Dubai: Stereotypes that all UAE nationals are rich could be the driving force behind the excessive spending and borrowing habits of Emirati youths, particularly males, psychological experts believe.

Youths who behave in this manner may subconsciously try to reinforce notions that all of them are well off through the display of material wealth, suggests Dr Amber Haque, associate professor and director of the clinical psychology master's programme at UAE University.

"In the UAE, most expatriates believe all Emiratis are rich, which is certainly not true," he said. "This may be the reason some Emiratis are psychologically driven to keep up that image, by borrowing large sums of money to spend on material possessions, rather than admit that not every Emirati is rich."

Related stories:

- Easy credit part of the problem for many

- Emiratis decry big-spender label

- Temptation in the 21st Century

- Emirati males are the country's big spenders

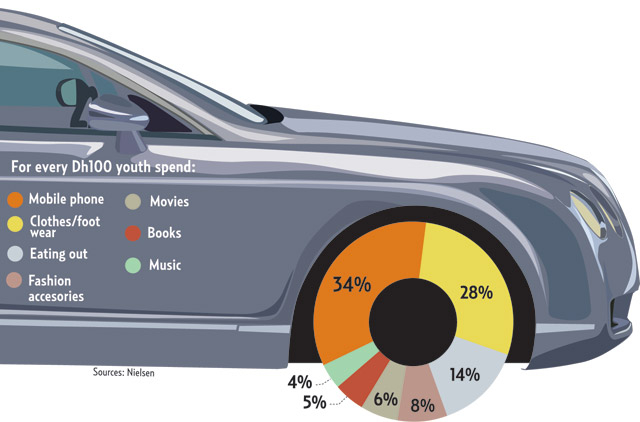

A recent Gulf News report revealed that Emirati males are the country's biggest youth spenders based on a study called ‘Nielsen Next: Understanding Youth in the UAE' conducted by the Nielsen Company.

The figures showed Emirati males spend just over Dh2,000 a month on mostly fashion and mobile phone accessories compared to Dh1,592 and Dh653 spent by their Arab and Asian expatriate counterparts.

Emiratis made up 33 per cent of the 600 surveyed youths aged 15-29, with 42 per cent of Emiratis cited as working full-time and the majority cited as unmarried.

Misha'al Mohammad Al Marzouqi, 21, a student, agrees that some Emirati men like to spend lavishly, especially on cars, to appear rich. "I've noticed that when most Emirati men think of buying cars they don't see anything wrong with Ferraris or Porsches," he said. "They want to show people they have money which is why they'd think of taking a big loan to buy an expensive car."

He added that such people contribute to the perpetuation of stereotypes of wealthy Emiratis.

"It really isn't true, we aren't all rich, which is something I've noticed mostly foreigners outside the Gulf and expatriates inside think we are because of the petrol," he said. "Everyone assumes because I'm Emirati, I'm rich, but I don't have petrol coming out of my pockets, I pay for it just like everyone else."

Al Marzouqi is supported by his father. He receives around Dh4,000 a month in pocket money but saves most of it to travel and see the world.

"Psychological attitudes towards spending in young people come from the attitudes of their elders," said Dr Haque. "It primarily comes from the parents and to live within their means is something a child should be taught at an early age."

How to fight the urge to splurge:

Childhood triggers

Dr Haque said lavish spending and excessive borrowing habits in young people could be due to childhood deprivation, resulting in the development of an inability to deny self urges.

Another psychological profile for excessive spending, he said, would be a person with an extreme urge to compete with others or an addiction to immediate gratification obtained by spending money.

"The personality of a person unable to say no to self urges usually comes from a psychological profile of a person who didn't have enough to spend when growing up," said Dr Haque. "Therefore, they seek to compensate for what they didn't have, but saw everyone else had as a child, by excessive spending because it gives them a sense of power."

Confirming Dr Haque's prognosis, Sultan Al Kuwaiti, 23, said: "I believe the big spenders come from high-income environments, and can afford to spend and the borrowers from low-income environments, looking to show off."

Lacking confidence

He added that in both cases the individual lacks self confidence and is looking to compensate through material purchases. "Someone who is raised to be spoilt with no responsibility lacks confidence in their abilities and for this reason they look to make up for it through material displays," he said.

As a part-time student working full-time, unnecessary purchases is something Al Kuwaiti is trying to avoid. "I don't have loans and I live off of my salary because I won't take the chance of ruining my future plans," he said.

Yet, he believes excessive spending amongst his peers is fuelled by jealousy and a sense of inadequacy. "I have one friend who earns a monthly salary of Dh40,000 and owns a Bentley," he said.

"A friend of ours who earns Dh15,000 a month, got jealous and bought a Bentley on loan because he felt inadequate and wanted to show himself as important; which is something we're used to seeing because it happens a lot," he said.

Have your say

Gulf News asked readers wWhat percentage of their salary they splurge on unnecessary purchases. Here's what they said:

"I spend around 50 per cent of my income but this money is used for entertainment to buy clothes and stuff because there is nothing else to do in Saudi Arabia. As a single man I can live off of 40 per cent of my salary and blow the rest."

Mohammad Al Obaid

Saudi Arabia

"Maybe 15 to 20 per cent which is not too much I don't think. Saving is a priority because times are changing and you never know how much is enough. So we need to make sure we have enough in store for emergencies."

Dhiren Shah

India

"We spend almost 10 per cent of our monthly income on unnecessary stuff like toys for my child which need not be necessarily bought at that moment, impulsive shopping. It's not a great thing but at times you just spend to make yourself happy"

Seema Relekar

India

"Less than 20 per cent, which is a bit much, because I spend it on unnecessary purchases. Sometimes I want to buy things and after I do, I realise I didn't really need to buy them in the first place."

Jin Suh

South Korea