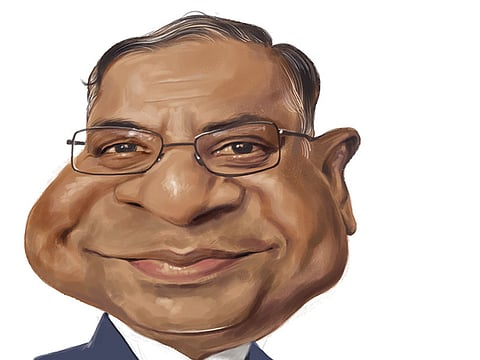

The classic insider

In more senses than one, Ratan Tata couldn’t perhaps have asked for a safer bet to lead the Tata Group

Natarajan Chandrasekaran is the Tata Group’s first chairman from outside the tightly-knit Parsi business community, but he’s no stranger to the $103 billion (Dh378.83 billion) Tata empire. The announcement came ahead of the February 24 deadline for choosing the new chairman after an unscheduled board meeting. The Board of Tata Sons said in a press statement: “Mr Chandrasekaran has demonstrated exemplary leadership as the chief executive officer and managing director of Tata Consultancy Services. We believe he will now inspire the entire Tata Group to realise its potential, acting as leaders in their respective businesses, always in keeping with our value system and ethics and adhering with the practices of the Tata Group, which have stood it in good stead.”

A five-man panel unanimously chose Chandra from a list of more than a dozen candidates. “He stood out both within the group and outside,” said former bureaucrat Vijay Singh, a non-executive director on the board of Tata Sons, which ratified the selection.

“We are at an inflection point,” said Chandra in a statement after his appointment. “I am aware that this role comes with huge responsibilities. It will be my endeavour to help progress the group with the ethos, ethics and values that the Tata Group has been built on.”

Chandrasekaran’s journey began three decades ago with his two siblings with whom he shared the same apartment in Chennai. Now, the trio hold top positions in corporate India — Tata, TCS and the Murugappa Group. Chandrasekaran, who was named Tata Sons chairman, is the youngest of the three brothers. His eldest brother N. Srinivasan, is the group finance director at Murugappa Group. The other brother, N. Ganapathy Subramaniam, was made the COO of TCS. The Natarajan brothers have come a long way from their humble beginnings. Fast forward to 2016, the youngest of the three — Chandrasekaran is one of the best known faces of the Tata Group. The 53-year-old has been the chief executive of the high-profile global IT service provider, TCS, since 2009.

His journey with the Tata Group began in 1987 after obtaining a Master’s degree in computer applications from the National Institute of Technology in Trichy in the southern Indian state of Tamil Nadu. The $103 billion (Dh378.83 billion) Tata enterprise is controlled by a Parsi family and for many observers, this decision to appoint Chandrasekaran as the group chairman marks a huge shift. Despite his many contributions to the behemoth, Chandrasekaran wears his achievements lightly. An affable, unassuming and approachable leader, he has a phenomenal capacity for remembering people. According to those who work under him, corridor conversations with Chandrasekaran can revolve around not only the executives themselves, but also their families.

His affable persona has allowed Chandrasekaran to remain connected with employees. His mentor, S. Ramadorai, had once said that “the ability to build world-class teams and value systems” was Chandrasekaran’s biggest strength. He delegates a lot and keeps up the pace and enthusiasm level up when a project is on. Interestingly, Chandrasekaran is a cricket fan and often uses cricketing terms and metaphors while setting targets!

Chandrasekaran was handed the baton at Tata Sons at perhaps the most difficult time in the history of the Group. How he fares is yet to be seen, but he has time, determination and experience on his side. As a seasoned marathon runner, he will know that that’s a huge advantage. His key priorities include ensuring the group has sufficient power over major listed companies using the Tata brand. India’s largest conglomerate aims to gradually increase its holdings in Indian Hotels Co., which runs the Pierre in New York, as well as Tata Chemicals Ltd and Tata Power Co. While it owns 73 per cent of TCS Ltd., the group’s stakes in the other key companies range from 31 to 39 per cent, data compiled by Bloomberg show. Nimesh Kampani, chairman, JM Financial, notes: “Chandra believes one can have opponents, but not enemies.” Plus, as the classic insider, he may well be the ideal person to negotiate the group’s intricacies.”

Tata Sons had to call extraordinary general meetings to remove its former boss Cyrus Mistry from the boards of its operating companies, after he was ousted as group chairman in an October boardroom coup. The conglomerate hired several investment banks to lobby for investor support ahead of the votes, which required more than 50 per cent of shareholders to approve Mistry’s removal, people with knowledge of the matter said in December.

Chandrasekaran will formally take over as chairman of Tata Sons from February 21. Under his leadership, profits of Asia’s biggest software exporter have quadrupled and its shares have tripled, making the business India’s largest company by market value. Chandra, as he is fondly called, must do something about TCS, of which he is the CEO. The software company is used by Tata Group as an ATM, but perhaps not for long. The business faces an existential threat in India. Clunky in-house applications at global corporations are giving way to leaner digital technologies. Clients won’t pay for 100 techies if, thanks to robotics, only 80 are needed. Incoming United States President Donald Trump might choke off work visas for Indian engineers in their most crucial market.

Big, bold acquisitions may have been outside his reach as long as Chandra ran TCS. As group chairman, he’ll need to demonstrate deal-making skills. In the end, it’s probably better that Ratan Tata stuck to a known quantity. A high-profile outsider (names like PepsiCo Inc. CEO Indra Nooyi and former Vodafone Group chief Arun Sarin did the rounds) might have boosted the group’s global profile, but the loosely held empire works best when it’s assured of long-term stability in its Bombay House headquarters. Chandra is eight or nine years younger than Nooyi, Sarin and Ralf Speth, the chief of Jaguar Land Rover.

In more ways than one, he’s the safest bet for Tata.

— Compiled from agencies