London: BP rose in London trading yesterday after agreeing to sell oil and gas fields in the US, Canada and Egypt to Apache for $7 billion (Dh25.7 billion), raising cash to meet the costs of the Gulf of Mexico spill.

BP climbed as much as 4 per cent and traded at 402.65 pence as of 10:20am local time. The stock is down 39 per cent since the Deepwater Horizon rig exploded on April 20, killing 11 workers and triggering the worst oil spill in US history.

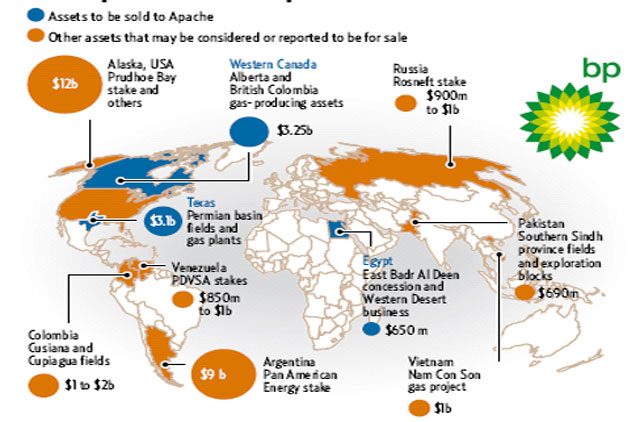

Europe's largest oil producer by volume said last month it would sell $10 billion of assets to raise cash for the $20 billion fund demanded by US President Barack Obama to compensate victims of the oil spill. BP said yesterday that it plans to sell assets in Pakistan and Vietnam, and the company was said to be in talks with Apache earlier this week about selling half its stake in Alaska's Prudhoe Bay oil field.

"It's a nice tidying up of the portfolio," said Iain Armstrong, an analyst at Brewin Dolphin, which overseas more than $31 billion in London, including BP shares. "If they can get rid of Vietnam and Pakistan assets as well, even better."

Apache will buy BP's Permian Basin holdings in Texas and southeast New Mexico and gas properties in western Canada, London-based BP said Tuesday after the close of trading. BP also agreed to sell exploration concessions in Egypt.

BP said Apache will pay a deposit of $5 billion in cash on July 30. The total price of $7 billion includes $3.1 billion for the Permian properties, $3.25 billion for assets in western Canada and $650 million for the Egyptian assets, according to BP's statement.

The Prudhoe Bay stake was on track to be sold for $10 billion to $11 billion, according to a person with knowledge of the matter. Jason Kenney, an analyst at ING Wholesale Banking in Edinburgh, values BP's assets in Vietnam and Pak-istan at about $1.7 billion altogether.

BP suspended its $10 billion annual dividend for three quarters and cut investment spending to help pay for spill costs, which Brewin Dolphin's Armstrong predicts will reach $40 billion. BP reports second-quarter earnings on July 27.

Robert Dudley, the BP executive running the spill clean-up operation, is the front-runner to replace chief executive officer Tony Hayward, who is set to step down in the next 10 weeks, the London-based Times reported Tuesday, citing unidentified people close to the company.

Hayward has the full support of the board and will stay in his post, a BP spokesman said.