Dubai: There seems to be no respite for the UAE’s advertising and media industry — advertising expenditures in the first three months of this year fell by a hefty 14 per cent compared with the last quarter of 2016.

What it means is that despite the spending spike linked to the Dubai Shopping Festival (DSF) in the first month, nearly just about every other advertising space budget-conscious advertisers drew back.

Comparisons even on a year-on-year basis do not make for happy reading. Ad spending was down 10 per cent when compared the first quarter of 2016, according to estimates by media agency BPG Maxus.

Print remains in the grip of tightened spending patterns, down more than 20 per cent across English and Arabic titles from a year ago. Matters were helped to an extent by real estate-related adverts, as well as those put out by government agencies.

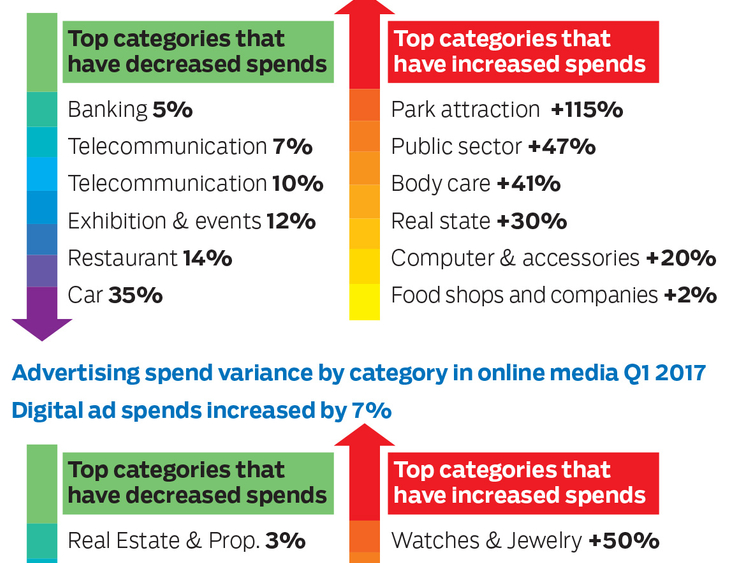

In fact, public sector messages were up 47 per cent in the first three months, while real estate provided a 30 per cent impetus, aided by the launches happening in town earlier in the year.

But auto-related spending was down by 35 per cent, and so were those extolling restaurant offers, down 14 per cent.

Within print, magazines continue to fare the worst, with the number of ads featured in local titles down by a whopping 43 per cent from a year ago. In dirham terms, this works out to a decline by 42 per cent.

Local radio stations too didn’t hear much of the high spending, also dropping in double-digit terms — except for Arabic-language stations which saw a year-on-year drop of 8 per cent.

When it comes to TV spots, brand-specific communications make up 75 per cent of commercials aired on pan-Arab channels.

For digital platforms, there were gains, but those too are seeing a slacking in growth rates. Year-on-year figures for the first three months were up 7 per cent, according to BPG Maxus. And late last year, digital-related spending actually recorded negative growth, possibly for the first time.

“In light of the current market scenario, almost all media houses have maintained the same rates in 2017,” said Vrinda Kamath, research manager at BPG Maxus. “They are also open to campaign-wise negotiations. However, when it comes to digital there has been a rate increase of around 5 per cent. [Digital] publishers of late are offering limited-time packages to agencies so that clients can invest more on their platforms.”

According to Kamath, while marketer budgets have by and large remained unchanged from 2016 levels, what’s changing is how it is being allocated. “There has been a drop in advertising/media budgets,” Kamath said. “However, advertisers are inclined to increase spending based on result-oriented opportunities or innovative/creative executions that would lead to consumer engagement and product purchase.”

Divide widens for ad spending on social and digital media

* More brands are letting video ads do the talking for them on social media/digital platforms. And without spending too much.

“Video ads on social media are one of the most cost-effective ad formats in terms of reach, engagement and cost,” said Yasser Ebrahim Al Sarw, associate director of Digital Media at BPG Maxus. “That’s why most of our brands are investing heavily behind it as a result of the ROI [return on investment] generated from it at a very competitive cost compared to other digital channels.

“There’s actually a gap between social media and other digital media channels but it’s not about cost. It’s their ability to provide precise and efficient audience-targeting capabilities, [as well as] deliver measurable outcomes and tangible business results.”