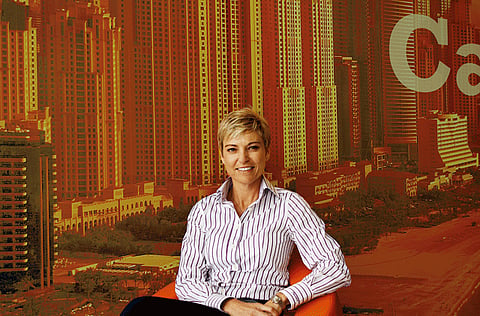

Agent for change

In a tenant-driven market, Billy Rautenbach believes a real estate broker needs to be assertive, especially when managing the client's expectations.

Name Billy Rautenbach

Position Managing director, The Property Store

Nationality British

She's been associated with the real estate industry for nearly 24 years. So when Billy Rautenbach voices an urgency for regulatory reforms in the industry, it comes with a certain amount of credibility attached. The owner of Dubai-based real estate brokerage firm, The Property Store, lauds the Real Estate Regulatory Agency's (Rera) initiative to issue identity cards to property agents which has helped purge the brokerage industry of freelancers, but is quick to point out that much more needs to be done. "A registered real estate broker needs more support from the regulatory authority. I'd like to see a committee that real estate brokers can approach if they have grievances," says Rautenbach, who was earlier employed with industry bellwethers Al Futtaim Group and Better Homes.

With leasing transactions and brokerage driving business during the down cycle, the executive is also looking to add the disciplines of property management and short-term rentals to the firm's portfolio. "We will start a property management division which will take care of individual units and supervise buildings," she adds.

Calling upon registered brokers to report unregistered counterparts operating in the Dubai market to Rera, Rautenbach alludes to how clients, particularly sellers, are still negligent in asking agents for their Rera cards. "A lot of landlords and property owners work with non-registered brokers because they want to get their properties leased or sold quicker."

While the boom phase was characterised by agents resorting to aggressive sales strategies, the current market has necessitated them to be trained in customer relationship management, retaining customers, getting referrals, specialising in a particular area, and so on. "Today, it's all about service to the client, getting back to him on time and making sure that you market the property properly. An agent needs to be assertive, especially when it comes to managing the client's expectations."

While commercial landlords are now more in favour of longer leases, Rautenbach insists there is nothing in it for agents, whose brokerage fee is still incommensurately set for a one-year lease. "There needs to be a restructuring of fees for commercial and long-term leases. In most countries, commissions are a minimum of one month's rental. In this country, it's 5 per cent. Brokers get no revenue for the rest of the lease."

On whether landlords still harbour unrealistic price expectations, she says, "There are some landlords who are realistic, some who aren't and others who don't care if their property stands vacant. There are also some who are really desperate and drop their prices. The longer a unit stands vacant, the more negotiable a landlord is. Every landlord is emotionally attached to his unit. But, the tenant will stick to his budget."

With the current crop of investors being in the market for the long-term, unit quality is of paramount importance to them. "Our investors are very specific about where they want to buy property. They want to know who the developer is, how old the building is and how well maintained the property is. They are not so concerned about whether the rentals are high.

BILLY ON...

... cash buyers, distress sales

"The number of cash buyers active in this market is surprising. They are from the UK, Canada, India, Pakistan, Iran, China and Russia. They are astute business people, waiting for good deals to become available. A distress sale is where you owe more money on the property than what you can sell it for. People may sell their units below the market price, but this does not constitute a distress sale. An investor who bought at the peak of the property boom and is looking to consolidate his portfolio could resort to a distress sale. But we aren't seeing a lot of these sales."

... units holding value

"Villas in well-established communities such as Jumeirah and Umm Suqeim have held their values. Quality [well-maintained] buildings in Dubai Marina have not dropped as much as those in outlying areas. Areas lacking a community feel and no infrastructure have seen an erosion in value. Developments such as International City, Dubai Silicon Oasis and Dubailand have not fared well. Prices and rentals have stabilised in Discovery Gardens since it's well located. But, you can't compare it to International City since they are different products. The latter is not well-maintained and well-tenanted. Prices in MotorCity have also held their own."

... the valuation industry

"Valuators sometimes undervalue property so that the bank wouldn't need to lend the full amount to the applicant. Valuators should be independent advisors and not work with banks. It's difficult for valuators to arrive at the real value of a property since prices are all over the place. They need to use different methods to gauge the property value and not just use the selling price of that property as the criterion. They should look at the average selling price of similar properties on the market, the replacement value, the rental income, and so on."

... demand for villas

"This is still strong since the number of villas is less compared to apartments in Dubai. Also, families prefer villas. Communities comprising villas are mostly well-established, except for those in Sports City and Dubailand. There is big demand for even unsettled areas. There is still demand for villa products in the Green Community, The Springs, The Lakes, The Meadows and The Palm, especially on the rental side."