Sharjah: Sharjah's landlords have had it rough for some time now, what with their having to compete with the steep drop in rentals in Dubai. But the going may have become a lot tougher.

Headlines blaring "Sharjah swelters" brought about by successive power failures in recent days would, of course, be no inducement for anyone considering a shift of residences to the emirate.

In fact, the challenge for the landlords is to retain their present tenants and not lose them to locations in Dubai such as Discovery Gardens, Mirdif or Al Ghusais.

The canny ones have already reduced their rents to stay competitive with their Dubai counterparts, and they might now be forced to offer more incentives in the wake of the power crisis when it comes to tenancy renewals. There are also the large numbers of new residential high-rises that are nearing completion.

"One of the major factors underlying Sharjah's rental adjustment is the amount of supply coming to the market," said a new report issued by Asteco on the situation in the northern emirates during the second quarter.

"However, we have witnessed over the last few months that there is some interest in these areas as some towers have been completed, providing tenants with low rents, larger properties and better facilities."

Rental drop

Until the latest power crisis broke out, there was a sentiment in real estate circles that the rate of decline among apartments had eased.

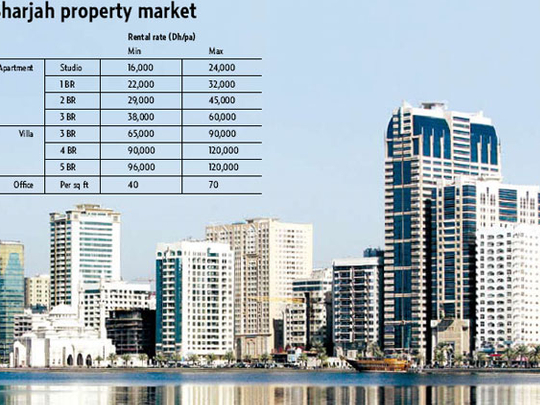

As a case in point, three-bedroom apartments in Al Nahda and Al Khan recorded an average decline of four per cent in the second quarter, after falling nine per cent in the first quarter.

Although studio apartments recorded no rental change, one- and two-bedroom units experienced drops of eight and four per cent respectively.

At the same time, the on-going decline continues to be steeper in the villa category.

"The rental rate for a typical three-bedroom apartment has put downward pressure on the villa market, particularly given the variances in accessibility, quality and value for money," the report added.

Now, it remains to be seen how Sharjah's residents — and landlords, for that matter — factor in the fallout from the power breakdown during their upcoming contract renewals.

Bargaining chip

These are interesting times as tenants could use this as a bargaining chip to get their rents reduced further. And it remains to be seen how well landlords can counter these arguments.

In fact, across the northern emirates, soft market conditions persist.

In Ajman, apartment rents fell at the same pace as in the previous quarter, and properties beside the Corniche fell 12 per cent after a seven per cent decline in the first quarter.

"Despite this, the Corniche area continues to attract interest from people working in the emirate, although the market is competitive and landlords, especially private landlords, are offering incentives and dropping their prices to secure occupancy," the report said.

In Fujairah, Ras Al Khaimah and Umm Al Quwain, no major changes have been reported in apartment rental rates, according to the report.

Trends in Sharjah's office rental market closely parallels those in the residential. A steady decline continued to be recorded in rents during the second quarter. To boost sentiments and activity in the hospitality arena, the Sharjah government's upcoming tourism masterplan is expected to create as many as ten new hotels. It is expected this would also rub-off positively on the residential, retail and office sectors as well.

Ten new hotels planned

Trends in Sharjah's office rental market closely parallels those in the residential. A steady decline continued to be recorded in rents during the second quarter.

To boost sentiments and activity in the hospitality arena, the Sharjah government's upcoming tourism masterplan is expected to create as many as ten new hotels. It is expected this would also rub off positively on the residential, retail and office sectors.