This month I'm going to punch holes in your insurance policy cover. And I intend to do that by answering a simple question: Is the group medical insurance policy that your company provides good enough?

The answer in almost all cases is simple - no. When a company buys a medical insurance policy for its staff (and dependants) the intention is to provide (in most cases) the most cost-effective solution. Most companies provide on average between Dh100,000 and Dh500,000 per member per year. As someone who enjoys this group cover, your average out-patient visits for a minor flu, sprains and fractures are all taken care of. However, it may not be enough to cover a major condition like cancer, which could require regular chemotherapy sessions and can be very expensive if treated in the UAE.

The decision to buy specific cover is usually made by the HR/finance department taking into account the benefit available to staff and cost of said cover.

Imagine this: You and your family are part of the company's group medical scheme. Three years into the programme, your company decides to change providers, as does happen, because the premiums that have been charged to them today have gone up by 25-30 per cent based on the claims ratio of the group, medical inflation and scheme members getting older.

While your old contract covered pre-existing illnesses (asthma, high blood pressure, diabetes) and maternity, the new contract does not. To make matters worse, the new insurance company underwrites you as a fresh case, and you now have to declare all your medical conditions again. And they may or may not cover you now. If your spouse is mid-term into pregnancy, the new contract may not cover her now or may have a waiting period. In the unfortunate situation that something goes wrong during the pregnancy or with the new born, the costs can be high enough to put you in debt for the rest of your life.

The safest option, albeit not always the most affordable one, is to buy your own private health insurance. This can be in addition to your company's group policy. Remember you get what you pay for. Look for a policy that has a guaranteed renewability clause and that doesn't stop cover after the age of 60 or 65.

You could even buy an In-Patient Only policy, this would bring down the cost significantly and take care of most, if not all, of your serious medical issues. If the cost of acquiring a separate contract is not feasible, then an option is to get the cover sorted through a provider in your home country. This may be cheaper and should work even when you eventually move back or elsewhere.

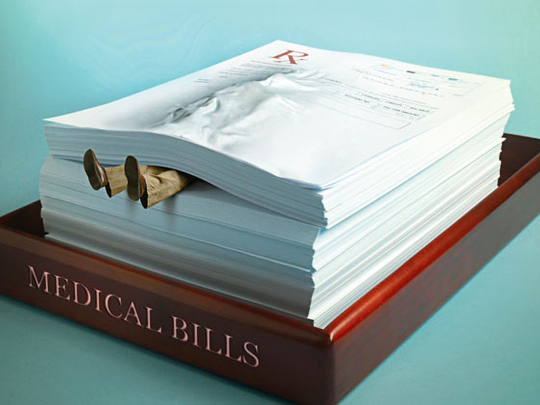

Again, nothing like a worst-case scenario to provide you with more insight. Ajay is covered under his company's group scheme. Now diagnosed with cancer, his treatment is covered fully up to Dh500,000 under his group plan. The nature of the treatment keeps him away from work for long periods. As a result, his employer has had to let him go, thus he is no longer part of the group medical plan. From here on, all the bills are his to pay. What's worse, no other insurer will cover him for the cancer as this is a pre-existing condition.

Now, do you still think your insurance cover is good enough?