For all the financial troubles Sony has faced in recent years, it is hard to imagine an incident more damaging to its reputation than its handling of the November cyber attacks. From Hollywood stars to President Barack Obama, the company was criticised for cancelling the release of ‘The Interview’ after cinemas were threatened by the hackers.

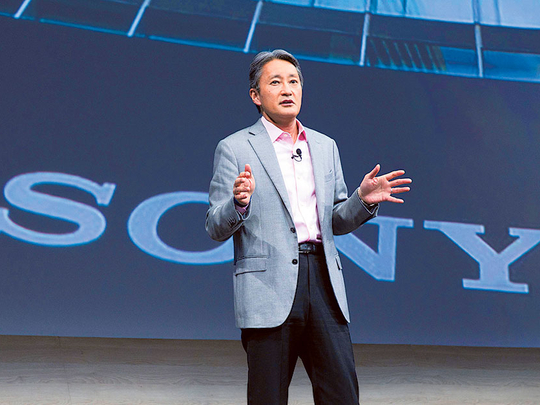

But shares of the Japanese electronics group have nevertheless bucked the negative publicity, rising 35 per cent in the past three months. Investors have sided with Kazuo Hirai, chief executive, who condemned the attacks on Sony’s movie studio as “vicious and malicious”, but who has also downplayed their broader financial impact as “insignificant”.

“We’re taking the company to a new phase of growth,” Hirai, who became CEO in 2012, said.

Analysts have also mostly brushed off the cyber attacks — both in terms of financial and reputational costs — as Sony cast itself as a “victim” of the hack, which the US government has blamed on North Korea. “Since Sony got caught in this incident without a major fault of its own, the impact on the company’s reputation is limited,” said Kota Ezawa, an analyst at Citigroup.

The entertainment arm of Sony, which includes movies and music, has long been one of the most profitable areas for the group, which expects a $2 billion annual loss. Even as its television, camera and mobile-phone businesses fell into the red, films have remained moneymaking over the past decade with margins between 4 per cent and 7 per cent.

Within the Sony group, however, the pictures division, with annual sales of Y830bn ($7.1 billion) in the last fiscal year, accounts for only 11 per cent of total revenue while its five consumer-electronics segments generate 63 per cent. Weighed against the total, the $44 million it spent to make ‘The Interview’ is small. Moreover, some of those costs have been recouped in digital sales after the studio decided to release the film online.

For the latest quarter through September 30, the division posted an operating loss of Y1 billion, but analysts expect growth to pick up after Sony Pictures completes its $300 billion cost-cutting programme.

Beyond the attacks, investors are optimistic that Sony is finally turning the corner after a perennial round of restructuring that has led to 33,000 layoffs over the past decade, the sale of its personal computer Vaio brand and a spin-off of its TV division. In the latest overhaul of its smartphone strategy, Sony is pulling back from the Chinese market and reducing its product range to combat squeezed profit margins.

Investors are also buoyed by the new management team that Hirai brought in last year, led by an odd pair of Sony dropouts: Kenichiro Yoshida, chief financial officer, and Hiroki Totoki, who was appointed in November to head the struggling mobile unit. “Yoshida has been such a breath of fresh air in terms of making some hard decisions that just weren’t being made under Hirai,” said Howard Smith, Tokyo-based managing director at Indus Capital Advisors.

In a break from the past, Yoshida has demanded that business segments release their individual financial targets for the year, a disclosure that has put more pressure on executives to meet their goals. Cost-cutting efforts, though a regular exercise at Sony, have also expanded from the manufacturing side to sales divisions, headquarters and to subsidiaries based in the US including the movie studio.

Yoshida and Totoki left Sony in the early 2000s to join its subsidiaries and are blunt in their criticism of the group’s failures — an uncommon trait for Japanese executives. A month after being appointed CFO in April, Yoshida said that past management had been slow in responding to changes in consumer trends. Five months later, he admitted that Sony’s smartphone strategy was not working.

Major brokerages from Citigroup to JPMorgan to Deutsche Bank all raised their target prices on Sony shares after Hirai tapped Totoki to oversee the smartphone business in late October. His appointment raised hopes for a speedy fix to Sony’s biggest business segment with projected annual sales of 1.4 trillion yen ($11 billion).

“We will address many issues in 2015, but the transformation will be completed over the next 12 months. We will return to a period of growth starting in 2016,” Totoki told employees upon his appointment.

The increased focus on profitability versus scale seems to be starting to bear fruit with four out of five consumer-electronics divisions — including TVs and digital cameras — moving into the black for the second quarter. For the next fiscal year through March 2016, Sony is targeting an operating profit of Y400 billion compared with a loss of Y40 billion projected for the current year.

But the spotlight on the two executives has also raised questions about Hirai’s leadership, especially after he remained mostly invisible during the hacking crisis. At the CES electronics trade event Hirai told reporters that he took command from the day the attacks occurred on November 24 and signed off on every external communication and decision made on the issue.

Still, not all investors have bought the turnaround story. At one large US asset management firm with a long presence in Japan, portfolio managers are continuing to debate whether they should buy more Sony shares. Younger members are voting in favour of increasing their exposure while veterans are opposed.

The head of its investment team remains unconvinced about where Sony will stand after the restructuring is completed. “Even if they are successful with their restructuring, I don’t like the end-product. It’s a strange conglomerate”, he said, that ranges from games, imaging sensors, entertainment businesses to financial services.

With a pullback from most consumer-electronics devices, Hirai is banking on growth for the PlayStation platform — which will be used for the new cloud-based TV service — and image sensors, a vital component for Apple’s iPhones and digital cameras that Sony now hopes to expand into cars. The two divisions together are expected to generate annual sales of Y2.2 trillion, still short of the Y2.6 trillion anticipated from mobile, TV and audio divisions.

Even with the new management taking control, analysts also expect a solid turnaround for Sony’s electronics businesses to take years to complete. Ezawa at Citigroup says that future options include joint ventures, regional tie-ups or, in the worst-case scenario, the sale of the TV or smartphones businesses.

Sony executives have not ruled out the possibility of tie-ups, but they have rejected the idea of pulling out of smartphones altogether. Questions also remain on what Sony will do with other hardware such as cameras and audio devices.

“Over the next five years, Sony will need to revisit the raison d’être of remaining a consumer-electronics maker,” Ezawa said.

— Financial Times