Dubai: Oversupply may not be music to the ears of landlords and developers, but the availability of units will make the UAE a more competitive place to live and work, analysts said.

Kosta Giannopoulos, manager of residential sales and leasing at Better Homes, said an increasing number of vacant units "isn't news".

"Now it will simply be easier for people from outside the UAE to afford to move here. The infrastructure is there and the systems are improving. Even though the vast majority of residents are expatriates we need a greater sense of belonging and believing in ‘Team UAE'," he said.

Vacancies

His colleague Jon Yarrow, assistant branch manager, contends that the Green Community, on which he focuses, has a queue of tenants wanting to move in.

"The number of vacancies is difficult to quantify as many developers or owners may choose to delay property handovers. But I expect vacancy levels to increase over the next six months as more supply comes into the market and the annual leasing merry-go-round slows," he added.

Cluttons reveals that Sharjah is not as out of fashion as recent news may suggest.

"We're renting high levels of residential property in Sharjah, particularly among the new projects," said Lesley Preston, director of Cluttons' Sharjah office.

However, she concurs that there are high levels of vacancies across all sectors in Dubai and Sharjah.

"This is clearly evident through the number of to let boards across Jumeirah and Umm Suqueim, where traditionally villa rental inquiries have been slower," she added.

The outlook though is worse for the office sector. Landmark Advisory's latest research indicates oversupply will double empty office space to 45.9 million square feet by 2014. Vacancies expected next year are at 53 per cent, rising to 58 per cent in 2013 and 2014.

The silver lining is that this will drive quality office rents down further, making Dubai and Abu Dhabi more attractive for new businesses to move in.

"The market now needs stimulus initiatives to leverage the improved affordability and to encourage the growth of industries that will diversify the local economies and fill the expanding vacancies projected over the next three to four years," said Jesse Downs, Landmark's director of research and advisory services.

Oversupply is less an issue in Abu Dhabi. According to Cluttons, current office vacancy rates amount to only three per cent in the second quarter of this year, but higher than the historic average of one per cent.

But this year is expected to witness a 32 per cent increase in office supply in Abu Dhabi, Downs warned, forcing rents to decline further.

Landmark's outlook for Dubai and Abu Dhabi projects vacancies in the residential sector to peak at between 25 and 28 per cent in 2012. Colliers International sets current vacancy rates at 13 per cent.

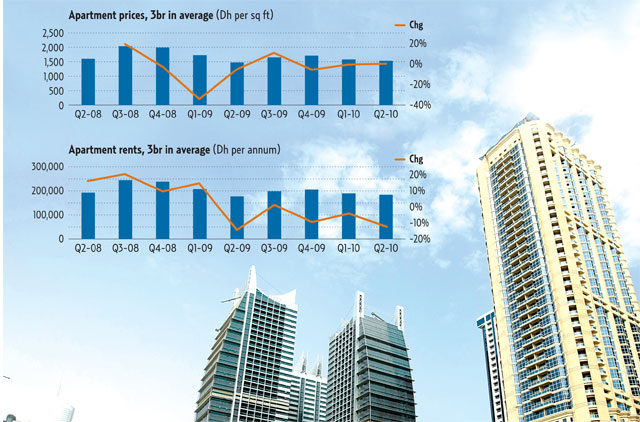

Distress sales appear to have returned in the first half of 2010, after calming down by the end of summer last year, Landmark pointed out. These are leading to an acceleration in the fall in prices, which are declining faster than rents.

This, however, is pushing up yields, said Downs.

"This is positive for the market as higher yields are required to attract investors. At the moment, financing remains limited, which means investors continue to dictate market trends."