Anyone who thinks their job stinks should consider the one Xi Jinping is about to take on.

Xi is expected to replace Chinese President Hu Jintao in the fall. He must have some serious misgivings. If the last 20 years were a golden age for the world’s most populous nation, today is one filled with growing doubts. The Bo Xilai scandal has shattered the veneer of political stability, cyber-dissidents are emboldened in their challenges of the Communist Party and diplomatic headaches abound — many of them concerning the US, where China may figure in November’s presidential election.

No issue looms larger than China’s suddenly shaky economy. The world is now bracing for a slowdown that pundits said was unlikely to happen. So are officials in Beijing, who worry that social unrest could boil over quickly if growth evaporates.

A bit of perspective is in order. Any serious slump in China probably is a few years off, not something that will send markets into a tailspin in the next few months. Look to Europe for that.

That’s not to say that a slowdown to 7 per cent growth or even 6 per cent is good news for anyone. The repercussions would hurt big commodity exporters such as Australia, Brazil and Canada, and make it even harder for Europe’s leaders to resolve the debt crisis. Remember that just a few months ago, traders were speculating that China would deploy its $3.3 trillion (Dh12.1 trillion) of currency reserves to bail out Europe.

Unhappy markets

Stock and commodity markets would be sideswiped by a China slowdown. That gloom would feed back through lower consumer confidence and business sentiment. That’s in addition to any trauma should Greece abandon the euro or if Italy is next up seeking a bailout following last weekend’s rescue of Spain’s banks.

There are reasons to believe China has the wherewithal to stave off a slump in the short run. Its central bank last week cut interest-rates for the first time in four years, and there was speculation this week about additional stimulus packages.

Gloomy data on industrial production, fixed-asset investment, exports, retail sales, coal and electricity have Chinese policy makers ready to double down on the massive 4 trillion yuan (Dh2.54 trillion) stimulus it tossed at the economy in 2008. Assume the next one will be huge and aimed at keeping today’s 8.1 per cent growth rate from slipping to the 6.4 per cent that China International Capital Corp, the nation’s biggest investment bank, says is possible this year.

That’s where the trouble begins. Last time, it was easy for China. Throw piles and piles of money at new infrastructure projects and watch gross domestic product boom. This time, China must be smarter. Xi, and whoever succeeds Wen Jiabao as premier, must avoid the asset bubbles and property-price spirals that accompanied the largess of 2008. Anything that pushes real estate further out of reach for China’s 99 per cent increases the odds that protesters will converge on Tiananmen Square.

Expectations are growing that the next fiscal injection will be targeted at strategic industries that create jobs without dangerous excesses. The question is how the central government can control the stimulus after it’s turned over to local officials. Provincial leaders are prone to financing pet projects, which may lead to more unproductive investments, corruption and public discontent.

The big risk for Xi’s team is that little of this money will go toward retooling the economy. China has made minimal progress cultivating a deep domestic market for consumption that relies less on exports and embraces full currency convertibility. To the contrary: China shows no signs that it is interested in growth that benefits anyone other than the elites and their extended families.

Two choices

China’s leaders have a choice. Either they make those difficult but necessary changes, with the chances of producing more sustainable growth. Or they kick reforms down the road, administer another stimulus, and risk a bigger crash in the years ahead. At the moment, the temptation is to pick No 2.

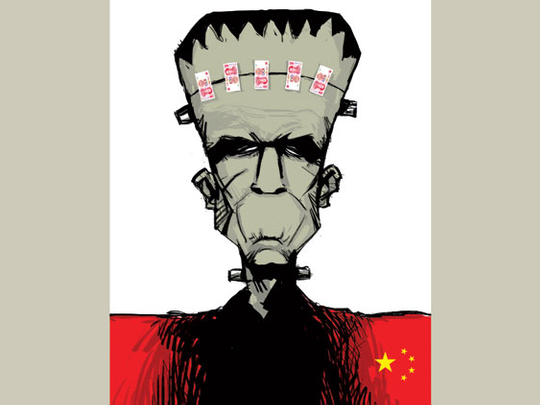

All stimulus and no reform gives China some Frankenstein-like qualities — a powerful economic creature born out of unorthodox experiments. Unproductive spending of the magnitude China already has unleashed, and what seems to be in the pipeline, may result in a Japan-like debt mess. When China’s reckoning does come, and every industrialising nation has one, it may be far worse than investors believe. Xi will have to do a much better job than his predecessor to keep that reckoning from becoming a monster all its own.

— William Pesek is a Bloomberg View columnist. The opinions expressed are his own