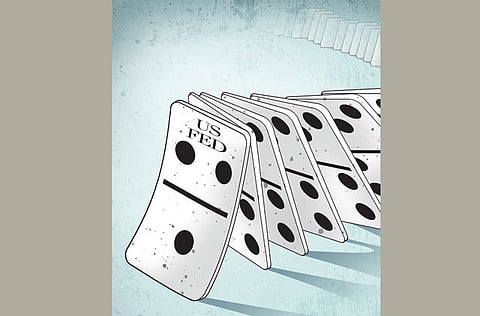

Reverse capital dynamics shake emerging markets

Trouble is the good times had lasted too long and slowed down their responses

Enthusiasm for emerging markets has been evaporating this year, and not just because of the US Federal Reserve’s planned cuts in its large-scale asset purchases. Emerging-market stocks and bonds are down for the year and their economic growth is slowing. To see why, it is useful to understand how we got here.

Between 2003 and 2011, GDP in current prices grew by a cumulative 35 per cent in the US, and by 32, 36 and 49 per cent in Great Britain, Japan, and Germany, respectively, all measured in dollars. In the same period, nominal GDP soared by 348 per cent in Brazil, 346 per cent in China, 331 per cent in Russia, and 203 per cent in India, also in dollars.

And it was not just these so-called BRIC countries that boomed. Kazakhstan’s output expanded by more than 500 per cent, while Indonesia, Nigeria, Ethiopia, Rwanda, Ukraine, Chile, Colombia, Romania, and Vietnam grew by more than 200 per cent each. This means that average sales, measured in dollars, by supermarkets, beverage companies, department stores, telecoms, computer shops, and Chinese motorcycle vendors grew at comparable rates in these countries. It makes sense for companies to move to where dollar sales are booming, and for asset managers to put money where GDP growth measured in dollars is fastest.

One might be inclined to interpret this amazing emerging market performance as a consequence of the growth in the amount of real stuff that these economies produced. But that would be mostly wrong. Consider Brazil.

Only 11 per cent of its China-beating nominal GDP growth between 2003 and 2011 was due to growth in real (inflation-adjusted) output. The other 89 per cent resulted from 222 per cent growth in dollar prices in that period, as local-currency prices rose faster than prices in the US and the exchange rate appreciated.

Some of the prices that increased were those of commodities that Brazil exports. This was reflected in a 40 per cent gain in the country’s terms of trade (the price of exports relative to imports), which meant that the same export volumes translated into more dollars.

Russia went through a somewhat similar experience. Real output growth explains only 12.5 per cent of the increase in the dollar value of nominal GDP in 2003-11, with the rest attributable to the rise in oil prices, which improved Russia’s terms of trade by 125 per cent, and to a 56 per cent real appreciation of the ruble against the dollar.

By contrast, China’s real growth was three times that of Brazil and Russia, but its terms of trade actually deteriorated by 26 per cent, because its manufactured exports became cheaper while its commodity imports became more expensive. The share of real growth in the main emerging countries’ nominal dollar GDP growth was 20 per cent.

The three phenomena that boost nominal GDP — increases in real output, a rise in the relative price of exports, and real exchange-rate appreciation — do not operate independently of one another. Countries that grow faster tend to experience real exchange-rate appreciation, a phenomenon known as the Balassa-Samuelson effect. Countries whose terms of trade improve also tend to grow faster and undergo real exchange rate appreciation as domestic spending of their increased export earnings expands the economy and makes dollars relatively more abundant (and thus cheaper).

Real exchange rates may also appreciate because of increases in capital inflows, which reflect foreign investors’ enthusiasm for the prospects of the country in question. For example, from 2003 to 2011, Turkey’s inflows increased by almost eight per cent of GDP, which partly explains the 70 per cent increase in prices measured in dollars.

Real appreciation could also be caused by inconsistent macroeconomic policies that put the country in a perilous position, as in Argentina and Venezuela.

Distinguishing between these disparate and inter-related phenomena is important, because some are clearly unsustainable. In general, terms-of-trade improvements and capital inflows do not continue permanently: they either stabilise or eventually reverse direction.

Indeed, terms of trade do not have much of a long-term trend and show very pronounced reversion to the mean. While prices of oil, metals, and food rose very significantly after 2003, reaching historic highs sometime between 2008 and 2011, nobody expects similar price increases in the future. The debate is whether prices will remain more or less where they are or decline, as food, metals, and coal prices have already done.

The same can be said of capital inflows and the upward pressure that they place on the real exchange rate. After all, foreign investors are putting their money in the country because they expect to be able to take even more money out in the future; when this occurs, growth tends to slow, if not collapse, as happened in Spain, Portugal, Greece, and Ireland.

In some countries, such as China, Thailand, South Korea, and Vietnam, nominal GDP growth was driven to a large extent by real growth. Moreover, according to the Atlas of Economic Complexity, these economies began producing more complex products, a harbinger of sustainable growth. Angola, Ethiopia, Ghana, and Nigeria also had very significant real growth, but nominal GDP was boosted by very large terms-of-trade effects and real appreciation.

For most emerging market countries, however, nominal GDP growth in the 2003-11 period was caused by terms-of-trade improvements, capital inflows, and real appreciation. These mean-reverting processes are, well, reverting, implying that the buoyant performance of the recent past is unlikely to return any time soon.

In most countries, the US dollar value of GDP growth handsomely exceeded what would be expected from real growth and a reasonable allowance for the accompanying Balassa-Samuelson effect. The same dynamics that inflated the dollar value of GDP growth in the good years for these countries will now work in the opposite direction: stable or lower export prices will reduce real growth and cause their currencies to stop appreciating or even weaken in real terms. No wonder the party is over.

Project Syndicate