DUBAI: Expatriates and Emiratis who are jailed for issuing dud cheques may continue to languish in jail even after completing the prison term - that is, until the debt is cleared, lawyers told XPRESS.

There is this mistaken notion held by many that a debtor is freed from his financial liabilities after doing time in jail. The reality is far from it.

Ahmad Abdullah, a 48-year-old Emirati, was jailed last year after his general trading business went under and cheques worth several hundred thousands of dirhams he signed bounced. He does not know when he will walk a free man.

"The problem is after my first cheque bounced, I was jailed for it and I've been unable to do anything about my situation," said the father of six from Al Aweer Central Jail. "So, the other cheques I issued also bounced. It became a domino."

Rushdie, a Filipino jailed since 2008 for his inability to pay Dh74,000 in personal loans, said he also does not know when freedom day will come.

A dud cheque entails a minimum of one month in jail to a maximum of three years. But Ali, a 50-plus Arab, has been in jail for nine years after being convicted in 2003 in a financial case.

"UAE law deems it a crime when a cheque is returned due to insufficient funds," said Jafar Al Touq, a lawyer practising in the UAE for 26 years. "Those who think that sitting in jail without paying a loan is a temporary, short-term way out of debt are absolutely wrong. Otherwise, I will also do the same thing - borrow, then stay in jail for a while and keep the money."

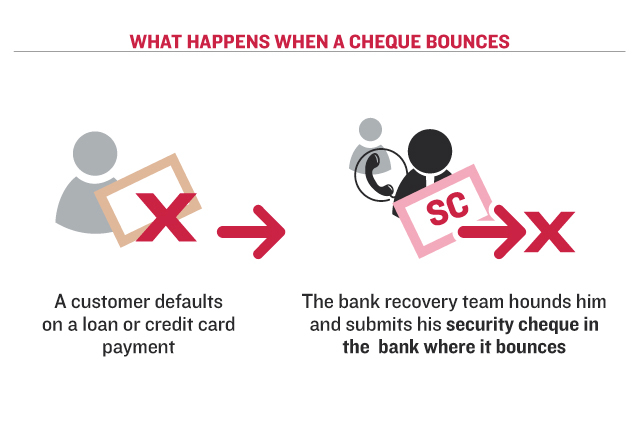

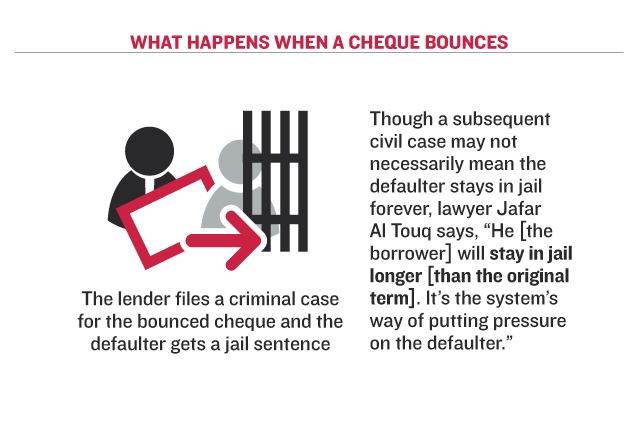

The process in a bounced cheque goes roughly like this: a customer defaults on a loan or credit card payment, the bank recovery team hounds him and submits his security deposit cheque (which will bounce). The lender then files a criminal case for the bounced cheque and the defaulter gets jail time.

Though a subsequent civil case may not necessarily mean the defaulter stays in jail forever, Al Touq said: "He [the borrower] will stay in jail longer [than the original jail term]. It's the system's way of putting pressure on the defaulter. If there's reason to believe fraud has been committed then the judge will put him behind bars longer."

Ignorance

But some end up serving long jail terms due to ignorance.

The case of Yousuf, a 28-year-old European sentenced to nine years in Dubai, is a classic example of how Article 401 of the UAE Penal Code is applied.

Yousuf earned Dh30,000 a month as an accountant for a real estate firm and signed cheques as part of his job.

