up software developer Gavin Andresen, 46, as his successor by giving him access to the Bitcoin source code.

Several people have since analysed every speck of digital data Satoshi left behind to try to unlock the secret of his identity. By looking at the timeframes during which he posted messages, some believe he lived in Northern Europe. Others have exhaustively run the phrases and words he used through Google to find similar matches that might yield clues.

Several people have been named as likely contenders, but none have admitted to being the person behind the myth.