Dubai: Banking sectors across the GCC countries are expected to face challenging business environment of varying degrees in the year ahead despite the strong balance sheets and capital strengths, according to banking sector analysts and rating agencies.

Substantial government ownership of major banks is common across all GCC countries which have significant impact on their ratings, liquidity position and loan growth. Analysts say under the current economic environment, the government links of banks are both a source of strength and weakness.

GCC banks have clear rating advantage compared to other emerging market counterparts because of their link to the respective sovereigns and the relative strength of sovereign ratings. However, the close link to the sovereigns also makes them vulnerable to economic fundamentals of the sovereigns they are associated with. Thus, the persistent low oil prices are expected to weaken the fundamentals and the rating outlook of GCC banks, according to analysts.

“The correlation of GCC banks’ creditworthiness to oil prices is very high. About 25 per cent to 40 per cent of GCC banks’ deposits come from government’s oil revenues. Low oil prices not only reduce their deposit base but also expose them to higher funding demands from government and government related entities,” said Anita Yadav, Head of Fixed Income Research at Emirates NBD.

Fitch ratings

Low oil prices continue to pressure bank liquidity and are also taking their toll on asset quality and earnings of banks across GCC, according to Fitch Ratings. The rating agency has a negative outlook on 30 per cent of its rated banks GCC region; most others are on stable outlook.

“The negative outlooks are largely driven by sustained low oil prices, which weaken sovereign ability to provide support and rationalise government spending, ultimately affecting banks’ financial metrics. This does not in any way reflect lower sovereign propensity to provide support,” said Redmond Ramsdale, Senior Director, Financial Institutions at Fitch Ratings.

Analysts say the outlook will remain challenging in relative terms as weaker economic growth will feed through to credit fundamentals. “The slow oil price recovery affects banks in all GCC countries, where about 70 per cent of GDP is driven, directly or indirectly, by oil revenue. We forecast oil prices to flatline in 2017 with Brent crude averaging $45 per barrel. Lower oil prices have put significant pressure on the fiscal and external positions of all GCC sovereigns and governments are cutting spending and looking to raise additional revenue in response,” said Ramsdale.

Some analysts expect limited upward potential for regional banks as oil prices have been showing signs of recovery in recent months while the overall economic growth is projected to remain positive with a gross domestic product (GDP) growth of 2 per cent next year, slightly above the 2016 level of 1.9 per cent

“While operating conditions for banks in the GCC remain challenging, the stabilisation of oil prices — albeit at a low level — and resilient non-oil sectors will moderate pressures on the banking sector from slowing economic growth, fiscal reforms and spending cuts,” said Olivier Panis, a vice-president at Moody’s.

Tightening liquidity

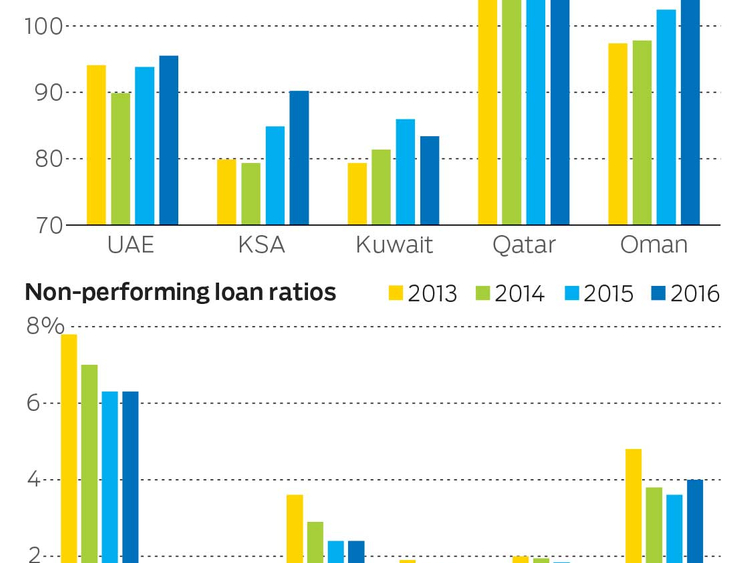

Analysts say pressure on governments and subdued economic growth will negatively affect banks’ credit profiles. Government deposits in banks have been shrinking or growing more slowly. Deposit and interbank rates have increased and banks have issued more debt and tapped the international syndicated loan market. Liquidity is still comfortable, but this tightening is likely to put pressure on loan growth, especially in Oman, Qatar and Saudi Arabia.

While the overall asset quality remains stable with non-performing loans averaging 3-4 per cent of total assets, analysts expect further deterioration in asset quality, going forward.

High levels of borrower- and sector-loan concentration continue to expose GCC banks to unexpected shocks. “We expect new problem-loan formation and increased loan restructurings due to sluggish economic activity and tightening liquidity. Certain sectors, particularly contracting, construction, real estate, retail and SMEs [small and medium enterprises], will be more affected,” said Panis.

Introduction of taxes

Analysts say affordability will come under pressure as borrowers will have to cope with government measures to address fiscal deficits, which will raise utility and petrol prices, and introduce taxes. The loan books are very concentrated, with large single-name exposures, and high sector concentrations, particularly to real estate and contracting.

Structural challenges, such as limited transparency of large corporate borrowers, as well as sizeable related-party lending will persist and can amplify downside risks.

However new macroprudential regulations, such as large exposure limits, mortgage loan-to-value caps, consumer lending caps, and credit bureaus are expected to support loan performance over time.

Profitability under pressure

Profitability of GCC banks are expected to be negatively impacted next year by lower economic growth with dampening transactions and lending activity. Higher funding costs will also have an effect. While conventional, non-Islamic banks are expected to feel the funding pressure more than Islamic peers, the deterioration in profitability should moderate in light of positive GDP growth and banks’ ability to reprice their loan books in a rising interest-rate environment.