Several parties sued his company after it went bust; one complainant alone demanded Dh5 million back. In February 2011, the Court of Cassation affirmed the lower courts' decision giving him three years for each of three bounced cheques worth millions. Yousuf's day in court involved the judge asking whether he had signed the cheques that bounced - Yousuf admitted they were his signatures.

"We argued that he signed cheques as part of his job," said his lawyer, Emirati Amer Syed Al Marzouqi. "The problem is that you have this law [that criminalises bounced cheques]."

Article 401 states that bouncing cheques is punishable by confinement of one month to three years or a fine of a minimum of Dh1,000 to any individual who, in bad faith, writes a cheque with insufficient funds.

Some legal professionals argue that it's harsh and archaic.

However, the UAE has now drafted a new insolvency law which aims to address some of these issues.

Mazen Boustani, finance and banking law expert for Habib Al Mulla and Co, said: "The UAE has a comprehensive insolvency law. The main challenge concerns security asked by creditors, and post-dated cheques, if not honoured, constitute a crime with a jail sentence. This results in creditors - instead of having recourse to normal insolvency procedures - resorting to a speedier process, that of filing a criminal complaint for a dishonoured cheque."

In Yousuf's case, it is unclear whether the complainants will file a subsequent civil case that would keep him in jail longer.

But this happened to Angelito, a 49-year-old Filipino logistics executive, who served two prison terms - one in 2001 and the other in 2010 - over the same bounced cheque. When Angelito's Dh75,000 cheque bounced in 2001, he was sent to jail for six months. He thought his liabilities had disappeared and he went back home to Manila. Nine years later, when he flew back to Dubai to try his luck once more, he was arrested upon arrival due to a civil case filed by the creditor. He spent more time in jail. "I did not know I could be jailed again for the same thing," said Angelito.

Col Adel Al Suwaidi, Director of Education and Training at Al Aweer Central Jail, said there's not much recourse for someone jailed over a bounced cheque except for the amount owed to be paid.

Other offenders - with the exception of murderers - may get their sentence commuted if they memorise parts or the whole of the Quran. But this, he said, does not apply to someone jailed for a bounced cheque. "The commutation of a jail sentence only applies if the offence is committed against the state, except murder. In a bounced-cheque case, a person is free the minute the amount owed is paid."

Jailed debtors can only hope for a debt write-off, a government bail-out or a Good Samaritan.

Al Marzouqi said a write-off is rare. "It never happens, especially after the defaulter has been arrested. Most banks demand the full amount from the jailed borrower."

Latifa Khadem, head of the Humanitarian Services Section at Al Aweer Central Jail, said: "There's not a day without one of our inmates asking for financial help. We welcome any financial aid from generous people to help the inmates who are unable to pay their loans."

Last year, the UAE government announced a Dh10 billion fund to help Emiratis who cannot repay their debts — to settle their personal loans through a process overseen by the UAE Central Bank.

CIVIL CASE

XPRESS posed specific questions - about the criteria for filing a post-jail civil case against a defaulter - to numerous banks. Most declined to comment.

A bank official told XPRESS: "It's a police matter."

An out-of-court settlement system implemented by Dubai Police last year has been fairly successful. It gives debtors a one-month grace period to clear bounced cheques. It led to a huge drop in bounced cheque cases. Among Emiratis, the numbers dropped to 3,760 in 2011 (January-September) from 5,623 in 2010. No data is available for expatriates.

A local bank official explained it's their legal department's call on whether or not to lodge a civil case against the jailed borrower. "It depends on the amount owed," said the official, who asked not to be named. "If it's a huge amount, a civil case will be filed," he said without elaborating.

Al Touq said, however: "If the person [defaulter] has no money, jail is not useful... it's damaging to all parties."

THE LAW

Article 401 of the UAE Penal Code:

Any individual who writes a cheque with insufficient funds - causing the same to bounce - can face imprisonment of one month to three years, or a fine of a minimum of Dh1,000.