American to sue UAE bank over travel ban

Miami-born naval captain says he is suing bank after he has been unable to travel for 10 years

Dubai: An American marine captain is preparing a Dh2 million lawsuit against a UAE bank for mental, physical and financial damages he alleges stem from a travel ban wrongfully imposed on him nearly 10 years ago.

The ban remains in force, holding him against his will within the UAE.

All attempts to settle an outstanding original debt of Dh50,000 on the two credit cards, in addition to efforts to lift the travel ban, have failed, he said, leading to a decade-long string of hardships that have only exacerbated his deteriorating health and financial condition.

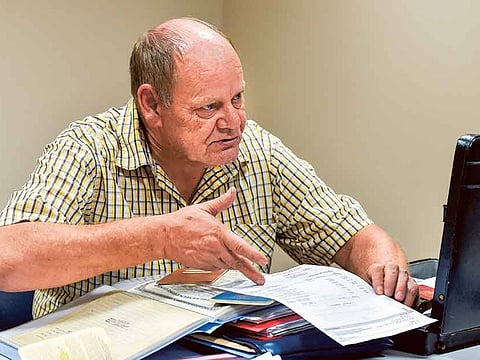

After managing to stay afloat through odd jobs on the periphery of the marine industry for years, Captain Ray Clevinger, 62, said he has “reached the end of my rope. I have nowhere else to turn”.

Broke, unable to pay his bills and with only Dh30 in his pocket, Clevinger said he now awaits eviction from his flat where he spends days without air conditioning and nights without any lighting because his electricity has been cut off.

Since the August 25, 2005 filing of the travel ban imposed on him by the bank, Clevinger said he has been unable to return to the United States to renew his captain’s licence and was essentially locked out of lucrative work within the maritime industry.

In an interview with Gulf News, Clevinger said his downward slide followed a respected 21-year career in the UAE as a marine captain steering large vessels that helped keep the country’s oil and gas flowing from platforms in the Gulf.

On March 9, 2005, Clevinger was struck by a massive heart attack and hospitalised.

As he was recovering, Clevinger believed he was safe financially because he had taken out “credit shield” insurance on his credit card which is supposed to cover monthly payments when tragedy strikes. He didn’t make his regular payments because he was counting on his credit shield.

Unknown to Clevinger, the bank’s credit shield declined to invoke the “credit shield” insurance coverage.

On the credit card’s credit shield policy, Clevinger said it reads “‘for peace of mind’ but believe me, there is none when you find out that the insurance you paid for won’t cover you. No one from the insurance company called to tell me I wasn’t covered.”

In July 2005, the Miami native was terminated by his employer at the time on the grounds that he could not be in charge of large ships with a heart condition, Clevinger said.

And then, his travel ban was imposed by the bank just as he was about to return to the United States to renew his captain’s licence and return to the UAE to accept a new job he had landed five days after his termination with his old employer.

“This is where all of my troubles stem from,” said Clevinger, who noted that if at the time he was allowed to travel, renew his captain’s papers and resume work with a new firm, he would have been able to pay his bills and get on with his life.

“If they had just let me go back to work, this would have all been settled and I would still have a normal life,” Clevinger said.

Some of the biggest regrets of living under the travel ban isn’t just the lack of freedom, he said.

It’s more about the loss of contact with family and friends.

He learnt through the mail that his mother died in 2010.

“It was very upsetting and I tried to discover when she died and where she died and where she is buried. I still know nothing as I do not have her social insurance number,” he said.

The pain continues with news that his former spouse is also terminally ill, according to Clevinger.

“My ex-wife of my two sons has Stage 4 cervical cancer and has a short time to live. She would like to see me before she dies. It’s very depressing,” Clevinger said.

When contacted by Gulf News on Tuesday, an official with the bank said it would like to help Clevinger.

“Thank you for giving us the opportunity to comment on the issue raised by Mr. Ray Clevinger. Kindly note that the Bank agreed to meet with Mr. Clevinger on 22 March 2015 to reach an amicable solution. Unfortunately, the customer did not attend the meeting and instead placed the matter in the hands of his lawyers. The bank has replied to his lawyers but we are yet to hear back,” the bank said.

Legal notice: The claim

In a legal notice sent to the bank earlier this year, Clevinger’s legal counsel, Al Obaidli & Al Zarooni, advised the bank who imposed the travel ban that their client “suffered severe damages — mentally, physically, financially and in all means as a result of the travel ban for a span of nine years and is entitled as per the law for damages. Our client has approached your esteemed bank several times to sort out the issue but you had not taken any serious attention towards our client’s repeated requests”.

The firm claimed that the bank did not file a civil case against Clevinger before or after the travel ban was filed.

The bank was advised that it “had not followed the procedures as stipulated by the UAE laws because as per UAE Civil Procedure, the creditor should file a civil case within eight days after the travel ban was passed”.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox