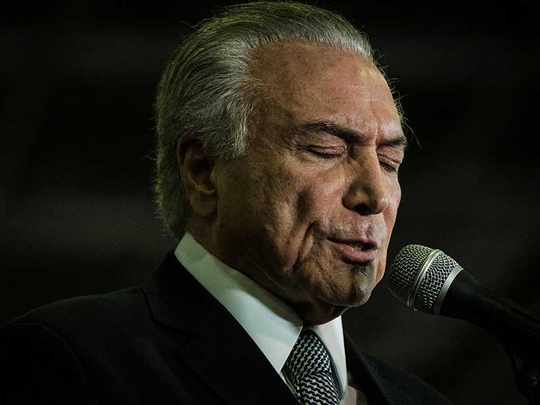

Pick almost any indicator, and Brazilian President Michel Temer comes up short. Job approval? 10 per cent. Jobs creation? Brazil has 13.5 million out of work, a five-year high. Office ethics? All but one of Temer’s most trusted aides has fallen to corruption scandals, and conceivably Temer himself may go if the electoral court that convened briefly in Brasilia this week finds that dirty money financed the presidential ticket he was elected on in 2014. Put it all together and the conclusion is inescapable: Michel Temer is the worst Brazilian president since Dilma Rousseff.

OK, so there’s plenty to disdain in the former vice president, who assumed office last year when Rousseff was impeached for fiscal crimes. A furtive political operator who turned on his commander, he has a tin ear for public opinion, indulges questionable people in high office and pens embarrassing poetry. And those are just a few of the sins fuelling the popular refrain “Fora Temer” (“Be gone, Temer!”) trending on the street and the web.

For all his shortcomings, however, crisis-addled Brazil is better off with Temer than without. It’s not just that he’s the constitutional leader, and that a working constitution is the firewall that safeguards Brazil from the convulsions roiling its dysfunctional neighbours in Venezuela and Paraguay. It’s also because Temer’s stand-in government may be the country’s last best opportunity to reverse colossal errors that have sabotaged Latin America’s biggest economy and disgraced its governing establishment.

Overhauling a country would be daunting even for a crowd-pleasing leader in the most prosperous times. Temer, for his part, has an economic emergency, a confidence-sapping corruption scandal, and half a mandate to work with. In his favour is Brazil’s dubious tradition of brinkmanship: Think Plan Real, which snatched the country from hyperinflation and economic calamity in 1994, or President Luiz Inacio Lula da Silva circa 2002, the former union man who lost the lefty act and led the chronically underachieving nation on an eight-year growth jag. Improbable as it seems, Brazil faces a similar defining moment today.

Less than a year after taking over from Rousseff, Temer has mustered legislative majorities to open ultra-deepwater “pre-salt” oilfields to foreign drillers and drop the protectionist rule obliging Petrobras to lead the risky pre-salt operations. Last year, he marshaled congress to impose a 20-year cap on government spending, and now is pushing to overhaul the rigid labour laws, the chaotic political party system, taxes and — most critically — the loss-making pension system that is turning into a national fiscal millstone.

What’s propelling the Temer agenda is not some spasm of civic enlightenment, but rank survivalism, as the fallout from the ever-widening, three-year Carwash probe into political payola and graft continues to spread. “The centre-right coalition backing reforms is heavily implicated in the Carwash case,” political scientist Octavio Amorim Neto, of the Getulio Vargas Foundation in Rio de Janeiro, told me. “They know their best bet for reelection is for the economy to start growing again, and that leaves them little choice but to fall in line behind the Temer agenda.”

Of course, such a fragile compact could come undone. If the economy languishes and protesters return en bloc to the streets, or if the taint from Carwash seeps even higher into Brazil’s ruling circle, the legislative ardour for reform will be tested. The suspense will build as the electoral court deliberates whether Temer should stay or go. It’s a measure of the tension in Brasilia that the court’s decision on Tuesday to postpone the trial until later this year, in order to hear more witnesses, was seen as a political win for the embattled Temer government. Whether it’s also a win for Brazil will be clear in the months to come.

— Mac Margolis writes about Latin America for Bloomberg View. He was a reporter for Newsweek and is the author of “The Last New World: The Conquest of the Amazon Frontier.”

Bloomberg View