Dubai : A Dubai-based Canadian, who was being treated for an intestinal problem, has accused a local insurance company of demanding a tenfold increase in premium to get his policy renewed in between procedures.

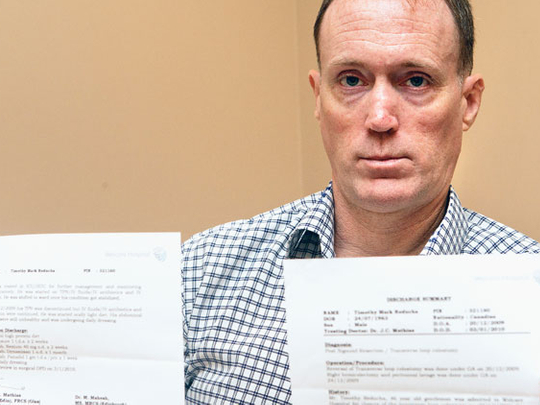

Timothy Mark Reducha, an interior design specialist who came down with an intestinal problem in August last year, said the Arab Orient Insurance Company asked him to pay Dh35,659 as premium to get his policy renewed for 2009-10 as against the Dh3,372 he had paid for the earlier policy in 2008-09.

He alleged that the company justified the tenfold increase on three grounds — he had been moved to the next age band, the "claims experience" for the expiring period had been unfavourable and the inflation factor. However, Reducha, 46, said he had made only one claim in the past one year when he had to be treated for a potentially fatal intestinal condition called sigmoid perforation and faecal peritonitis.

Sudden illness

He said he was in Amritsar in India when he had to be rushed to Hope Hospital with severe abdominal pain on August 1, 2009. He underwent a series of procedures, including a transverse loop colostomy, at the hospital. On August 13, he was flown to Sharjah and shifted to Welcare Hospital in Dubai.

Reducha, who continued to get treatment for the next eight days, said he ran up a bill of Dh30,000 at Welcare Hospital, which was covered by Arab Orient Insurance. In addition, he said the company had reimbursed the Dh25,000 claim he had made for his treatment in India. Meanwhile, Reducha had to wait for the internal wounds to heal before a reverse transverse loop colostomy could be scheduled to complete his course of treatment. He said when his policy was due for renewal on November 10, 2009, he was asked to pay Dh35,659. "I expected a small increase but not this huge. This is a case of gouging the consumer," he said, adding he had to pay the amount as otherwise he would have had to cough up around Dh130,000 for his upcoming surgery.

Muddassir Ahmad Khan, Assistant Manager, Medical Department, Arab Orient Insurance, said, "Individual policies are a yearly contract and terms can be changed at renewal of each year. Either side has the right to accept or decline the proposal." He said, "We have submitted the renewal terms to Timothy which he had accepted to bind the renewal cover and terms cannot be changed during the year."